100 MW Free State solar project represents IPP empowerment landmark

The selection of Pele Green Energy (PGE) to supply renewable energy to the South African ferrochrome smelters operated by the Glencore Merafe Venture represents an important milestone in the steady yet uneven evolution of South Africa’s electricity industry.

Its significance is not immediately apparent, largely because the novelty of such multidecade power purchase agreements (PPAs) between electricity-intensive private firms and independent power producers (IPPs) has worn off somewhat three-and-a-half years after President Cyril Ramaphosa successfully twisted a reluctant Gwede Mantashe’s arm to enable such deals at scale.

Initially a 100 MW cap was placed on these agreements, but that too was eliminated in July 2022, as South Africa sought to further accelerate the construction of new generation in a context of extreme loadshedding, which has thankfully eased since late March as Eskom improved the performance of its coal fleet.

Various companies have taken advantage of the space created partly to secure cleaner electricity amid rising regulatory, shareholder and customer pressure on companies to reduce their carbon emissions, as well as to prepare for the looming risk to their export competitiveness as country’s move to implement carbon border adjustment mechanisms.

This greening motivation was highlighted when Glencore’s ferroalloys division and its joint venture partner Merafe Resources confirmed that PGE’s 100 MW Sonvanger solar PV project had reached financial close and would provide “clean, reliable and sustainable energy” to their smelters.

Besides reducing Scope 2 emissions, such deals are also designed partly to shield companies from Eskom’s uncertain tariff trajectory, as well as to diversify supply away from a monopoly provider whose poor performance in recent years has sapped both investor confidence and growth.

The 20-year Sonvanger solar contract, which arose following a competitive process involving multiple recognised IPP bidders, includes several other noteworthy milestones, however.

The winning bidder is not only a wholly South African entity, but is also 100% black-owned, the sole equity participant in the R2-billion project, initially developed for a public procurement round, and which has secured an 85% debt component provided by Nedbank and Absa.

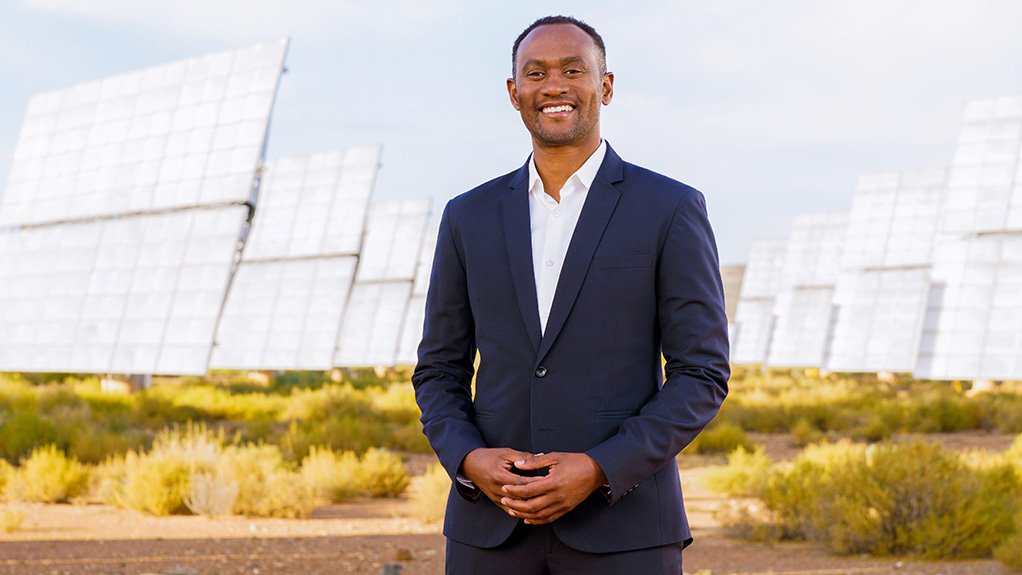

CEO Gqi Raoleka tells Engineering News that the project underlines PGE’s status as a fully-fledge IPP; a goal that seemed audacious when five black entrepreneurs established the company to participate as a junior sponsor of the 36 MW Solar CPV 1 project during the first public procurement round for renewables in South Africa in 2011.

More importantly for Raoleka, however, is that the project offers a tangible counterpoint to the cynicism that still surrounds the ecosystem that was created by government 15 years ago and which viewed the emergence of black IPPs as a key policy goal.

While few black IPPs have emerged, he argues that the ecosystem has been key to PGE’s development from what was then a minority black economic empowerment partner.

It provided the framework for the company to take ownership of CPV 1 and develop operational and maintenance capabilities.

It also fostered financial innovation that, for PGE, culminated in the pioneering R2.5-billion Sithala facility concluded last year with Nedbank, Norfund and the Industrial Development Corporation.

This arrangement helped facilitate its competitive bid for the Glencore Merafe Venture and is providing the capital base for PGE’s plan to expand its portfolio from what was 1 GW in 2022 to 5 GW by 2027.

Today, the 100-employee company is a far larger, at times equal, partner in various renewables and battery projects procured by government, six of which reached financial close in the past 12 months.

In addition, the Sonvanger project indicates that the business has developed to the point where it has been able to bid independently, and successfully, for a private PPA against well-established IPPs, many of them multinationals.

“This project represents the culmination of the 15 years we have spent building a homegrown IPP organically, while partnering with top multinationals from the Middle East, from Europe, and from North America.

“This project, for us, represents the culmination of all of those learnings from working alongside the top IPPs and in understanding how to use the support provided by the government’s empowerment policies,” Raoleka says.

Even though the 195 000-panel project, which will be located on land leased from farmers near to the Free State town of Theunissen in the Masilonyana local municipality, is a private transaction, invaluable support was provided from the Strategic Integrated Projects and the Energy One Stop Shop.

These structures, Raoleka explains, helped PGE clear significant hurdles, particularly given that the Masilonyana local municipality, on to whose network the project needs to connect to wheel electricity, was facing significant governance and financial difficulties.

They also proved effective in assisting the company to navigate Eskom’s complex Interim Grid Capacity Allocation Rules.

Attention now turns to building the project on the 270-ha site over the coming 20 to 24 months.

In parallel, however, PGE is continuing to develop a portfolio of public and private projects in line with its vision of becoming a leading African IPP; a vision that is likely to require a broadening of PGE’s shareholding beyond its five entrepreneurial founders.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation