+27 11 441 1111

SRK House, 265 Oxford Road, Illovo, 2196, South Africa

Muntanga uranium project, Zambia – update

Photo by GoviEx Uranium

Name of the Project

Muntanga uranium project.

Location

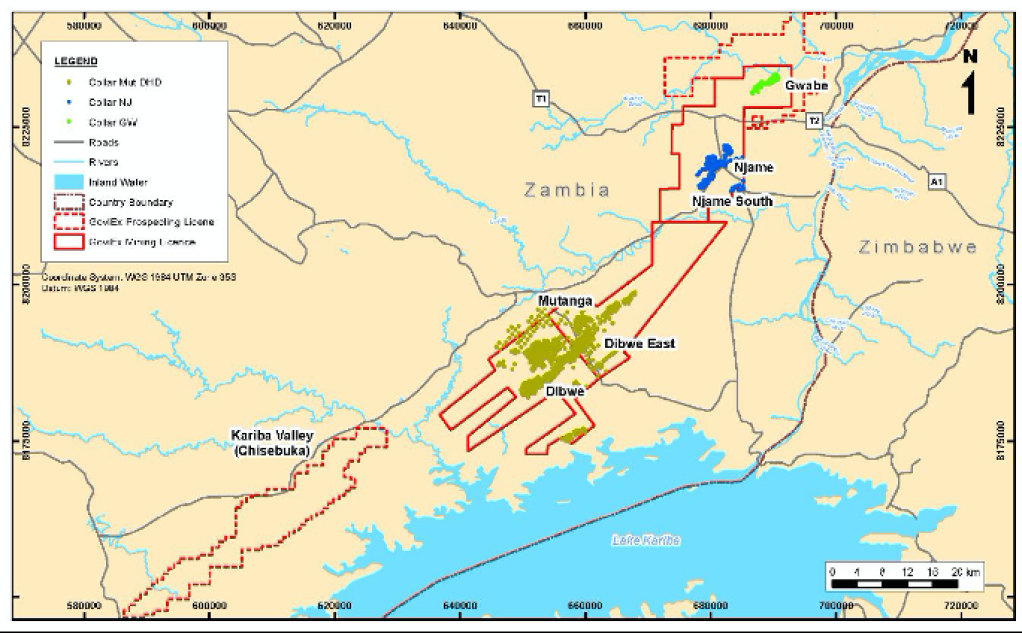

Siavonga and Chirundu districts, in the south-eastern region of Zambia.

Project Owner/s

Africa-focused uranium company GoviEx Uranium signed an agreement with ASX-listed Tombador Iron in August to undertake a reverse takeover. The deal will result in GoviEx shareholders’ becoming the majority owners of a new Australia-listed company that will be renamed Atomic Eagle.

When the deal closes, GoviEx shareholders will hold 75% of the new company, while existing Tombador shareholders will own 25%.

Atomic Eagle is expected to start trading on the ASX in November 2025.

Project Description

Muntanga encompasses the Muntanga, Dibbwi and Chirundu mining licences. The Muntanga and Dibbwi mining licences comprise the Muntanga, Dibbwi and Dibbwi East deposits. The Chirundu mining licence contains the Njame and Gwabi deposits.

The project is based on standard truck-and-shovel openpit mining, with a planned steady-state rate of 3.5-million tonnes a year of ore feed supplied to the heap-leach facility.

A total of 39.6-million tonnes of ore, at an average grade of 320 parts per million (ppm) of triuranium octoxide (U3O8) and 144.1-million tonnes of waste will be mined over a 12-year life-of-mine (LoM).

Ore and waste mining are planned to be undertaken using eight backhoe excavators with 5 m3 buckets, supported by about 49 haul trucks with 45 t payloads.

Initial ore production will start with the mining of the Muntanga deposit, owing to its low stripping ratio at 1.2:1, and continue simultaneously at the Dibbwi East deposit, which has a 4.2:1 strip ratio. Once mining at Muntanga is completed, Dibbwi East will serve as the sole source of ore feed.

The central processing plant has been designed to handle 3.5-million tonnes a year of run-of-mine material sourced from the Muntanga and Dibbwi East mining sites. The flowsheet encompasses primary, secondary and tertiary crushing stages, and aims for an 80% passing size, or P80, of 25 mm.

The project will not require any tailings storage.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

At a US price per pound of U3O8 of $90, the project has a net present value (NPV), at an 8% discount rate, of $243-million and an internal rate of return of 20.8%, with a payback of 3.8 years.

The project is highly leveraged to uranium prices, with an additional $45-million added to NPV for every $5/lb increase in U3O8 prices.

Capital Expenditure

Initial capital is estimated at $281.9-million.

Planned Start/End Date

The mine is expected to start production in 2028.

Latest Developments

GoviEx Uranium has filed the environmental- and social-impact assessment (ESIA) report with the Zambia Environmental Management Agency (Zema).

This follows the submission of the draft ESIA earlier this year, which received no objection from Zema, and the agency’s request that GoviEx proceed with the filing.

The ESIA has been prepared in accordance with Zambian regulations and international best practices, and is a key requirement for obtaining an environmental permit, GoviEx has noted.

Approval of the ESIA, which typically takes up to six months, is a critical milestone on the path to project development.

The ESIA is being reviewed with the project’s resettlement and compensation action plan, aimed at ensuring that environmental and social considerations are fully integrated with stakeholder engagement and resettlement planning.

“With this filing, we remain firmly on track in our permitting process and continue to build momentum toward developing one of the few near-term uranium projects capable of helping [to] meet the growing global demand for nuclear fuel as we transition into the next phase of growth under the Atomic Eagle brand,” GoviEx CEO Daniel Major has said.

Key Contracts, Suppliers and Consultants

Ukwazi Transaction Advisory; SRK Consulting (UK); and SGS Bateman (feasibility study).

Contact Details for Project Information

GoviEx Uranium, tel +1 604 681 5529 or email info@goviex.com.