The rich world’s plan to help developing countries go green is floundering

It was meant to be the climate justice blueprint, the deal that showed how rich countries could help developing economies end their reliance on coal and go green. Almost 18 months on, South Africa’s $8.5-billion transition showpiece looks more like a cautionary tale.

Only one coal-fired power plant has been closed since the so-called Just Energy Transition Partnership was unveiled to great fanfare at the COP26 climate talks in Glasgow. Now, some South African politicians are pushing to keep others open longer than planned — potentially for years — as the country struggles to end daily blackouts that are angering voters and turning off foreign investors.

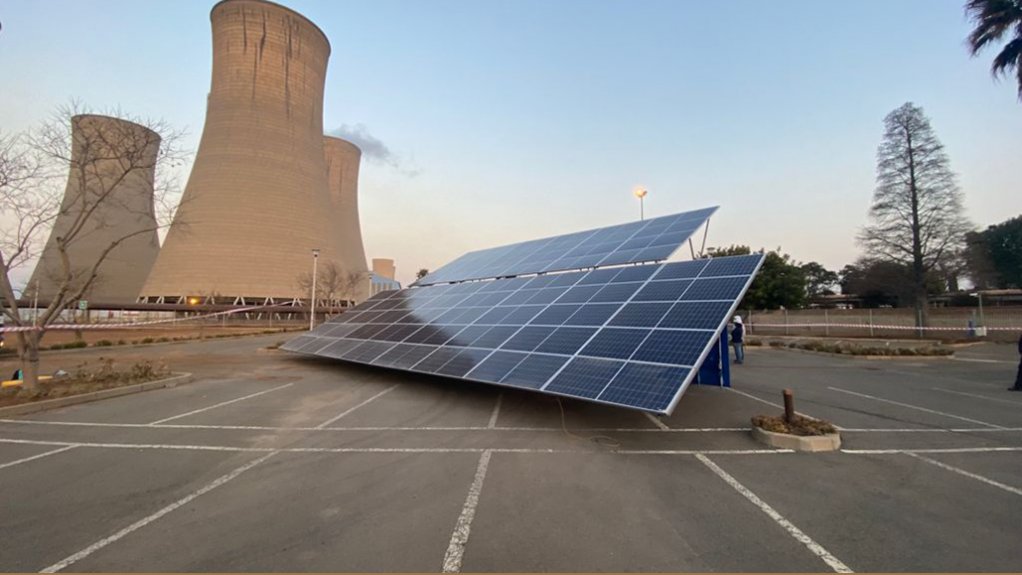

The JETP’s success hinges on a plan by Eskom Holdings SOC Ltd., the state power utility responsible for about 40% of South Africa’s planet-warming emissions, to replace most of its 14 remaining coal plants with wind and solar. But setback after setback has dogged the program since its inception, casting a shadow over similar agreements currently being hammered out with Indonesia, Vietnam, Senegal and India.

Indebted and reliant on government handouts, Eskom has been searching for a leader since its Chief Executive Officer Andre de Ruyter quit in February, accusing a government minister of graft and opponents of trying to poison him. Decades of indecision, mismanagement and corruption have hollowed out the company to the point where it can no longer keep the lights on. Beyond Eskom, the challenges are just as daunting. Political turbulence and critical personnel changes have stymied progress. The government has so far neglected the difficult work of negotiating with the labor unions. And the country’s energy minister, a former miner and union leader, is a self-described “coal fundamentalist.”

It’s little wonder then, that the government plan on which the funding depends is already behind on its own targets, unsettling international partners interviewed by Bloomberg, who are keen to show they’re doing their bit for climate justice. Funders privately describe the current situation as a hiatus.

“It doesn’t make sense to be shutting down units at coal-fired power stations when we have an energy crisis,” Vikesh Rajpaul, general manager at Eskom’s JETP office, said by telephone. The company is currently considering operating “some of these units as long as we can continue to operate them without significant capital investment.”

