Construction index weakens on the back of heavy rainfall, poor govt spending

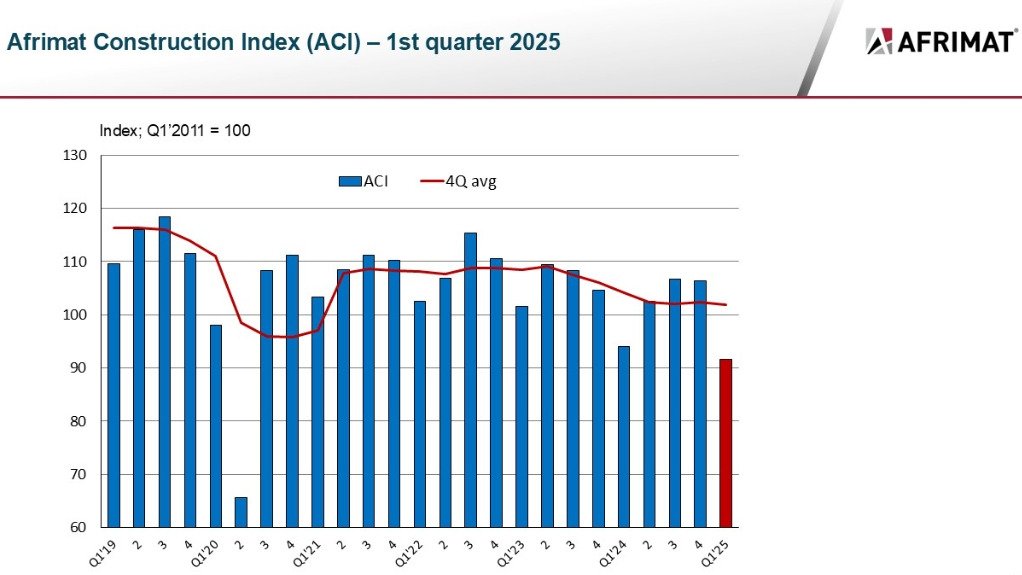

The Afrimat Construction Index (ACI) for the first quarter of this year decreased by 2.6% year-on-year, with economist Dr Roelof Botha stating that the reading is an accurate reflection of government's lack of willingness to spend on economic assets.

“It should be a point of concern for South African policymakers. Following a sharp drop during the pandemic, the ACI recovered swiftly to within a whisker of its pre-Covid level, but the recovery was then stymied by a combination of inadequate fiscal support for infrastructure expansion and the hangover from the State capture era, during which the effectiveness of several key State-owned enterprises and other public sector agencies was eroded.

"Over the past two years, these problems have been exacerbated by the South African Reserve Bank’s restrictive monetary policy, leading to the highest lending rates in 15 years,” he says.

Botha compiles the ACI, a composite index of the level of activity within the building and construction sectors, on behalf of Afrimat – a multi-commodity, midtier mining company that produces and supplies construction materials, iron-ore, anthracite, phosphate and industrial minerals.

Botha says the marginal declines in the prime overdraft rate since September last year have not been sufficient to exert a meaningful positive impact on the ACI, with the construction sector having been hamstrung since the high interest rates started to "bite into the pockets of prospective home-owners and property developers", as witnessed by the decline in the real value of building plans passed by the metros and larger municipalities.

Over the past three years, these have declined for Gauteng, the Western Cape and KwaZulu-Natal.

“Construction is the most labour-intensive sector in the economy, and the restrictive monetary policy has not only prevented this sector from recovering from the pandemic but has also contributed to the sector entering a deep recession,” he says.

In addition, parts of the country experienced above-average rainfall in the first quarter of this year, severely impacting construction activity and production in several provinces.

KwaZulu-Natal had a noticeable increase over its historical average, consistent with reports of the province experiencing exceptionally heavy rain. Gauteng also experienced above-average rainfall, particularly in January, while the North West saw a notable increase in rainfall compared to its historical average.

The exceptionally high rainfall was a major contributing factor to the decline of some of the indicators comprising the ACI during the first quarter, with only two indicators showing growth on a year-on-year basis.

According to Botha, the roadmap for higher and sustained economic growth in South Africa that was published recently by the World Bank at the request of the government, provides ample opportunity for eliminating some of the impediments to a revival of the construction sector, especially in the area of enhancing the competence of decision-making in relevant public sector agencies.

“Hopefully, the government will soon start to implement the recommendations of the World Bank roadmap, which, together with a further significant lowering of interest rates, should pave the way for a revival of construction sector activity,” he says.

Afrimat CEO Andries van Heerden, meanwhile, says the company is seeing market demand that is "significantly stronger than originally anticipated".

"Despite heavy rainfall in the North West, the dryer weather has come at a perfect time and we have made up some of the heightened demand we experienced for our products," he comments, adding that demand for Afrimat’s low-carbon cement product continues to be strong.

“Quarrying and fly ash operations are performing significantly better than the previous year, with the former Lafarge quarry volumes increasing, and in some areas, where large projects are under way, such as in KwaZulu-Natal, demand for construction materials has been strong.”

Should the government roll out its announced infrastructure investment over the next three years, Afrimat stands ready. “This spend will be hugely beneficial to the country in terms of vital job creation as well as ensuring economic activity is heightened. This is especially true in terms of logistics, with mineral and material exports being critical to the fiscus of the country. The renewed focus on rail maintenance is creating a welcome increase in the demand for construction materials such as ballast stone,” says Van Heerden.

“In my opinion, it is critical for the government to ensure that export logistics are maintained and optimised for the wealth of exports our country has. Thankfully, Afrimat has been able to export anthracite via the Maputo port, and in the first quarter, two shipments were exported with further shipments currently being loaded.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation