Dividend-paying Gem Diamonds working on technologies to reduce diamond damage

Gem Diamonds results presentation covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

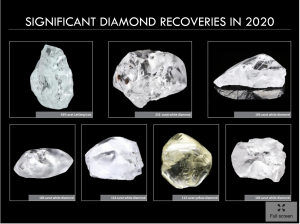

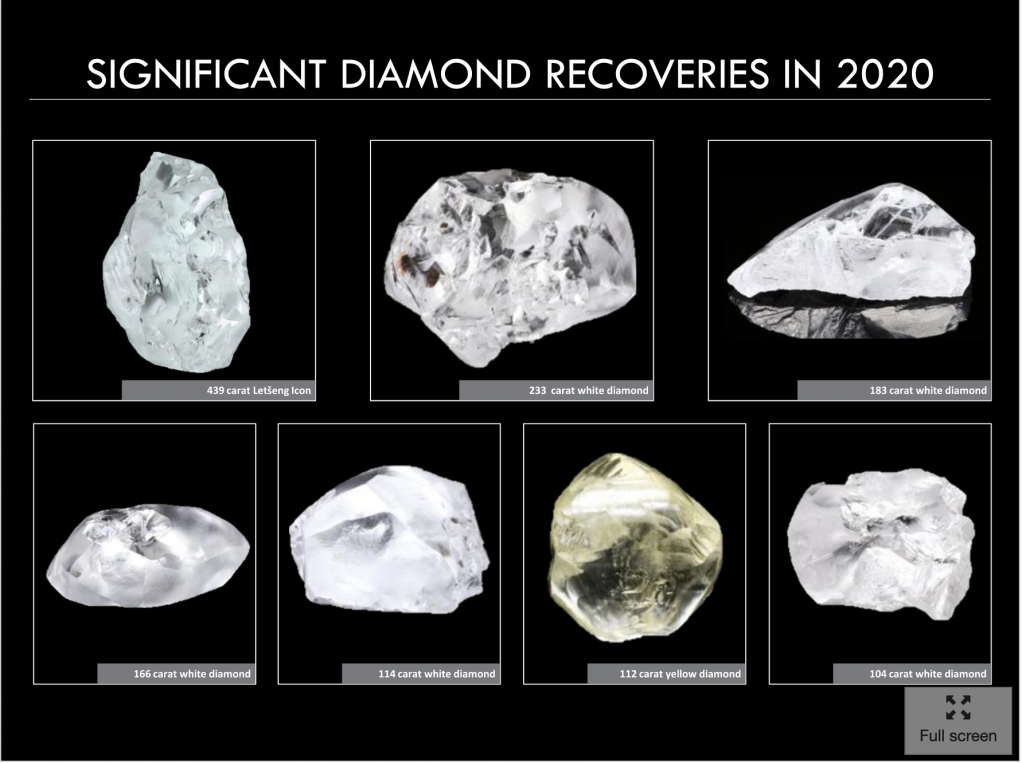

Big diamonds Gem recovered in 2020.

Wetland rehabilitated as part of Gem Diamonds' environmental protection effort.

Letšeng diamond mine, located in the Maluti mountains of Lesotho.

JOHANNESBURG (miningweekly.com) – Diamond mining and marketing company Gem Diamonds is advancing innovative technologies that reduce diamond damage by ejecting rock non-mechanically and being able to see diamonds in a certain size of rock, Gem CEO Clifford Elphick said on Thursday when the London-listed company reported positive operational and financial results, the Covid-19 pandemic notwithstanding.

On revenue of $189.6-million and underlying operational earnings of $53.2-million, Gem directors have proposed dividends of 2.5c a share in a year in which it recovered 16 diamonds larger than 100 ct each compared with 11 in 2019. (Also watch attached Creamer Media video.)

Gem achieved an average value of $1 908/ct, with the highest value of $38 827/ct achieved for a white rough diamond.

Its Letšeng mine, located in the Maluti mountains of Lesotho, is known for the recovery of large quality diamonds, including 2020’s 439 ct Letšeng Icon, which the company displayed during the presentation, along with six other large stones, one of them an 112 ct yellow diamond.

Gem Diamonds owns 70% and the Lesotho government 30% of the mine's holding company Letšeng Diamonds.

Elaborating on damage-reducing technologies, Elphick said at the presentation covered by Mining Weekly: “There are two aspects to it. The one is to get the diamonds out of the rock using non-mechanical means. We’ve ticked the box there. That has gone well and we're very comfortable with the final stage of the process.

