Centamin declares 53% interim dividend payout ratio

London- and Toronto-listed gold miner Centamin has declared an interim dividend of $0.025 a share for the six months ended June 30, resulting in a total distribution of $26-million, which represents a 53% payout ratio.

This exceeds its policy of distributing at least 30% of cash flow as dividends.

The dividend was supported by a 95% increase in adjusted free cash flow to $42.7-million for the six months under review, compared with $21-million in the first half of 2023.

The group’s adjusted earnings before interest, taxes, depreciation and amortisation improved by 9% year-on-year to $210-million, while its profit before tax improved by 2% year-on-year to $117-million.

Basic earnings per share, however, decreased by 9% year-on-year from $0.078 in the first half of 2023 to $0.071 in the reporting period.

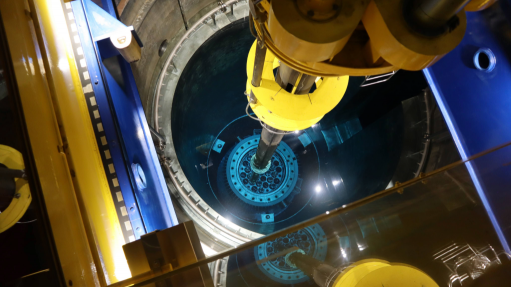

The company produced 224 738 oz of gold from the Sukari mine, in Egypt, having realised an average gold price of $2 218/oz for 209 269 oz of gold sold. This compares with an average realised gold price of $1 936/oz in the prior comparable period.

“Our focus on operating performance has enabled us to take advantage of stronger gold prices to deliver improved earnings and a significant increase in free cash flow,” says CEO Martin Horgan.

He adds that the company will start with a grid connection project in the second half of the year, which will further reduce costs. The grid connection is on track for commissioning in the first half of next year.

The grid connection involves a connection to the national grid combined with the site’s existing 30 MW solar plant on site. the company plans to install 5 MW of solar power every year for four years from 2024.

Following recent upgrades to Egypt’s power distribution infrastructure, a high voltage grid connection was extended through Marsa Alam, the local city to Sukari, located about 25 km away from site.

Establishing a 50 MW connection to the national grid, combined with the existing onsite solar plant, would fully meet the electricity needs of the mine without the requirement for onsite thermal power generation using diesel fuel.

Grid electricity is partly generated from renewable sources with the remainder being generated from non-renewable fuels, predominantly natural gas.

The Egyptian government is planning to increase renewable-energy generation to 40% by 2030 as published in their Nationally Determined Contributions. “Our 2030 interim target accounts for an increase in renewable energy sourced through the grid, from 12% in 2021 to 38%,” Centamin explains.

Moreover, Centamin also completed a definitive feasibility study for the Doropo project, in Côte d'Ivoire, with the company being well positioned to apply for a mining licence. The study confirms the project’s net present value of $426-million after tax at a $1 900/oz gold price, as well as an internal rate of return of 34% after 2.1 years.

Horgan expects the mining licence to be granted by the end of this year, ahead of a final investment decision on the project.

The company is also advancing drilling on the Little Sukari discovery, as part of its Eastern Desert Exploration. The Little Sukari prospect is located 28 km west of the Sukari mine.

Centamin’s cash and liquid assets totalled $200-million at the end of June, with total liquidity of $350-million considering an undrawn $150-million credit facility.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation