Can adding rooftop solar really move the loadshedding needle?

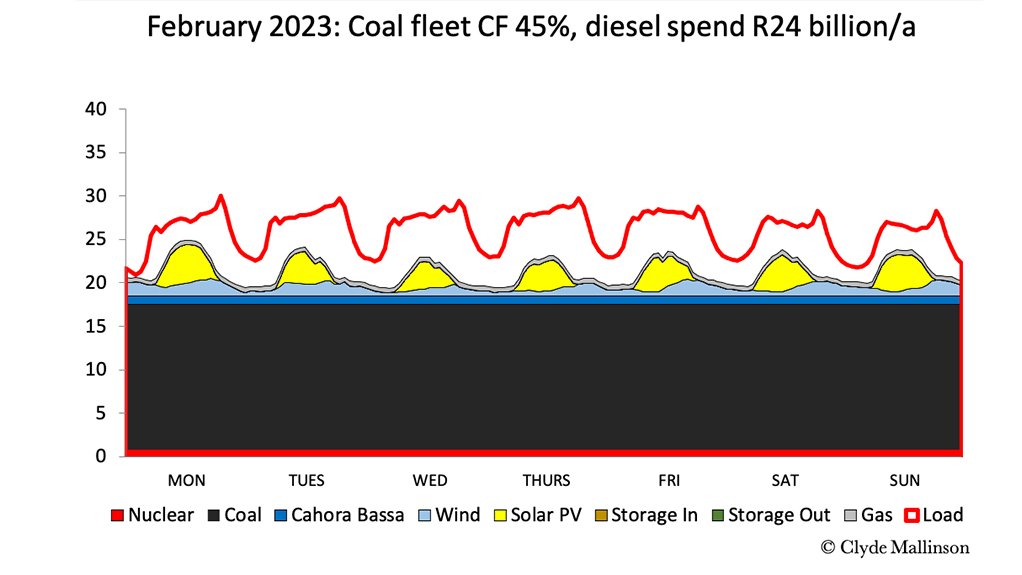

This figure, the first in a series of three, shows the electricity situation as it is currently in February 2023, with loadshedding represented by the white area between the load (red line) and supply.

Photo by Clyde Mallinson

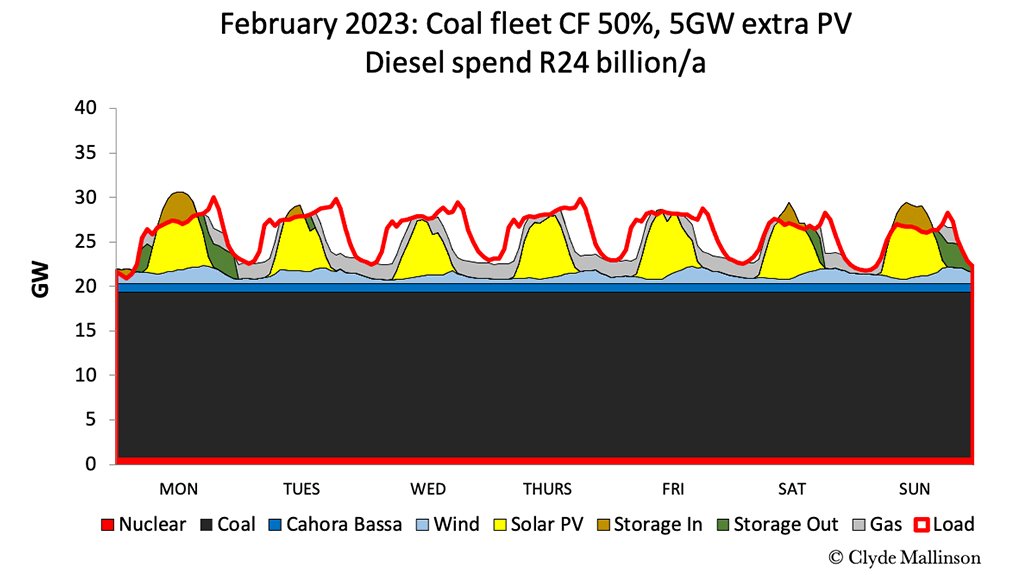

This figure, the second in a series of three, shows the electricity situation as it is currently in February 2023, but with 5 GW of additional solar and a diesel spend (grey) of R24-billion a year. The white area below the load (red line) represents loadshedding.

