Premier gold project, Canada – update

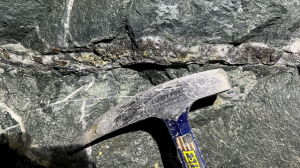

Photo by Ascot Resources

Name of the Project

Premier gold project (PGP).

Location

British Columbia, Canada, adjacent to the border with Alaska, in the US, in the Golden Triangle gold mining district.

Project Owner/s

Gold and silver explorer Ascot Resources.

Project Description

An independent feasibility study has outlined a low-capital restart plan, based on a proven and probable reserve of 6.2-million tonnes grading 5.9 g/t gold and 19.7 g/t gold.

The study is based on four underground mining operations – Silver Coin, Big Missouri, Premier and Red Mountain – feeding a centralised 2 500 t/d processing facility at the project. The mining operations will be sequenced over eight years to initially produce 1.1-million ounces of gold and three-million ounces of silver.

Mining will start from the Silver Coin and Big Missouri deposits, which will be followed by the Red Mountain deposit in Year 3, and then the Premier deposit.

In the four planned operations, access for production will be through new and existing adits (side hill portal access) using a combination of new ramp development and the refurbishment of existing underground infrastructure.

Mining methods will largely comprise low-cost longhole stoping for most of the ore, with limited use of inclined undercut longhole, room-and-pillar and cut-and-fill mining methods in specific shallow or flat-lying stopes. Ore will be trucked to the processing facility and mining waste will be used underground as a combination of rockfill and cemented rockfill.

The existing processing facility will be refurbished within a construction period of about 40 weeks. The process plant will use conventional crushing, grinding and gravity circuits, followed by a standard carbon-in-leach process to produce gold doré.

The plant refurbishment will comprise a combination of existing, new and repaired equipment and supporting plant infrastructure. Prior to ore from the Red Mountain project being treated, the plant will add an energy efficient fine grinding mill, as well as an additional preleach thickener, to accommodate the processing of harder-ore feed and the finer grind required for recovery purposes.

The project has an existing tailings storage facility (TSF) and water treatment plant. The independent feasibility study proposes two key enhancements to the existing infrastructure.

The first enhancement entails raising the tailings dam using centreline lifts throughout the mine life, with about 1.2-million cubic metres of nonacid-generating rock excavated from a nearby quarry.

The second enhancement entails modifying the water treatment plant to nearly double its existing capacity to accommodate additional water treatment from the Big Missouri and Silver Coin operations, and will also include an ammonia treatment plant, a water clarifier and a lime high-density sludge system.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The April 2020 feasibility study highlighted an after-tax net present value (NPV), at a 5% discount rate, of C$341-million and an internal rate of return (IRR) of 51% at $1 400/oz gold.

The project has an estimated after-tax NPV, at a 5% discount rate, of $546-million and an IRR of 73% at current gold prices of $1 740/oz gold.

Capital Expenditure

Capital costs, including mining costs, incurred as of December 31, 2023, are C$292-million. The remaining project construction capital required to achieve first gold pour is about C$47-million.

The total project capital cost will, thus, amount to C$339-million, which is slightly higher than the most recent total project budget of C$334-million reported in the third quarter.

Planned Start/End Date

Rock was introduced into the grinding circuit of the mill on March 31, 2024, and the first ore was introduced into the mill on April 5, 2024.

Latest Developments

Ascot has suspended operations just months after its first gold pour.

The company has cited the need for mine development to align with the mill's capacity as the reason for the shutdown.

Ascot has reported that while the mill's operations have progressed smoothly, development at the Big Missouri mine has fallen behind schedule by up to two months.

The delayed start of the Premier Northern Lights (PNL) ramp-up from July to December last year further postponed production from PNL. This has resulted in an insufficient number of stoping areas to provide the necessary ore feed for the mill.

Although Ascot expects to achieve first development ore from PNL this month, the company has noted that additional development is required to access deeper ore than initially planned. This will extend the timeline for completing the PNL mine's development and ramp-up.

The company estimates that an additional three to six months of development work is required, primarily at the PNL mine, pending further investigation and cost assessments.

Ascot has also highlighted the need for further funding to complete the necessary mine development.

As of the end of August, the miner had C$15-million in cash resources, which it has deemed sufficient to properly suspend operations during the upcoming US winter season. However, the company has warned that there is no certainty that the required funds will be secured to complete the necessary mine development and resume operations.

Over the past two months, mill operations at the Premier mine have poured 3 430 oz of gold, which is 418% above the amount recorded over the entire second quarter.

The mill operated near or above its design capacity in August.

Key Contracts, Suppliers and Consultants

Sacre-Davey Engineering (overall coordination, infrastructure and the economic evaluation in the independent feasibility study); InnovExplo Inc and Mine Paste (mining); Sedgman Canada (metallurgy and processing); Knight Piésold (tailings and water management); SRK Consulting (water treatment plant); Paul Hughes Consulting (site geotechnical); McElhanney (access roads); Prime Engineering (electrical substation); Palmer Environmental Consulting Group (geochemistry, hydrology and water-quality modelling); Falkirk Environmental Consultants and EcoLogic Consultants (environmental studies); Farnell-Thompson Applied Technologies (semiautogenous grinding mill ball mills and related parts); and Procon Mining & Tunnelling (underground mining services).

Contact Details for Project Information

Ascot Resources, tel +1778725 1060 or email info@ascotgold.com.