When the concept of helping developing countries transition away from fossil fuels first began to coalesce at meetings of the Group of Seven industrialized nations, South Africa emerged as a seemingly ideal test case. It would be simpler to work out a plan in a country with one big energy company rather than many small ones. A land of abundant sunshine and high winds, South Africa is also well-suited to renewable energy — and Eskom was already looking at a potential green transition but didn’t have the funds to pursue it.

Five partners — Germany, France, the UK, US and European Union — agreed to provide some of the money required for South Africa to close dilapidated and failing coal plants, bolster transmission capacity, add renewable energy and foster the development of electric vehicle and hydrogen industries to create new jobs. The JETP model was appealing because it was clearly-defined and measurable while still being large-scale. That made it easier to finance than the more amorphous funds poor countries have demanded to help them adapt to extreme weather or protect carbon-trapping forests.

Climate finance is likely to be a focus of December’s COP28 meeting in the United Arab Emirates, with the oil-exporting host saying it will address ways to fund the energy transition in poorer countries that simultaneously need to expand access to electricity. That adds pressure on industrialized nations and oil producers to step up.

While Vietnam’s $15.5 billion and Indonesia’s $20 billion planned JETP agreements are at an earlier stage, they’re also much bigger and potentially more complex. A smaller deal envisaged with Senegal is complicated by its plan to start producing gas.

“We could have done an amazing, amazing model right here in South Africa,” said Tasneem Essop, executive director of Climate Action Network International, which represents over 1,900 climate-focused organizations in more than 130 countries. But “we got embroiled in the politics of it all.”

There was always going to be push-back.

Coal is the fuel upon which South Africa’s economy, the most advanced on the continent, was built. Cheap power from abundant coal fields powered gold mines that earned foreign currency for the Whites-only government. In a country that lacks oil, Sasol uses coal to make motor fuels. Today coal-fired plants provide over 80% of South Africa’s electricity, making it more dependent on the dirtiest fossil fuel than any other major economy.

At least 110 000 people are employed in the mines and power plants, which puncture the flat, corn-growing vistas of Mpumalanga province, east of Johannesburg. While the region boasts spectacular scenery and wildlife, it is also home to some of the most polluted places on Earth. Some municipalities rely on coal for more than 40% of economic activity.

The coal supply chain also serves as a linchpin of the government’s Black economic empowerment drive. The ruling African National Congress has used it to foster Black-owned businesses and provide jobs to its constituents. Closing any large industry is never easy — it requires skill to bring unions, political parties and other vested interests onside. It’s especially complicated in South Africa, where coal is enmeshed with the history of the liberation struggle.

While South Africa operates a largely free-market economy and counts the EU, US and UK among its top trade partners, the ANC remains rooted in the liberation struggle era, when it enjoyed support from the Soviet Union, and some politicians remain suspicious of Western nations.

That skepticism manifested itself when Germany’s vice chancellor Robert Habeck visited South Africa in December. Gwede Mantashe, the coal-supporting minister of mineral resources and energy, told the Green party politician that South Africans didn’t want to be the West’s guinea pig for the global energy transition. Habeck offered to withdraw the JETP funding, according to people familiar with the conversation. Mantashe declined to comment. Habeck’s spokeswoman did not respond to an email requesting comment.

As the finances of Eskom and the government have deteriorated, power plants and towns across South Africa’s eastern coal belt have been left to ruin, with half the generating capacity out at any one time. Eskom has had to ration electricity in recent years. Rotating power cuts have been imposed every day bar one this year, often for more than 10 hours at a time.

Mantashe, who has overseen a stop-start effort to boost renewable power generation, and newly appointed electricity minister Kgosientsho Ramokgopa have made it clear that their priority is to alleviate the blackouts. They argue that the quickest way to do that is to fix the coal plants, which has the added benefit of preserving jobs and patronage networks.

