+27 11 441 1111

SRK House, 265 Oxford Road, Illovo, 2196, South Africa

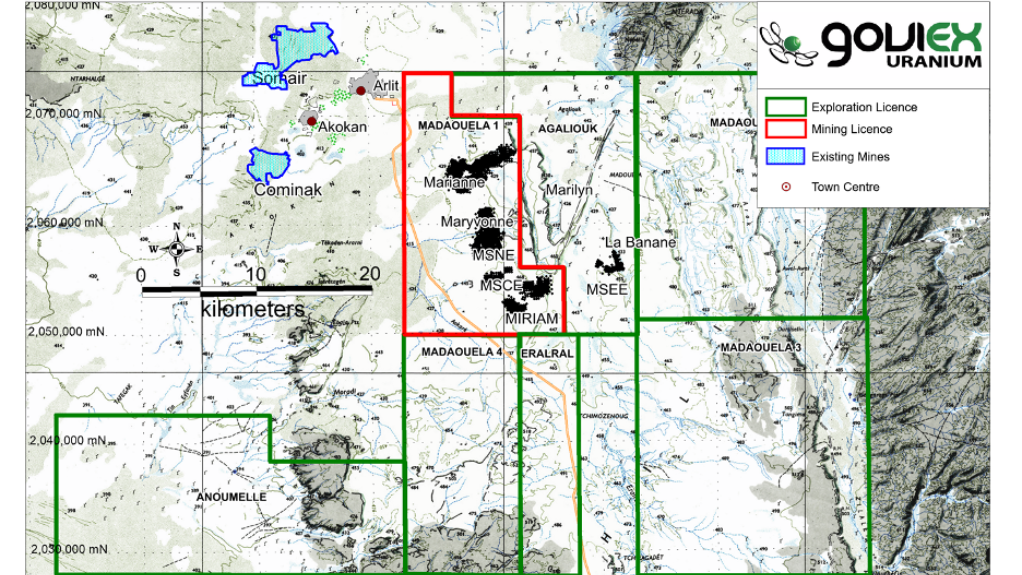

Madaouela uranium project, Niger – update

Photo by GoviEx

Name of the Project

Madaouela uranium project.

Location

Agadez region, northern Niger.

Project Owner/s

GoviEx.

Project Description

The project hosts one of the biggest uranium resources in the world, with 100-million pounds of uranium in measured and indicated mineral resources, and inferred resources of 20-million pounds of uranium.

The mineral resources comprise the Miriam, M&M, MSNE, MYVE, MSEE and MSCE sandstone-hosted uranium deposits.

The project is based on a self-sustaining operation, including process plant and renewable power supply, without any reliance on third-party facilities.

Mining operations are planned to be based on standard truck-and-shovel openpit mining for the Miriam deposit at one-million tonnes a year of ore feed to the process plant.

The M&M and MSNE-Maryvonne deposits are planned to be mined as two separate underground room-and-pillar operations. M&M will be mined first, after the completion of the Miriam openpit operation, with MSNE-Maryvonne to be mined after M&M.

At both underground operations, the mine development and ore-production operations are planned to be mined using conventional drill-and-blast methods. The process plant is designed around two-stage acid leaching to maximise uranium and molybdenum recovery while reducing overall acid consumption. Plant feed is designed at one-million tonnes a year, with ore initially crushed before milling.

Life-of-mine uranium production is estimated at 50.8-million pounds of uranium, averaging 2.67-million pound of uranium a year over 19 years.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $140-million and an internal rate of return of 13.3%.

Capital Expenditure

$343-million.

Planned Start/End Date

Not stated.

Latest Developments

GoviEx is in discussions with the government of Niger regarding the start of mining operations, after having received notice that it must begin mining at its Madaouela uranium project by July 3 or risk having its mine permit revoked.

The company is committed to developing the project and is working with government towards a mutually beneficial solution that complies with applicable law and protects the company’s rights.

In parallel with government discussions, GoviEx is also in discussions with third parties regarding potential investments to expedite the development of the project. The will provide further updates as these discussions progress.

GoviEx has indicated that the project has advanced despite political change since the coup d’état on July 26, 2023. Since then, it has completed its updated environmental- and social-impact assessment that is required to start construction and operations.

The company announced in March that due diligence for the project had started on behalf of prospective lenders and that it had received expressions of interest of more than $200-million for project-related debt finance. The company is continuing discussions with potential lenders and offtakers.

It also started front-end engineering designs and initial ground works, including the construction of an access road at the project, and preparation of terracing necessary to start civil engineering.

Key Contracts, Suppliers and Consultants

SRK Consulting and SGS Bateman (feasibility); and Endeavour Financial (financial adviser).

Contact Details for Project Information

GoviEx, tel +1 604 681 5529 or email info@goviex.com.