+27 11 441 1111

SRK House, 265 Oxford Road, Illovo, 2196, South Africa

Premier gold project, Canada – update

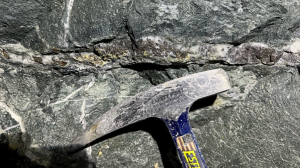

Photo by Ascot Resources

Name of the Project

Premier gold project (PGP).

Location

British Columbia, Canada, adjacent to the border with Alaska, in the US, in the Golden Triangle gold mining district.

Project Owner/s

Canada based gold and silver explorer Ascot Resources.

Project Description

An independent feasibility study has outlined a low-capital restart plan, based on a proven and probable reserve of 6.2-million tonnes grading 5.9 g/t gold and 19.7 g/t gold.

The study is based on four underground mining operations – Silver Coin, Big Missouri, Premier Northern Lights (PNL) and Red Mountain – feeding a centralised 2 500 t/d processing facility at the project. The mining operations will be sequenced over eight years to initially produce 1.1-million ounces of gold and three-million ounces of silver.

Mining will start from the Silver Coin and Big Missouri deposits, which will be followed by the Red Mountain deposit in Year 3, and then the PNL deposit.

In the four planned operations, access for production will be through new and existing adits (side hill portal access) using a combination of new ramp development and the refurbishment of existing underground infrastructure.

Mining methods will largely comprise low-cost longhole stoping for most of the ore, with limited use of inclined undercut longhole, room-and-pillar and cut-and-fill mining methods in specific shallow or flat-lying stopes. Ore will be trucked to the processing facility and mining waste will be used underground as a combination of rockfill and cemented rockfill.

The existing processing facility will be refurbished within a construction period of about 40 weeks. The process plant will use conventional crushing, grinding and gravity circuits, followed by a standard carbon-in-leach process to produce gold doré.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The April 2020 feasibility study highlighted an after-tax net present value (NPV), at a 5% discount rate, of C$341-million and an internal rate of return (IRR) of 51% at $1 400/oz gold.

The project has an estimated after-tax NPV, at a 5% discount rate, of $546-million and an IRR of 73% at current gold prices of $1 740/oz gold.

Capital Expenditure

Since construction and development started in mid-2021, the company has incurred about C$538-million in construction and development costs.

Planned Start/End Date

Rock was introduced into the grinding circuit of the mill on March 31, 2024, and the first ore was introduced into the mill on April 5, 2024.

Latest Developments

Ascot Resources has unveiled a recapitalisation and restructuring plan aimed at stabilising its finances and positioning the company for a potential restart of the project.

The plan includes a C$0.01-a-share rights offering, a 50:1 share consolidation and a best-efforts private placement of up to C$150-million. The restructuring will be supported and advised by Fiore Management and Advisory, which has agreed to fully support the C$14.9-million rights issue.

Fiore will also assist Ascot with leadership changes and longer-term refinancing efforts, including negotiations with senior lender Nebari and stream partner Sprott Private Resource Streaming and Royalty. Discussions with Nebari are under way to secure a bridge loan of up to $18-million, with further amendments to existing debt, and stream agreements expected to follow.

Ascot chair of the special committee, Andrée St-Germain, has described the restructuring as a “turning point” for the company after a difficult period.

She has acknowledged that the plan will be a “difficult next step” for shareholders, but has emphasised that it is necessary, noting that Ascot has evaluated alternatives including mergers, asset sales and even creditor protection.

Once the restructuring is complete, Ascot plans to keep the project on care and maintenance while the incoming management team conducts studies on the optimal path to commercial production.

Key Contracts, Suppliers and Consultants

Sacre-Davey Engineering (overall coordination, infrastructure and the economic evaluation in the independent feasibility study); InnovExplo Inc and Mine Paste (mining); Sedgman Canada (metallurgy and processing); Knight Piésold (tailings and water management); SRK Consulting (water treatment plant); Paul Hughes Consulting (site geotechnical); McElhanney (access roads); Prime Engineering (electrical substation); Palmer Environmental Consulting Group (geochemistry, hydrology and water-quality modelling); Falkirk Environmental Consultants and EcoLogic Consultants (environmental studies); Farnell-Thompson Applied Technologies (semiautogenous grinding mill ball mills and related parts); and Procon Mining & Tunnelling (underground mining services).

Contact Details for Project Information

Ascot Resources, tel +1778725 1060 or email info@ascotgold.com.