Eskom estimates 53 gigawatts of clean energy would need to be installed by 2032 to make up for the six coal-fired stations due to be retired before then. But major renewables projects being built in western provinces with strong wind power potential are held back by a lack of grid capacity. The Northern Cape, an arid area favoring solar plants, also needs to expand its transmission infrastructure to carry power to the big population centers.Eskom is also meant add some renewable units at idled coal sites, which have the advantage of being already connected to the vast grid that feeds the nearby cities of Johannesburg and Pretoria and carries power as far as Cape Town.

But the terms of a 254 billion rand debt bailout announced by the government in February prohibit the company from investing in new generation capacity. It can’t take on additional debt without Treasury permission and can only spend within narrow constraints.

South Africa estimates it will cost about R1.5-trillion over the next five years to begin the switch, including funding for everything from power lines to kickstarting a hydrogen industry.

The $8.5 billion that international partners are offering is meant to serve as a catalyst for more investment. Spain, for example, said this month it was providing 2.1-billion euros ($2.3-billion) toward energy transition and water needs.

But most of the money isn’t free. JETP funding consists of a mix of grants, concessional finance, commercial loans and debt guarantees; under the current deal, only 4% of the total doesn’t have to be repaid. South African Finance Minister Enoch Godongwana has expressed concern about some of the loan terms. Even President Cyril Ramaphosa, who has championed the deal, has sought more money in the form of grants.

While Eskom initiated the conversations that led to the JETP, its most prominent internal advocates — De Ruyter and Mandy Rambharos, who previously headed the JETP department — have since left. Daniel Mminele, who as head of the Presidential Climate Finance Task Team oversaw negotiations on the deal’s details, is also gone.

Joanne Yawitch, who’d overseen a sustainability initiative for businesses, has now been appointed to manage the transition plan, a spokesman for Ramaphosa said in a response to queries. She has yet to make any statement on her plans.All that’s created confusion among funders who privately say they are also concerned about how to navigate Eskom’s planned restructuring into three separate units — generation, transmission and distribution — under a holding company. Though even those plans have been delayed.

Meanwhile, worsening power cuts are increasing pressure on Ramaphosa a year before general elections in which the ANC may lose its majority for the first time.

Even though they sit on opposite sides of the clean-energy debate, Ramaphosa depends on the energy minister for his political survival. As ANC chairman, Mantashe helped Ramaphosa head off a potential challenge and win an internal vote as recently as December. That makes him impossible to replace.

The ANC is also dependent on an increasingly fractious relationship with the 1.8 million-member Congress of South African Trade Unions. Ramaphosa has so far shied away from confronting them over the coal closures, storing up potential trouble for the future.

Matthew Parks, parliamentary coordinator for the Congress, said the unions only saw a draft of the JETP after it was approved by the cabinet. “We were barely consulted,” he said in an interview. “We’ve had one meeting, I think, in September.”

Still, donor countries aren’t giving up on the deal. They’re being pragmatic and will do what they can to make the JETP more politically palatable because they need it to succeed as a “proof of concept,” one of the people involved said.

“The UK is fully committed to supporting South Africa’s just energy transition,” Antony Phillipson, British High Commissioner to South Africa, said in a response to queries. Alexis Latortue, assistant secretary for international trade and development at the US. Department of the Treasury, said his country was also standing by the program, a sentiment echoed by the German and French embassies.

Ramaphosa is racing to pass a revamped Electricity Regulation Act that would incentivize private participation in the power market — reducing the burden on Eskom in accelerating the deployment of clean energy — before elections bring potential coalition partners into the mix.

Meanwhile, a consortium of German companies has agreed to assess Eskom’s coal plants to see which of them can be repaired. It will submit a report to the government by midyear that will help it decide whether to officially extend the timeline for decommissioning coal plants. Just last week, Mantashe attended the opening of a new coal mine, saying the fossil fuel would be there for a “long time.”

“Consensus-building is hard work but necessary work,” said Climate Action’s Essop, who previously served on South Africa's National Planning Commission. If partners think “this is all about funding and infrastructure and this isn’t going to have a wider impact on the economy as a whole, on society as a whole, then they will run into roadblocks.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation