Tiger Brands reports a 10% increase in total revenue despite poor economic conditions

Food manufacturer Tiger Brands has reported a 10% increase in total revenue to R34-billion from continuing operations, ultimately delivering robust results for the financial year ended September 30, despite tough trading conditions and significant input cost inflation.

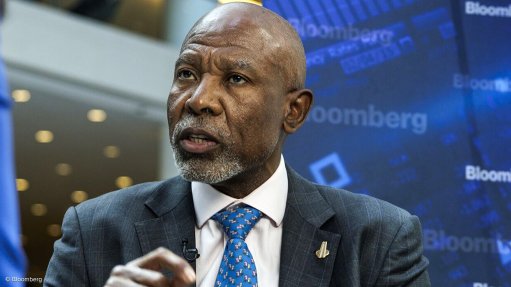

“This year’s solid performance is encouraging and provides us with important forward momentum and internal confidence as we continue to focus on . . . implementing our strategies,” Tiger Brands CEO Noel Doyle said on December 2.

The company reported that its year-end results were underpinned by a strong second-half performance, supported by the effective implementation of category-specific margin recovery initiatives in the second half, as well as the successful execution of initiatives in the group’s snacks and treats, as well as bakeries and exports divisions.

In addition, Tiger Brands’ deciduous fruit business benefitted from improved global fruit pricing and a weaker exchange rate.

Volume growth in the group’s exports and international business was offset by volume declines in the domestic business, primarily attributable to milling and baking, snacks and treats, baby, as well as home and personal care business units.

These volume declines were partially offset by good volume growth in the rice, beverages, groceries and out-of-home segments.

Cost-saving initiatives and supply chain efficiencies continued to make a positive contribution to the results Tiger Brands reported.

This, together with further progress in revenue management, resulted in the maintenance of the overall gross margin – excluding the impact of a product recall and civil unrest – at 30.3% when compared with the prior year. This was achieved despite gross margin regression in the first half of the year, the group said.

Group operating income, before impairments and non-operational items, increased by 53% to R3.4-billion.

Earnings a share from continuing operations increased by 65% to R17.62 from R10.70 a year ago, while headline earnings a share from continuing operations increased by 51% from R11.27 last year to R17.02.

The Tiger Brands board declared a final ordinary dividend of R6.53 a share for the year, bringing the total dividend for the year to R9.73, an 18% increase over last year.

In addition, about R1.5-billion was returned to shareholders through a share buyback programme.

“The operating environment this past year has remained tough, with ongoing supply and cost challenges exacerbated by prolonged periods of loadshedding. Consumer households also continue to face sustained pressure.

“However, despite these challenges we have not only delivered a credible set of results but have also maintained focus on investing in the future to ensure sustainable long-term returns and build societal value,” Doyle said.

In response to the constrained consumer environment, Tiger Brands has accelerated value-led innovation and renovation, including price-pack architecture solutions across key segments of the group’s product portfolio.

Over the past year, the group leveraged brand collaborations, academic partnerships and new technology to deliver product innovations to meet consumers’ changing behaviours and needs in terms of health and nutrition, and to help ease some of the financial burdens that consumers now face.

To strengthen innovation capability, Tiger Brands has said it has committed to further invest in research and development pilot plants at some of its facilities across the country and is developing what it called a world-class innovation centre at its corporate offices in Johannesburg. This is expected to be in operation early next year.

Aligned with its sustainable future strategy, Tiger Brands said it had invested in driving economic inclusion, launching healthier food products, supporting food security and driving resource efficiencies to minimise environmental impact.

During the year, work started on rolling out solar power at an initial four manufacturing sites – Henneman Mill in the Free State, King Foods in the North West, as well as the Beverages and Home and Personal Care manufacturing plants in Gauteng – through the procurement of power purchase agreements from independent power producers.

The initial rollout will generate 2 MW of power, supplementing at least a third of the sites’ power use and is expected to go online between the last quarter of this year and the first quarter of 2023.

This first phase kicks off a multimillion-rand investment, with Tiger Brands stating that its goal is to have 65% of the business’s electricity requirements at manufacturing site level across South Africa sourced from sustainable energy solutions by 2030.

Tiger Brands maintained its Level 2 broad-based black economic empowerment (BBBEE) contributor status in 2022. Local procurement from BBBEE-verified suppliers increased to R14.5-billion during the year, with R6.6-billion and R6.1-billion procured from black-owned and black-women-owned enterprises respectively.

Tiger Brands’ Dipuno enterprise and supplier development fund increased to R104-million during the year, with agri-development projects to the value of R54.4-million having been approved.

Through its agriculture aggregator model – the group’s enterprise and supplier development programme – Tiger Brands said it supported 67 smallholder farmers and created 271 permanent and 628 seasonal jobs in the sector.

In addition to Tiger Brands’ ongoing community food and nutrition programmes to promote food security, the group launched Isondlo, a child nutrition programme in partnership with the Nelson Mandela Children’s Fund, at a cost of R42-million, in September.

Tiger Brands said that the number of hunger-related deaths among children younger than five years old was on the rise in South Africa, which the programme hoped to address. The Isondlo programme will support 10 000 children under five, as well as their families, who are food insecure, with a monthly food hamper for a period of nine months.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation