+27 11 441 1111

SRK House, 265 Oxford Road, Illovo, 2196, South Africa

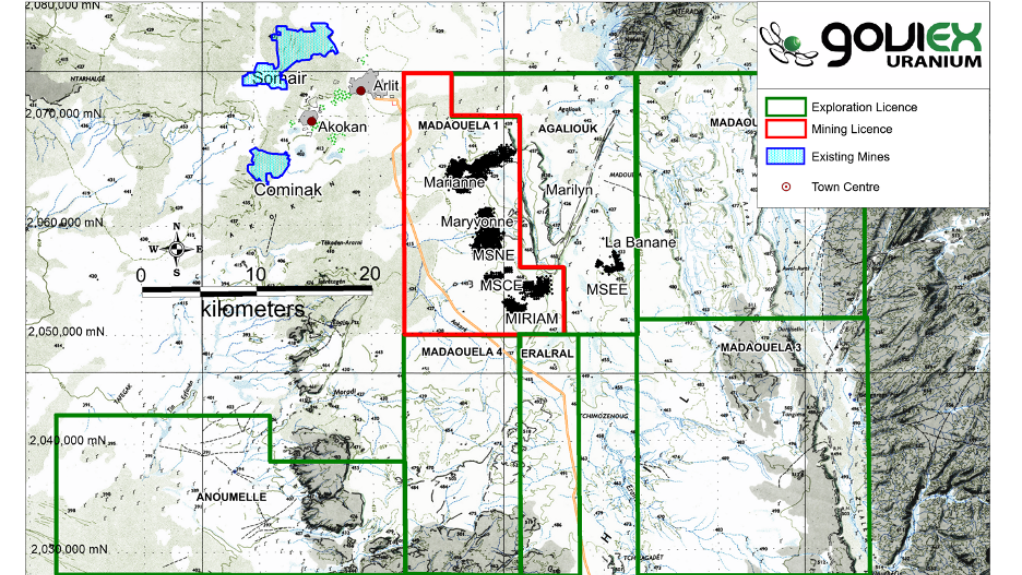

Madaouela uranium project, Niger – update

Photo by GoviEx Uranium

Name of the Project

Madaouela uranium project.

Location

Agadez region, northern Niger.

Project Owner/s

GoviEx. The Nigerien government holds a 20% stake in COMIMA SA, the Nigerien company established to develop the project.

Project Description

The project hosts one of the biggest uranium resources in the world, with 100-million pounds of uranium in measured and indicated mineral resources, and inferred resources of 20-million pounds of uranium.

The mineral resources comprise the Miriam, M&M, MSNE, MYVE, MSEE and MSCE sandstone-hosted uranium deposits.

The project is based on a self-sustaining operation, including process plant and renewable power supply, without any reliance on third-party facilities.

Mining operations are planned to be based on standard truck-and-shovel openpit mining for the Miriam deposit at one-million tonnes a year of ore feed to the process plant.

The M&M and MSNE-Maryvonne deposits are planned to be mined as two separate underground room-and-pillar operations. M&M will be mined first, after the completion of the Miriam openpit operation, with MSNE-Maryvonne to be mined after M&M.

At both underground operations, the mine development and ore-production operations are planned to be mined using conventional drill-and-blast methods. The process plant is designed around two-stage acid leaching to maximise uranium and molybdenum recovery while reducing overall acid consumption. Plant feed is designed at one-million tonnes a year, with ore initially crushed before milling.

Life-of-mine uranium production is estimated at 50.8-million pounds of uranium, averaging 2.67-million pound of uranium a year over 19 years.

Potential Job Creation

The project is expected to create up to 800 skilled and semiskilled jobs over its forecast 20-year mine life. Madaouela is also expected to contribute substantial royalty payments and taxes to the Nigerien government.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $140-million and an internal rate of return of 13.3%.

Capital Expenditure

$343-million.

Planned Start/End Date

Not stated.

Latest Developments

GoviEx Uranium has received its radiological certificate for the project from the Nigerien government.

The certificate is a regulatory requirement prior to starting mining operations and confirms the completion of radiological baseline studies.

Key Contracts, Suppliers and Consultants

SRK Consulting and SGS Bateman (feasibility); and Endeavour Financial (financial adviser).

Contact Details for Project Information

GoviEx Uranium, tel +1 604 681 5529 or email info@goviex.com.