Deloitte discusses funding options ahead of Mboweni’s special adjustment budget

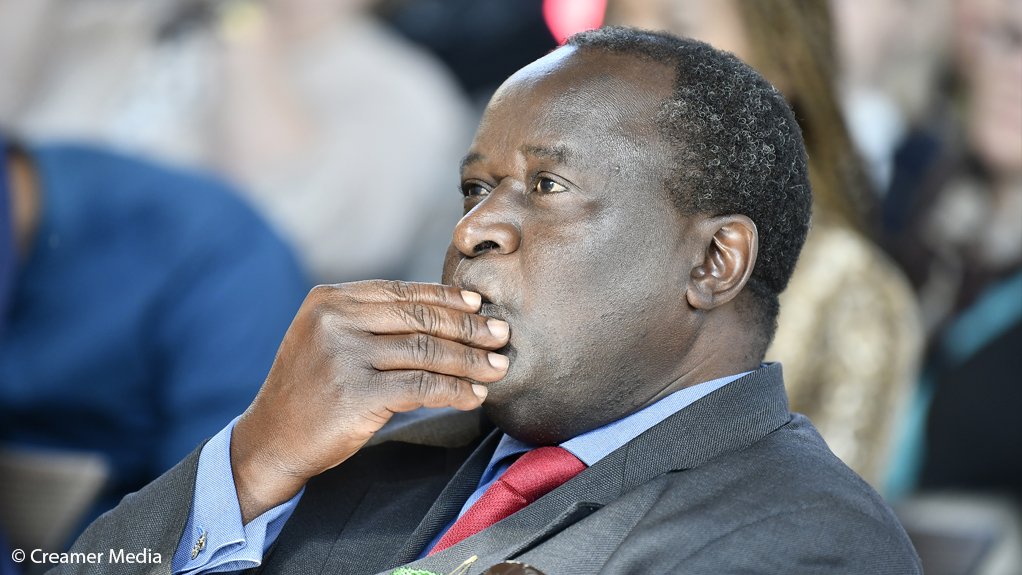

With the coronavirus, or Covid-19, pandemic having forced every South African to “radically reassess any plans he or she may have had for 2020”, no one has had to do so more than Finance Minister Tito Mboweni with regard to the national budget.

Originally tabled on February 26, Mboweni and his team at the National Treasury have had to, in unprecedented times, reassess the national budget in an effort to unlock funds needed to mitigate the impact of the pandemic.

Among the measures previously announced by President Cyril Rampahosa in April, was that the government would provide a R500-billion fiscal support to be directed to Covid-19-related priorities. Of this, R130-billion was to be reprioritised from the February budget.

Mboweni has since asked Parliament to be allowed to table an emergency budget on June 24, which advisory firm Deloitte on June 18 said, “raises several questions”.

Chief among them were the options open to Mboweni as he explores further sources of income to finance not only government’s ongoing Covid-19 efforts but other budget priorities, which have temporarily been neglected owing to the public health emergency, the firm noted.

As such, Deloitte said that when it comes to raising more revenues via taxes, Mboweni has a “limited number of options” open to him, including hiking taxes on individuals, companies or consumers via personal income tax, corporate tax and value-added tax (VAT) increases, all unpalatable at a time when re-starting the stalled economy is probably government’s major priority after protecting the health of its citizens.

With the single biggest contributor to the tax base being the tax on individuals, there was fairly widespread anticipation at the time of the national budget speech in February that taxes on individuals might be further increased given South Africa’s dire financial situation.

The fact that this did not happen – and that some relief was given (in the form of bracket adjustments) even at the top brackets – came as a surprise to many, which Deloitte said “seemed to indicate an acceptance by the government that further taxing a tax base which is already under strain was not part of the answer to the country’s problems”.

However, increasing the tax rate for companies is an option, according to Deloitte. The firm said that this approach would, however, be “counter-productive” for two reasons. Firstly, South Africa’s tax rate was already quite high and further raising it is likely to deter investment, and secondly, many companies are loss-making and are not even paying tax.

In any event, corporate income tax is only the third biggest contributor to tax revenue – significantly behind tax on individuals and VAT, the firm said.

This led the firm to question the future of VAT, which is the second biggest contributor to the tax base. However, considering that VAT is a tax on the consumer and the consumer is already under huge strain, Deloitte said that it would also be a regressive tax in as much as it burdens the poor proportionately more than the rich.

Therefore, to increase VAT now would be “massively unpopular and is probably unworkable”, according to the firm.

To compound matters further, the government is currently foregoing valuable sources of income in the form of excise duties, customs duties and VAT owing to the ban on the sale of tobacco products and, until recently, alcohol.

Overall, this leaves the country’s fiscal position with a something of a “digital dilemma”, as a possible revenue source is a digital tax similar to the 3% that France imposed on companies such as Amazon, Netflix and Facebook but later had to abandon amid push-back, from the US government mostly.

According to Deloitte, the probability of the government introducing such a digital tax seems remote because most countries are waiting for the Organisation for Economic Cooperation and Development to design a unified digital tax approach to be adopted globally to avoid more countries unilaterally imposing a digital tax.

In the absence of a growing economy, Deloitte said where government would look for more tax revenue, is “very hard to tell”.

In the firm’s view, tax increases are unlikely, but it noted that should this be the case on June 24, it could be on a once-off basis, for example, a levy on wealthy individuals.

“This seems to be the only realistic taxing measure, with possibly a credit for contributions made by qualified individuals to the Solidarity Fund. It is doubtful whether the government could introduce this as a new tax, as it is probably too difficult to design and implement a new tax in a short timeframe,” Deloitte explained.

According to the firm, an easier option may be to have a one-off Covid-19 surcharge levy as a new income tax band for high-net-worth individuals.

Additionally, the phased reintroduction of the sale of tobacco and alcohol products, but subject to higher taxes/duties to discourage consumption is another option, Deloitte said.

“We are looking forward to the Minister’s address and special adjustment budget. It will be very interesting to see how this need for funding is positioned and where the Minister will look to obtain the necessary funding.”

Mboweni is expected to table the revised budget on June 24.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation