+27 11 441 1111

SRK House, 265 Oxford Road, Illovo, 2196, South Africa

Bengwenyama platinum group metals project, South Africa – update

Name of the Project

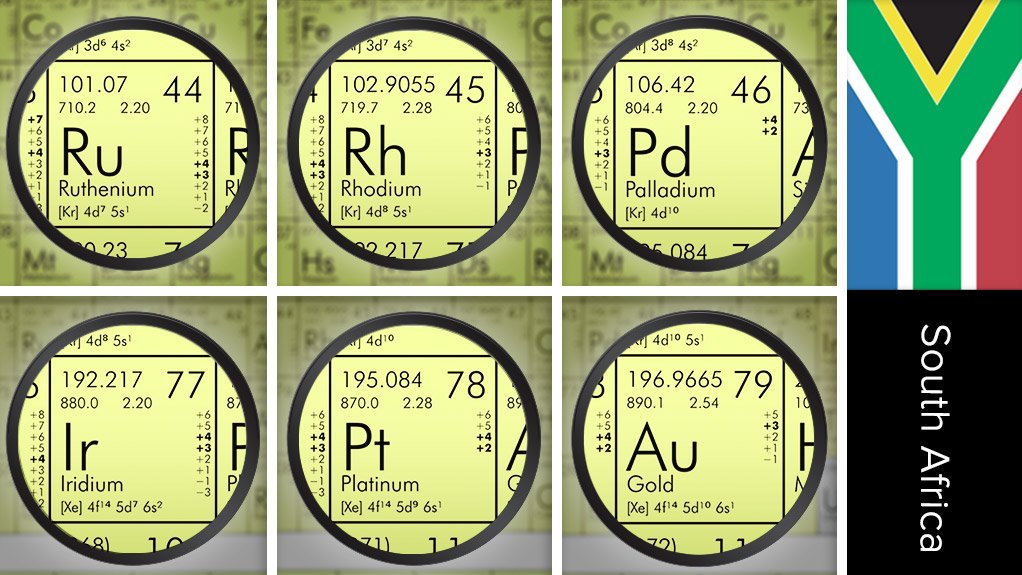

Bengwenyama platinum group metals (PGMs) project.

Location

Eastern Limb of the Bushveld Complex, in Limpopo, South Africa.

Project Owner/s

Southern Palladium.

Project Description

A scoping study has shown the project to have very attractive economics, with results justifying a prefeasibility study (PFS) already under way.

The project aims to extract PGMs from the upper group two (UG2) and Merensky reefs, which constitute one of the very few remaining areas within the Bushveld Complex where economically viable PGMs deposits remain unexploited.

The scoping study proposes a two-million-tonne-a-year UG2 reef underground mining operation using hybrid mining, with conventional stoping supported by on-reef mechanised development and ore clearance.

The life-of-mine for only the UG2 reef is estimated at 36 years, with a total of about 52-million tonnes mined – about 10.9-million ounces platinum, palladium, rhodium, ruthenium, iridium, osmium and gold (7E or 6E+gold), for an average production rate of 330 000 oz/y platinum, palladium, rhodium, ruthenium, iridium and gold (6E or 5E+gold) basis. This ignores residual value beyond modelled life or any exploration upside.

The project includes:

- construction of a flotation and spiral plant to deliver PGM and chrome concentrates from a conventional plant, with an estimated 200 000-t-a-month ore feed design capacity. A 75 µm grind size is envisaged.

- construction of a dry-stack tailings storage facility conforming to Global Industry Standards on Tailings Management requirements.

- connection to the nearby national grid power substation and construction of a 132 kV overhead powerline to supply (based on initial indications) of about 43 MVA peak demand.

- connection to an existing licensed, bulk water supply pipeline, located at the entrance road to the project. Water supply will be supplemented with available ground- and surface water.

- comprehensive integration of all on-site infrastructure, encompassing site access roads, office and administrative buildings, engineering workshops, stores, a guardhouse, surface-water storage facilities and other supporting facilities.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate of, $1.04-billion and an internal rate of return of 24%, with a payback of from the start of plant production of 4.5 years.

Capital Expenditure

$408-million.

The project is fully funded.

Planned Start/End Date

The completion of the PFS and associated resource drilling is planned to be completed during the second half of 2024.

Latest Developments

Southern Palladium has reported that drilling is advancing the prefeasibility study (PFS) for the project.

To date, more than 30 000 m of diamond drilling have been completed, comprising 79 mother holes and 48 deflections.

Notably, the initial target area in Eerstegeluk had been successfully converted to indicated mineral resources by the end of 2023, marking significant progress.

Recent drilling has targeted the North Horst Block to get a better understanding of that area for the forthcoming PFS, and potentially converting more of the inferred resource to indicated status.

Souther Palladium MD Johan Odendaal has said that, with assay results for the North Horst Block still pending, the project already boasts an existing indicated and inferred mineral resource estimate of 26.22-million ounces.

Results for the final drill holes will be incorporated into an updated mineral resource estimate, which is scheduled for completion early in the third quarter.

The updated mineral resource estimate and maiden reserve will form part of the PFS, which is scheduled for completion early in the fourth quarter.

SRK Consulting has been commissioned to review ongoing PFS work to ensure the highest standards of due diligence and quality assurance.

An environmental-impact assessment (EIA) is also under way and advancing on schedule, with submission slated for midyear.

The company has said that it remains well funded to complete the PFS from existing cash reserves, with a cash position of $8.34-million as at December 31, 2023.

Key Contracts, Suppliers and Consultants

SRK Consulting (PFS review).

Contact Details for Project Information

Southern Palladium, email info@southernpalladium.com.