Photo by Clyde Mallinson

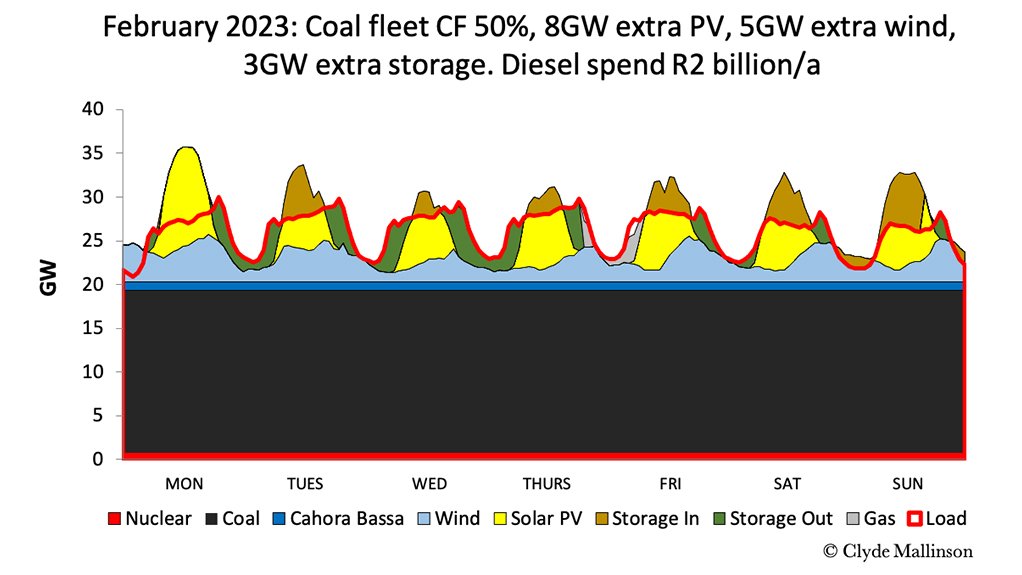

This figure, the third in a series of three, shows the electricity situation as it is currently in February 2023, but with 8 GW of additional solar PV, 5 GW of additional wind, and 3 GW of additional storage. As can be seen, there is no loadshedding and there is a dramatic reduction in diesel consumption.

Photo by Clyde Mallinson

President Cyril Ramaphosa’s announcement that incentives will be introduced to help facilitate solar investments by businesses and households was arguably the high point of a State of the Nation Address where the declaration of a state of disaster and the appointment of an Electricity Minister stole the headlines.

But can such investments really help to reduce loadshedding, which increased by four times last year to about 8.1 TWh and disrupted a total of 3 775 hours across 205 days?

Independent energy analyst Clyde Mallinson says while much will depend on the nature, timing and scale of the investments, the introduction of at least 5 GW of new solar by year-end could make a major contribution to reducing the intensity of loadshedding in 2024.

There would, however, also need to be some recovery of the performance of the coal fleet, with a “modest but achievable target of lifting the coal fleet output back to at least 175 TWh a year, the same as the output achieved in 2022”.

Mallinson’s forecast gels with an analysis conducted recently by Meridian Economics, which showed that had an additional 5 GW of variable renewable energy capacity (both wind and solar) been installed last year, 71%, or 5.8 TWh, of the power cuts implemented in 2022 would have been eliminated.

The figure could have been reduced by over 90% had Eskom had the financial and logistical wherewithal to deploy its diesel-fuelled open-cycle gas turbines (OCGTs) more optimally.

The Meridian analysis is based on actual Eskom data run through two separate platforms – a spreadsheet model and a dedicated system modelling software tool that simulates hourly dispatch more accurately – to verify the findings.

The analysis confirmed that, while a combination of 60% wind and 40% solar photovoltaic (PV) renewables mix would have a greater impact, loadshedding could have nevertheless still been reduced by 62% even if the capacity had arisen only from solar PV, even if much of that capacity had been derived from rooftop PV, which is less potent than utility scale solar farms that often include tracking technology.

“Incentivising residential, commercial and industrial customers to invest in distributed PV generation can clearly have a profound impact on reducing loadshedding.

“Based on international experience, this can also be achieved in the shortest space of time compared to other new generation interventions,” Meridian states, referencing Vietnam where more than 9 GW of rooftop solar were added in 2020 alone.

Mallinson concurs, reporting that his model shows that loadshedding could have been reduced to about 2.95 TWh last year, or to about 40% of the eventual total, had there been an additional 5 GW of solar PV in the system.

The figure would probably be somewhat lower, however, if the solar energy had been derived from rooftop sources only, given that such facilities are unlikely to match the 28% capacity factor that the Eskom data is recording for the more efficient utility-scale solar farms. The capacity factor reflected for wind in the Eskom data is nearly 40%.

“However, 5 GW of rooftop solar would still make a significant contribution, particularly in a context where the system is so energy starved that Eskom is unable to fully deploy its pumped hydro stations, which are currently reliant on high diesel burn rates or loadshedding in order for their upper dams to be replenished.”

That said, Mallinson is highly pessimistic about the outlook for loadshedding in 2023, noting that even a rapid acceleration in the roll-out of rooftop systems will take time to implement.

Should Eskom’s coal fleet fail to recover from the dismal performance of January, when the fleet’s capacity factor fell to below 45%, and should Eskom fail to secure a higher budget for diesel to cover the gaps left by three Kusile units being inoperable, Medupi Unit 4 having exploded and the prospect of Koeberg operating at half its capacity due to two successive life-extension outages, Mallinson believes there will be higher levels of loadshedding this year than was the case in 2022.

Given the difficulties Eskom is experiencing in recovering the coal fleet, he also believes the odds are stacked against a major turnaround in the performance of the coal fleet, despite the emphasis being given to the recovery in the fleet’s energy availability factor (EAF) by the Eskom board and by government.

“Therefore, we should not be targeting to introduce only 5 GW of rooftop solar.

“If South Africa wants to make a real and long-lasting impact on loadshedding without dramatically increasing the cost of electricity, every effort should be made to add as much solar, wind and storage as is financially and logistically possible as quickly as possible.

“If 8 GW of solar, 5 GW of wind and 3 GW of storage can be added over the next two years, which would be difficult but possible, South Africa will no longer be experiencing loadshedding, the prices of electricity will stabilise, there will be headroom to maintain the coal fleet and we will not need to burn nearly as much diesel to keep the lights on.

“In this scenario, with the coal fleet producing 175 TWh, and with the recommended additions of PV, wind and storage, the existing OCGT fleet would only need to run at less than a 2% capacity factor, and the diesel bill would be less than R2.5-billion for the year.

“Therefore, that should be the priority of the National Energy Crisis Committee,” Mallinson avers.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation