Opinion: AMSA closure – where to for automotive manufacturing in South Africa?

In this article, National Association of Automotive Component and Allied Manufacturers (NAACAM) CEO Renai Moothilal writes that ArcelorMittal South Africa's (AMSA's) decision to halt long steel production from its Newscastle blast furnace will significantly impact on the country's automotive and automotive component manufacturing, as well as the broader economy.

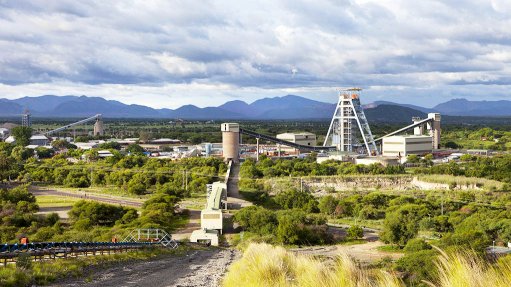

The announced closure of AMSA's long steel production from the Newcastle blast furnace could significantly impact on the South African automotive sector, a cornerstone of the country's economy. A core supplier of speciality steel, AMSA has been central to automotive manufacturing, providing high-grade materials critical for components into vehicle production lines.

This has been a vital contributor to the competitiveness of the domestic sector.

Its exit from the market will create ripple effects throughout the automotive value chain, and other downstream industries. The economic value of local steel production is significant. According to InvestSA, every 1 000 t of steel produced in South Africa adds R9.2-million to GDP. This production supports six jobs – three directly and three indirectly – and drives domestic procurement including at the small, medium-sized and microenterprise level.

Within the automotive sector, metal fabrication, forming and pressing is one of the largest subsectors. This is not by coincidence. Local automotive-grade steel from AMSA has been a catalyst for the development of this subsector.

Beyond supply into domestic original-equipment manufacturing (OEM) value chains, the ability to source local steel has become a competitive advantage for export supply of various metal components into global markets.

Electric vehicles assembled in the US have components forged in the Eastern Cape using speciality steel coming out of the Newcastle blast furnace.

AMSA is the sole domestic supplier of about 70 000 t/y of speciality long steel grades to the automotive sector.

AMSA’s short-notice announcement that the plant will close at the end of January, risks supply chain disruptions and delocalisation in the short-term and overall sector competitiveness in the medium to long term. With no other local suppliers of automotive-grade long steel immediately available at OEM certified standards and volume, component suppliers will either need significant buffer stock or must import steel to keep plants operational this year. This will have a cascading effect on the manufacturing value chain.

Steel importation can increase costs by up to 25% due to longer lead times, logistics and foreign exchange exposure.

Added to this is the loss of local content derived from local steel, reducing Automotive Production and Development Programme (APDP) incentives to vehicle and component manufacturers, and placing South Africa at risk of failing to meet export rules of origin requirements.

The automotive industry is a significant contributor to South Africa’s GDP and export revenues, with vehicles and components accounting for approximately 15% of total exports. Any decline in the industry's cost competitiveness would directly affect its ability to play in global markets.

Of interest, China, India and Japan have the highest number of steelmaking blast furnaces globally. An analysis of those countries’ vehicle export penetration rates into global markets, including South Africa, underscores a rule of thumb around steel supply being a competitive driver for automaking and industrialisation.

Moving to imported raw material or even a new domestic source is not that simple. Material changes are subject to extensive approval processes and, in some instances, vehicle crash testing and other re-homologation is required. This is typically a 12-month process but could be longer for safety critical components.

In the absence of sufficient buffer time and raw material, a likely outcome of this in South Africa for vehicle plants that are already in mid-cycle production - to prevent their own assembly line stops - is that OEMs will, via imports, resource entire finished components, as opposed to raw material, from preexisting, certified global component suppliers of sister plants.

Such an outcome would reduce the South African component sector’s contribution to the economy and impact jobs before the year is out.

This despite the South African Automotive Masterplan having increased localisation as its underpinning tenet.

South Africa’s automotive supply chains are intricately linked to local steel production. The closure of AMSA Newcastle will introduce volatility, with manufacturers facing longer lead times and potential delays in production schedules. This disruption will affect the timely delivery of vehicles to both domestic and international markets, possibly impacting the reputation of South Africa as a reliable automotive hub.

For automakers operating under just-in-time production systems, precise timing of parts delivery is key. Disruptions stemming from the lack of specialty long steel or delays in import setups could result in production slowdowns or shutdowns, compounding the economic impact.

In 2024, the automotive manufacturing sector directly employed over 116 500 workers and supported thousands more indirectly. The loss of AMSA longs would lead to significant job curtailment, severely impacting on the industry and the livelihoods it sustains.

Other than the estimated 3 500 direct job losses at the Newcastle blast furnace, NAACAM's research has estimated this decision could mean the further immediate retrenchment of up to 3 000 auto component sector jobs in components directly affected. This is alarming given that South Africa’s unemployment rate stands at a staggering 32.1%.

Any future vehicle plant production line stoppages due to unavailability of steel, reduced production volumes and rising operational costs associated with increased material imports could force automakers and suppliers to further reduce their workforce to maintain sustainability.

Here, a further 13 000 jobs are seen to be at risk in 2025.

It’s conceivable that coupled with other competitiveness concerns around logistics, OEM volume volatility etc, the plus-100 000 jobs become untenable over time.

Will the closure of AMSA’s long steel production out of Newcastle prove a bellwether for the domestic automotive sector? Can the sector achieve the growth rates expected in the masterplan between now and 2035, but at the same time absorb the loss of such a key local raw material?

The absence of this reliable local steel supply could lead to line stoppages plant closures and volume cuts, jeopardising both the sustainability of component suppliers and OEMs. As production halts and employment risks escalate, an overall drop in competitiveness may undermine the industry’s global position.

If indeed South Africa is committed to a path of industrialisation, State intervention is required to find measures that ensure the automotive value chain has access to local speciality steel. That includes getting an AMSA commitment for required production out of the Newcastle blast furnace for at least a full year buffer supply, buying time to transition local mini-mills into certified suppliers of automotive-grade steels, or better yet, explore sustainable ways to keep Newcastle open. Equally, give comfort to vehicle assemblers to not expediently shift to imports of finished components currently produced in South Africa to mitigate their own line stoppages, and support impacted component manufacturers to alleviate the added cost pressures that will come with re-grading raw material (if available), as well as cushioning employees with wage assistance measures should the expected loss of local content ensue.

There is often commentary around whether traditional manufacturing sectors, including automotive, are protected and incentivised at the expense of others in South Africa.

It is a fact that the automotive sector receives a package of fiscal support, led by the Department of Trade, Industry and Competition-implemented APDP, but this is no different to other automotive locations. An example of a previously strong automotive producing country is Australia, whose government began turning off the taps on State support about 20 years ago, to the extent there is no automotive manufacturing left today.

It is doubtful whether South Africa’s coffee shops can absorb the plus-100 000 skilled jobs at pay rates currently found in the domestic automotive sector.

The AMSA situation allows reflection and for South Africa to be even stronger in industrial policies starting from bottom up, using raw materials and intermediate production as long-term drivers of competitiveness.

*Moothilal is an expert in the field of automotive sector development in South Africa. He is an advocate of increasing localisation rates in South Africa’s automotive value chain, supporting sectoral transformation, as well as promoting the adoption of class-leading technologies and skills among the supplier base. NAACAM is recognised as the voice of the South African automotive component industry. As a member-driven organisation, it is at the forefront of industry leadership, representation and stakeholder engagement for automotive component manufacturers.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation