Selling Mutlu, stabilising Hesto key as Metair moves towards new strategy

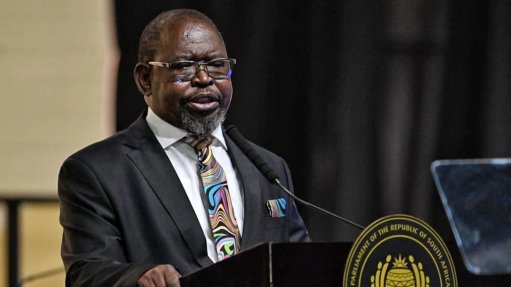

Selling the troubled Mutlu battery business in Türkiye and continuing the stabilisation efforts at Hesto Harnesses are key in returning Metair to solid ground, says CEO Paul O’Flaherty.

Announcing the energy storage and auto component group’s financial results for the six months ended June 30 on Thursday, O’Flaherty said the JSE-listed company was now six months into its restructuring and turnaround strategy.

Should the proposed sale of Mutlu go ahead later this year, the business would become a discontinued operation, freeing Metair from the complexity of managing and reporting on a hyperinflationary environment.

Continued macroeconomic pressure in Türkiye had resulted in the yearly inflation rate increasing to 71.6%, with interest rates at around 50%.

The disposal of Mutlu would allow Metair to work with its funders to restructure its remaining debt of R3.7-billion post-sale, said O’Flaherty.

Two previous attempts at selling Mutlu had failed.

Within a restructured Metair, Hesto would be the group’s biggest subsidiary.

Metair held 75% of Hesto.

Hesto had faced a number of setbacks on the back of a challenging contract rollout related to local Ranger production at Ford’s Pretoria plant, but had managed to return to profit in the six months under review.

“Hesto’s continued profitability, performance and generation of cash flow are fundamental to the future of the group,” noted O’Flaherty.

“We need Hesto to generate the cash flows and profits it is capable of.”

Hesto’s prime customer, Toyota South Africa Motors, is also gearing up for the rollout of the new Hilux bakkie at its Durban assembly plant.

The capital investment required for this project at Hesto had not yet been finalised.

Rolling out a new strategy at Metair was equally vital to the future success of the group, added O’Flaherty.

“We can’t just sit and think we have problems to solve. We have to rethink our strategy. We have to reset.

“Who will we be post-Mutlu? What will be when we reinvest in Hesto and balance the shareholder loans?

“The core of Metair is automotive component manufacture. That is our core and it will remain our core,” said O’Flaherty.

“However, our strategic focus is going to move into Africa – sub-Saharan Africa – into moblity and the energy sector. We won’t lose who we are, but we have to look for diversification.

“We have to look to balance other annuity income streams; to balance when we have customer volatility. So, we need to look into the aftermarket, which we are well positioned to do.

“We need to look into industrial business in Africa, and that is part of the strategy which we will be approving with the board and rolling out into the future.”

Port, Car Production Challenges

South Africa’s inefficient ports continued to act as a drag on Metair’s business performance.

“We see no relief at the ports. We see no relief in terms of getting goods into South Africa through the ports and to our factories – no relief,” emphasised O’Flaherty.

“It remains of high concern to airfreight goods in and to try and plan nine months in advance; it is a big challenge for most of our subsidiaries.”

O’Flaherty added that new-vehicle production at South Africa’s car and bakkie assembly plants was expected to be less than 600 000 units this year, down from 650 000 units last year.

This placed pressure on Metair’s component businesses to continuously weigh cost and production efficiencies at their factories.

A significant part of the expected drop in production volumes came from Metair’s main customer Toyota, with saw a 29% decline in assembly at its Durban plant for the first six months of the year owing to engine certification irregularities laid bare at parent company Toyota Motor Corporation.

As for the influx of cheaper Chinese and Indian vehicles fully imported into the South African market, O’Flaherty acknowledged that it was a “big threat”, but said it was a challenge best resolved by government and the local vehicle assembling industry.

Metair on Thursday reported a 4% increase in revenue for the six-month period ended June 30, to R7.95-billion, and a 59% drop in operating profit, to R134-million.

Hesto returned to profitability, following a R711-million loss in the first half of last year.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation