Investment group suggests nuclear could form part of country’s future energy mix

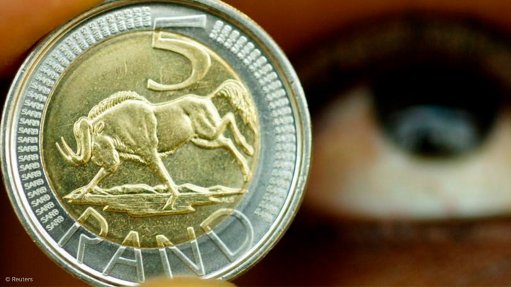

South African specialist investment company Futuregrowth Asset Management has expressed the view that nuclear power “should not be dismissed outright” as a long-term contributor to the country’s electricity generation system. Futuregrowth currently manages assets worth some R193-billion, or about $12-billion (these being the values on December 31 last year).

In an ‘Insight’ note published on Thursday, investment analyst Bongile James and portfolio manager Paul Semple acknowledged concerns in South Africa regarding the construction of new nuclear power plants (NPPs) in the country. “Nuclear power as a long-term solution to our energy woes is a sensitive topic, partly due to the ramifications for our country of the substandard design and poor build quality of [the new and coal-fired] Medupi and Kusile, the last mega-power plants constructed in South Africa,” they noted. “There are also concerns about Eskom’s ability to procure, build and operate a new nuclear power project.”

However, they also listed a series of reasons why an “open mind” should be kept, regarding nuclear. Thus, most of South Africa was seismically stable, meaning the earthquake threat was negligible, reducing that risk to nuclear reactors. Over its lifecycle, nuclear had a very low carbon footprint, while also being an efficient source of base load energy. And to reach net-zero carbon emissions by 2050, South Africa had to consider nuclear as one of the clean energies needed to achieve this target. The country also had 40 years of experience in running the Koeberg NPP, giving the country technical expertise in the field, which itself was a reason to include nuclear in the discussion about South Africa’s future energy mix.

A further factor was that, over the past decade, the use of public-private partnerships to acquire new sources of energy in South Africa had proven highly successful and had become established, under the Renewable Energy Independent Power Producer Procurement Programme. “Against this backdrop, our view is that South Africa cannot rely on Eskom to procure, build and operate [italics in original] nuclear power alone, and that any nuclear project would need to be done on a public-private partnership basis,” they wrote.

Moreover, price was “critical”. Decisions had to be based on the least cost, per unit of electricity, for the consumer, as well as on long-term supply consistency and reliability. Any nuclear option should be undertaken in an open and transparent manner using competitive bids.

Also, large NPPs could take 12 to 15 years to design, plan, get regulatory approval and be built. End-of-life decommissioning could take another five years. On the other hand, once built, NPPs had long lives, currently averaging more than 50 years. Costing a lot upfront to build, over this long life nuclear electricity average unit cost “could be closer to the other forms of base load energy currently available, especially when considering the environmental costs of coal and gas-fired energy”.

However, energy technologies, especially renewables, were developing rapidly. And large NPPs, as already noted, take a long time to build and commission. Thus there was an argument that South Africa should not lock itself into any long-term programmes. Small modular reactors (SMRs) might be the answer, but no SMR design was yet commercially available. And while there were indications that SMRs would be significantly cheaper (in terms of capital cost per kilowatt of electricity) than conventional NPPs, that had yet to be established in practice.

“Because technologies are constantly changing, giving rise to a risk of committing to a potentially obsolete nuclear reactor technology, a ‘watch and wait’ strategy seems reasonable, as we do not know what developments may occur in the next 15 years,” they suggested. “[SMRs] of 300 MW or less, in tandem with the planned decentralisation and reform of the power sector, could be a solution.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation