Not viable for South Africa to invest in li-ion battery recycling

A recent study undertaken by mineral processing expert Mintek has confirmed that there is no viable business case for South Africa to invest in lithium-ion (li-ion) battery recycling.

Mintek bio-metallurgy manager Mariekie Gericke spoke during the Battery Technology conference on August 13 about the existing li-ion battery recycling facilities globally and how South Africa could leverage off existing technology in future, when the economics potentially make more sense.

She explained that the business case for establishing li-ion battery recycling capacity in South Africa was unjustified owing to low collection rates of batteries, which was, in turn, a result of lacking collection infrastructure and political will to stimulate electric vehicle (EV) uptake.

Once potential recyclers could achieve a collection rate of 500 t/y, it would start making sense to establish these facilities; however, South Africa is estimated to have collected only between 6 t and 10 t of li-ion battery waste in 2019.

While laptops and mobile phones are the major waste streams for the recovery of li-ion battery waste in South Africa, there is no evidence of waste being recovered from industrial equipment such as forklifts.

Waste collection volumes are an important consideration for establishing recycling facilities, but so are the difficulties in storage and transportation of li-ion batteries owing to their highly flammable nature.

The industry should also be aware of the complexities related to different battery designs, since new battery chemistries are formulated regularly and there is no one process of recycling that can accommodate all of them.

Gericke said li-ion battery recycling most often takes place in close proximity to battery manufacturing facilities, since closed-loop systems provide a source of material that can be reused by manufacturers for the production of new batteries.

To effectively increase the amount of li-ion battery waste volumes for processing, Gericke suggested that government and other relevant stakeholders would need to establish collection infrastructure and consider incentives to encourage EV market penetration.

Moreover, compelling automotive and information and communication technology original-equipment manufacturers to take ownership of their products from cradle to grave can result in the development of dedicated li-ion battery collection infrastructure, increasing collection volumes and the development of a processing plant in South Africa.

Although the business case for local li-ion battery recycling capacity is not yet there, she stated that the increased use of these batteries would lead to South Africa contributing to these waste streams soon enough. It was, therefore, important to start considering what would be done with those tonnages.

Gericke said it was also necessary for government to start thinking about local li-ion battery recycling solutions considering that Asian and European recyclers – should South Africa consider exporting its waste – require batches of at least 20 t at a time be sent, which means it will take years to fill up a container, if South African collection volumes remain at current low levels.

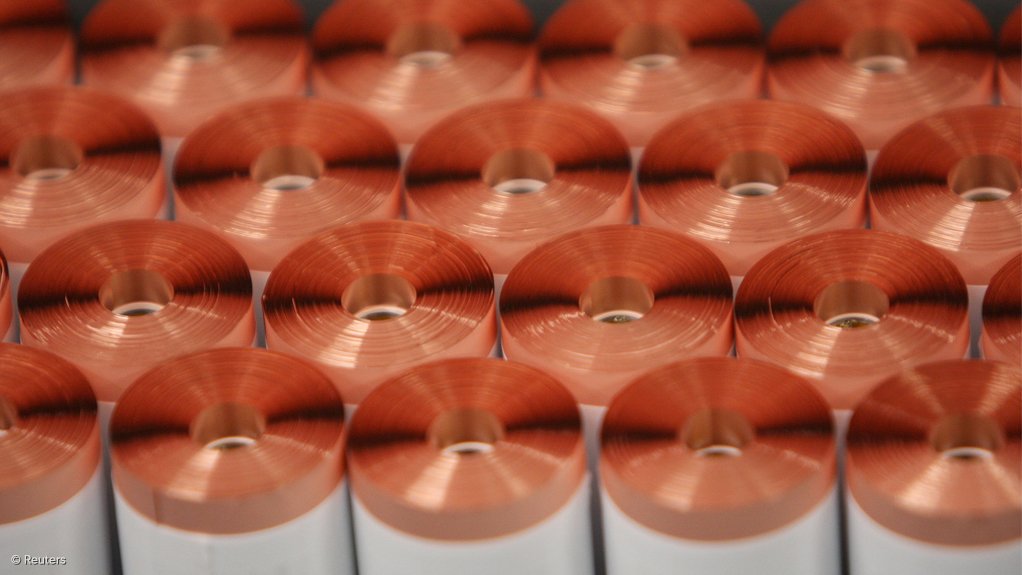

Drivers for the establishment of li-ion battery recycling are typically economic considerations, such as recoverable metals – particularly cobalt, lithium and copper – and ever-stricter environmental regulations and policies.

Additionally, Gericke noted that the world also wanted to reduce its reliance on primary mining activities, such as for cobalt, since mining thereof in the Democratic Republic of Congo is ridden with security and ethical issues, for which recycled metal holds a safer opportunity.

She mentioned that recycling technology is also becoming more efficient as more research and investment globally takes place, which will in future bode well as an option to effect local economic development opportunities.

In terms of li-ion battery production, China is the leading manufacturer at 118 234 MWh in 2019, followed by the US at 24 766 MWh, Japan at 22 479 MWh and South Korea at 18 574 MWh.

This while demand for li-ion batteries will reach 8.6 GWh for automotive and transport applications by 2030. Energy storage will demand 418 GWh by 2030, and portable electronics will demand 604 GWh. The compound annual growth rates for li-ion battery demand from these three sectors between 2020 and 2030 is 21%, 16% and 3%, respectively.

The global li-ion battery recycling industry was worth about $1.5-billion in 2019, and is expected to increase to $12.2-billion by 2025 and $18.1-billion by 2030.

TECHNOLOGY TYPES

Gericke pointed out the two types of recycling technology commonly used globally – pyrometallurgical and hydrometallurgical.

Pyrometallurgical processing of li-ion batteries involves smelting and is applicable to any battery chemistry and configuration; however, it is capital intensive, energy intensive and produces significant greenhouse-gas emissions.

It does offer a high recovery rate of key metals – cobalt, nickel and copper – while much of the aluminium and lithium is lost.

Hydrometallurgical processing entails chemical leaching and is much less energy intensive, while still offering high recovery of metals, but reagents are costly.

The processes can be used separately or in combination.

A third option, direct recycling, involves battery materials recovered and reintroduced into the supply chain with little additional processing. Electrolytes are removed, cells are crushed and the parts of the battery are separated.

Germany is the leader in using pyrometallurgic recycling technology, having more than 20 000 t/y of capacity in the country, followed by Belgium with 7 000 t/y and the US at 6 000 t/y.

On the hydrometallurgical front, China has more than 50 000 t/y of treating capacity, followed by Canada, the US and Germany, with 4 500 t/y, 4 000 t/y and 3 000 t/y of capacity, respectively.

Direct recycling is more in a conceptual phase, with no large commercial facilities having been established yet. Gericke said there were some projects in pilot and conceptualising stages in Canada and the US.

According to Mintek’s study, pyrometallurgical plants have the highest capital cost at around $20-million, followed by hydrometallurgical plants at around $12-million and under $5-million for the direct recycling route.

In terms of operating costs, all methods have high transport costs and purchasing li-ion batteries for feedstock involved, followed by power and labour.

Relating the technology question back to the South African context, she pointed out that the country would ultimately need to opt for the highest recoveries for cobalt, nickel, copper and, if possible, lithium, to achieve profitability.

To read more about the Mintek study, visit https://wasteroadmap.co.za/research/grant-030/

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation