+27 11 441 1111

SRK House, 265 Oxford Road, Illovo, 2196, South Africa

Kamoa-Kakula copper project, Democratic Republic of Congo – update

Photo by Ivanhoe Mines

Name of the Project

Kamoa-Kakula copper project.

Location

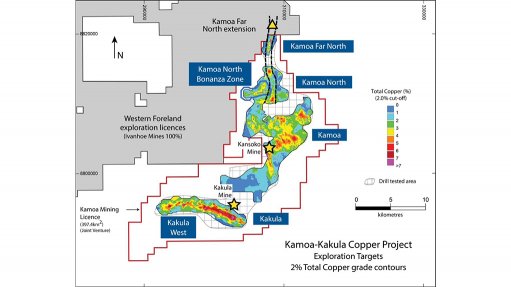

The Kolwezi district of Lualaba province, in the Democratic Republic of Congo (DRC).

Project Owner/s

Kamoa Copper, a joint venture (JV) between base and precious metals developer Ivanhoe Mines, with 39.6% ownership; Zijin Mining Group, with 39.6% ownership; Crystal River Global, with 0.8% ownership; and the DRC government, with 20% ownership.

Project Description

Ivanhoe Mines has announced outstanding economic results in the independent integrated development plan for the tier-one Kamoa-Kakula copper project.

The Kamoa-Kakula Integrated Development Plan 2020 comprises three development scenarios: the Kakula definitive feasibility study (DFS), the Kakula-Kansoko prefeasibility study (PFS) and the Kamoa-Kakula preliminary economic assessment (PEA).

Kakula

The Kakula DFS proposes the development of a Stage 1, six-million-tonne-a-year underground mine and surface processing complex at the Kakula deposit, with a capacity of 7.6-million tonnes a year built in two modules of 3.8-million tonnes a year. For this option, 110-million tonnes will be mined at an average grade of 5.22% copper, producing 8.5-million tonnes of high-grade copper concentrate and containing about 10.8-billion pounds of copper.

Kakula-Kansoko

The Kakula-Kansoko 2020 PFS evaluates the development of mining activities at the Kansoko deposit in addition to the Kakula mine, initially at a rate of 1.6-million tonnes a year, to supply the concentrator at Kakula, eventually ramping up to six-million tonnes a year as the reserves at Kakula are depleted.

Kamoa-Kakula

The Kamoa-Kakula 2020 PEA assesses an additional development option of mining several deposits on the Kamoa-Kakula project as an integrated, 19-million-tonne-a-year mining, processing and smelting complex, built in multiple stages.

An initial six-million-tonne-a-year mining operation will be established at the Kakula mine on the Kakula deposit, which will be followed by a separate six-million-tonne-a-year mining operation at the Kansoko mine. A third six-million-tonne-a-year mine will then be established at the Kakula West mine, in addition to a fourth initial mine in the Kamoa North area operating at one-million tonnes a year. The processing plant will be built in five modules of 3.8-million tonnes a year, with an ultimate capacity of one-million tonnes a year.

As the resources at the Kakula, Kansoko and Kakula West mines are mined out, production will begin sequentially at five other mines in the Kamoa North area to maintain throughput of 19-million tonnes a year to the existing concentrator and smelter complex.

Each mining operation is expected to be a separate underground mine, with a shared processing facility and surface infrastructure located at Kakula. Material will be transported to the Kakula processing complex using a system of overland conveyors. Included in this scenario is the construction of a direct-to-blister copper smelter with a capacity of one-million tonnes of copper concentrate a year.

Potential Job Creation

Once the two processing plants at Kakula are operating, Ivanhoe expects to employ almost 2 000 permanent Kamoa employees.

Net Present Value/Internal Rate of Return

The Kakula DFS yields an after-tax net present value (NPV), at an 8% discount rate, of $5.5-billion and an internal rate of return (IRR) of 77% over a 21-year mine life, with a payback of 2.3 years.

The Kakula-Kansoko PFS yields an after-tax NPV, at an 8% discount rate, of $6.6-billion and an IRR of 69% over a 37-year mine life, with a payback of 2.5 years.

The Kamoa-Kakula PEA yields a potential after-tax NPV, at an 8% discount rate, of $11.1-billion and an IRR of 56% over a mine life of more than 40 years, with a payback of 3.6 years.

Capital Expenditure

The Kakula DFS estimates peak funding at $775-million, remaining initial capital costs at $646-million and expansion capital costs at $594-million.

The Kakula-Kansoko PFS estimates peak funding at $848-million, remaining initial capital costs at $695-million and expansion capital costs at $750-million.

The Kamoa-Kakula PEA estimates peak funding at $784-million, remaining initial capital costs at $715-million and expansion capital costs at $4.46-billion.

Planned Start/End Date

The initial production of copper concentrate at the Kakula mine processing plant began on May 25, 2021, and achieved commercial production on July 1, 2021.

The expansion of the Kakula processing plant will be brought forward from the first quarter of 2023 to the third quarter of 2022.

Latest Developments

Ivanhoe Mines has set its sights on producing between 290 000 t and 340 000 t of copper in concentrate this year.

The Kamoa project produced 105 884 t of copper in concentrate in 2021. This exceeded the upper end of the guidance range, which was set at between 92 500 t and 100 000 t.

The project has been ramping up its processing capacity as part of Phase 1. Phase 2 expansion is 80% complete and will start operations in the second quarter of 2022.

Phase 2 will take the plant’s nameplate milling capacity to 3.8-million tonnes a year.

Ivanhoe co-chairperson Robert Friedland has said that Phase 2 remains significantly ahead of schedule and the project is well on its way to doubling its copper output to more than 400 000 t/y, starting early in the second quarter – vaulting the project into the ranks of the world’s ten biggest copper mines.

Phase 3 of the concentrator expansion is targeted for 2024, with earthworks to access new mining areas under way.

“We will be conducting an extensive drilling campaign on . . . [the] Western Foreland exploration licences this year to unlock the potential of this highly-prospective ground,” Friedland has said.

Key Contracts, Suppliers and Consultants

DFS/PFS/PEA:

OreWin (overall report preparation, mining, logistics, power and economic analysis); China Nerin Engineering (smelter design); DRA Global (mine surface infrastructure and metallurgical processing); Epoch Resources (tailings storage facility design); Golder Associates (hydrology models and recommendations); KGHM Cuprum R&D Centre (technical adviser on certain mining methods and geotechnical); Outotec Oyj (smelter technology); Paterson and Cooke (paste backfill plant design and surface/underground paste distribution system); SRK Consulting (mine geotechnical recommendations); Stantec Consulting International (mining and mineral reserves); Wood (mineral resources estimation); Kamoa Copper and SNEL, together with Stucky SA (engineering procurement and construction management – Turbine 5); Voith Hydro (contractor Turbine 5); China Nerin Engineering (basic engineering contract for the smelter); and Metso (smelter technology).

Contact Details for Project Information

Ivanhoe Mines, tel +1604 688 6630 (North America), +27 11 088 4300 (South Africa) or email info@ivanhoemines.com.