“The first stage of the process was to see the diamonds in the rock. That didn’t deliver as well as we thought it might do. We have brought that plant back to Johannesburg. We have pulled it apart, taken out what wasn’t working. We're busy putting it back together again. Of course, as things move, computing power improves. The detection units are improving as well as the pixilation capabilities, and so we are upgrading that plant and moving to pilot plant two.

“The ambition remains the same: to be able to see diamonds in a certain size of rock and then to be able to eject them at the speed which is required to meet a commercial need. We can do this at slow speeds but that doesn’t really help us. It’s a question of improving and making this faster. So, technology advances, we seem to rush forward and then crawl forward and then have a rush forward, and that’s exactly where we are. We’ve got a team coming here from Europe in the next month to take this forward to the next step,” Elphick outlined.

Letšeng has an opencast life-of-mine that stretches to the 2030s. “We’ll need to start looking at the underground, and that will come at some point in time,” said Elphick.

CLIMATE CHANGE

On Gem’s climate-change adaption plan, Elphick spoke of the company’s adoption of the United Nations Sustainable Development Goals requiring considerable effort: “A lot of work goes into this and we make a major effort there,” he said.

On the 2020 diamond market, he noted that demand growth, particularly in China, the US, India and Australia, was showing strong post-Covid recovery, which was pushing its way through to stock market valuations. “And we know there’s a correlation between stock market valuations and diamond prices; that correlation was a little bit disturbed, but is now back, we think, with diamond prices rising quite strongly. Inflation started to appear but very much recent information it seems as it’s not quite as frothy as one might have expected, but no doubt as the world roars back from the Covid crisis, we may well see some inflation, and, of course, that’s helpful for diamond prices,” he said.

He described the 2020 holiday retail season as being strong, with the maturing Chinese and Indian consumer markets continuing to show strong growth trends.

Midstream inventory and debt levels decreased substantially and this part of the diamond pipeline was in relatively much better shape than for some time.

“And we’re not finding, at this point, the synthetic diamonds are having any impact on the demand or the prices for the sorts of goods that the Letšeng orebody delivers,” he said, adding that being the highest dollar per carat kimberlite producer was a good position to be in.

“We’ve had a good year in terms of recoveries on almost all categories, but particularly the top end,” he said.

Elphick said Gem had been participating in trials to capture additional value, involving its goods being polished into the high-end luxury brands strategy, and the company was capturing some of the additional value between rough and polished and finding its way into the brand. So far we’ve had a good experience and we’re pushing these trials out further to see what it might mean in the longer term. We're quite excited about that,” Elphick said.

Mining Weekly put these two questions to Gem relating to going green and decarbonising:

- What steps is Gem taking to be carbon neutral. Is Gem replacing fossil electricity with renewable energy, and when will Gem likely be carbon neutral? Or will the company opt for carbon offsets?

- What value does Gem place in potentially becoming a miner and a marketer of carbon-neutral diamonds, or is the market not demanding decarbonised diamonds currently?

In response, Elphick said: “Diamonds are carbon so it is difficult to sell non-carbon diamonds. I’m not trying to be facetious, but we haven't got into this in as much detail as your question is assuming.

“There is a big debate on the footprint of mining and there’s quite a complicated answer. There is a little bit of work being done particularly on man-made diamonds to what their carbon footprint and how their carbon footprint is hugely in excess of naturally mined diamonds.

“If you wouldn’t mind us coming back to you in time with a more considered answer to get into best practice, but at this point, frankly I don't have an intelligent answer to give you. Buying carbon offsets – that’s the same issue.

“With respect to replacing fossil electricity with renewable energy, we have looked at this in some detail, particularly solar and wind, and the combination. We have assessed this quite often and unfortunately the outcome of that is not good enough from a cost perspective to make a transition right now.

“It is moving in the right direction and there will come a minute when that is right. Of course, we have to also assess, not just a straight-forward cost question, but the cost of not doing this and what that does to our contribution to the planet. It’s not just a simple cost answer, but just to give you comfort there that we have looked at this in great detail over a number of years,” Elphick said.

Profit for the year from continuing operations was $27.5-million and attributable profit from continuing operations $16.9-million.

Earnings a share from continuing operations were 12.1c and cash on hand $49.8-million as at December.

At Letšeng, 100 780 ct were recovered in the 12 months to December 31, with waste mined totalling 15.6-million tonnes.

Ore treated of 5.4-million tonnes was below the 6.7-million tonnes of 2019.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation