Low demand threatens sustainability

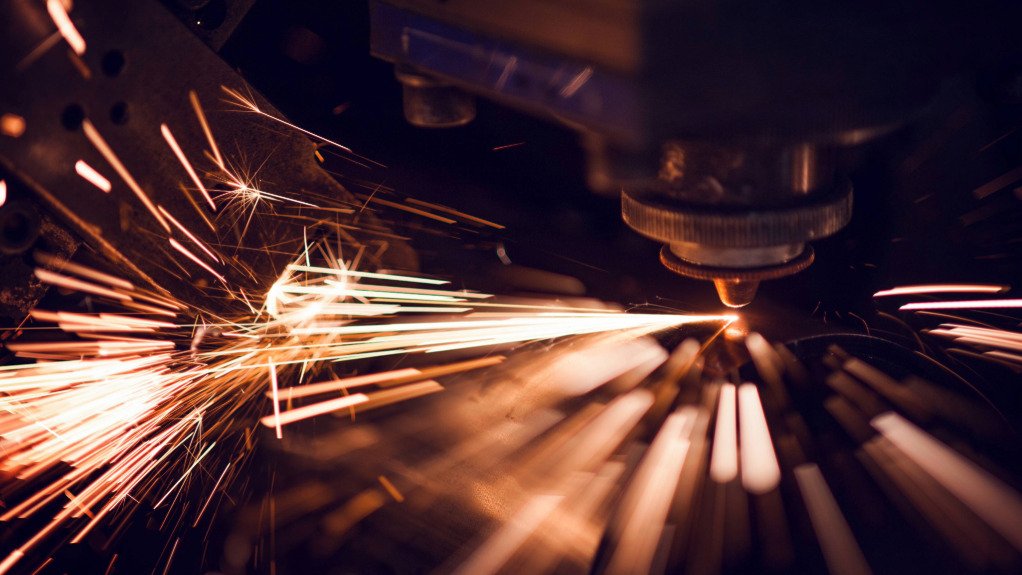

SPARKING GROWTH A stable, supportive business environment is essential for the long-term viability of the steel sector

MIKE BENFIELD Better balance between supply and demand is need to revitalise the steel industry

SOLID FRAMEWORK Steel mills must operate within a framework that optimises efficiency and scalability

The South African steel sector is facing significant challenges, primarily because of oversupply, in addition to very little demand, coupled with economic constraints.

Resolving these issues requires strategic alignment among steel mills, downstream merchants and policymakers to optimise efficiency, scale and competitiveness in the steel industry, says steel supplier Macsteel Group CEO Mike Benfield.

There is a lack of significant demand for steel, with little effort by government to stimu-late demand. Government trade policies have mainly focused on increasing competition, which has resulted in creating more steel capacity than required.

Consequently, prices have been driven down to an unsustainable level, notes Benfield, adding that companies in the steel industry are compelled to lower their prices significantly to attract customers, hindering companies’ ability to turn a profit and remain sustainable.

These factors have led to intense price competition, eroding margins across the value chain and threatening the sustainability of businesses.

“We need to create better margins and . . . get a better balance between supply and demand,” he says.

Additionally, as local demand for steel decreases, companies look towards exporting products to countries that have a stronger demand. However, logistical challenges and a volatile exchange rate can make it difficult for local companies to break into the international market.

Benfield explains that inefficiencies regarding logistics, the movement of goods, and congestion at ports and border posts, in addition to loadshedding, result in further disruptions to business, making it more difficult for companies to remain sustainable.

Some steel mills cater directly to smaller downstream customers, sometimes at the expense of their own profitability, and this practice leads to direct competition with larger clients, such as Macsteel.

He adds that the decision to do business with these customers is often done in pursuit of achieving higher margins, particularly if such companies have insufficient profitability or scale at their primary level of operation to cover overhead costs.

However, it can result in the steel mills relying only on these downstream customers that are also encountering various challenges – steel mills may have to lower their pricing to appeal to smaller downstream clients and if they were to close, the steel mills would also be significantly affected.

Benfield suggests that, to address these challenges, steel mills must operate within a framework that optimises efficiency and scalability. This involves ensuring that downstream merchants maintain adequate inventory levels to support production cycles. Further, steel mills should strive for operational consistency and scale to absorb overhead costs effectively.

Benfield notes that various infrastructure projects require steel and fast-tracking these would provide a much-needed boost for the steel industry in the short term and create a positive foundation for long-term growth.

Policy Reforms

Benfield highlights the closure of major steel plants to underscore the urgent need for policy reforms to revitalise the sector.

He emphasises that government policy needs to focus on identifying and rectifying systemic issues to address these challenges and foster growth in the steel sector.

The Steel Master Plan was signed in 2021 to work towards achieving a healthy balance between supply and demand, but there is also a lot of criticism and debate regarding “what trade policy should look like” in the sector.

Benfield says policy has focused primarily on building and encouraging supply capacity as opposed to facilitating demand, when efforts should rather focus on creating an economic environment that is conducive to improving demand.

In this regard, he advocates for a multifaceted approach, with government reassessing existing legislation and policies affecting the steel sector and related industries.

He calls on government to create a more conducive economic environment in which businesses can thrive. This includes policies that stimulate domestic demand through investments in infrastructure projects, such as railways and ports, which would create a steady demand for steel products.

Consolidation within the supply chain to streamline operations and improve efficiency requires that government make regulatory changes that allow for mergers and acquisitions, while ensuring minimal job losses.

Benfield acknowledges that this approach will nonetheless lead to job losses, but adds that these losses would be small in comparison to those that could be lost if more companies close altogether.

Additionally, to remain competitive in the global market, there is a need for a comprehensive overhaul of the logistics infrastructure. This requires concerted efforts in policymaking and implementation to address logistical challenges effectively.

Benfield argues that the privatisation of key infrastructure could also be explored to incentivise private-sector investment in upgrading and expanding these facilities, ultimately driving demand for steel.

Restoring confidence in government policies, and fostering a more stable and supportive business environment, are essential for the long-term viability of the steel sector in South Africa, he concludes.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation