Gas industry undergoes shift amid depleting supply

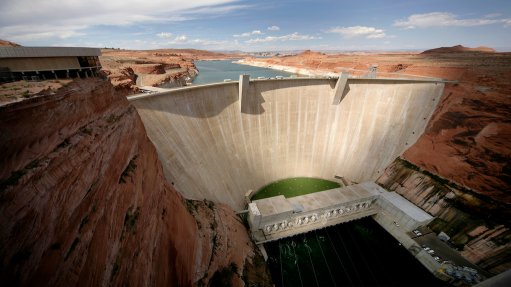

CHANGING LANDSCAPE Liquid natural gas imports through Matola in Mozambique and connecting to the ROMPCO pipeline remains the most viable option to replace current gas supplies in mid-2026

The South African gas industry is experiencing pressure as gas supply from energy company Sasol’s Pande and Temane gas fields, in Mozambique, is expected to decline from 2026, while liquified natural gas (LNG) might be too expensive for the local market given international pricing and elevated demand, warns pipeline operator Republic of Mozambique Pipeline Investments Company (ROMPCO) commercial and customer affairs GM Motlokwe Sebake.

In August 2023, Sasol expressed that it would stop supplying gas to third parties at the end of June 2026 as a result of its depleting gas supply and would only be importing gas from the Pande and Temane fields for its own operations.

The Pande and Temane gas fields – operated by Sasol, is an unincorporated joint venture between Sasol, financial institution International Finance Corporation and Mozambican State oil company Companhia Moçambicana de Hidrocarbonetos – have an expected life of about 25 years and started production in 2004, with gas supply expected to start declining.

Therefore, third parties will need to look for alternatives gas supplies; however, he explains that there is currently no significant indigenous gas source in the region that can supplement declining supply for South African customers by mid-2026, when Sasol will cease supply to the third-party market.

While Sasol has made a gas discovery in the Bonito-1 exploration well, in Mozambique, which is not far from its existing fields, the discovery is in its early stages and would likely take between five to eight years before it is developed and able to supply gas, as opposed to being able to supply gas within the short 2026 timeframe, Sebake explains.

Further, despite various other gas discoveries in Mozambique, Sebake explains that these are still in the early stages of development, delayed by the instability in the Cabo Delgabo province and located too far away from the ROMPCO pipeline to be able to viably leverage the existing ROMPCO infrastructure.

Currently, ROMPCO has no intentions of extending the pipeline to the northern part of Mozambique where the discoveries were made, as doing so requires a significant and stable gas source, significant investment and a guaranteed customer base.

He explains that ROMPCO would only consider potentially extending the pipeline if gas offtakers reach an agreement that warrants the extension of the pipeline and subsequently requests the company to enable transporting gas to its intended destination.

Timely Action Steps

Without a stable gas supply, businesses and industries that rely on gas will have to look at alternative energy sources while many gas- related businesses may be forced to close, either outcome of which would impact the over 70 000 people employed directly and indirectly in the gas industry.

Sebake stresses that gas projects take a significant amount of time to develop; therefore, decisions in the gas industry need to be made in a timely manner.

“A lot of players in this industry have dragged their feet around making decisions, which is understandable given the amount of investment and long-term commitments they would have to make and I think it's partly the reason we find ourselves in this panic and also relying solely on one player to provide solutions,” he says.

He notes that Sasol notified the market that its supply was declining in 2018, thereby providing time for new gas suppliers to enter the market and discoveries to be made to offset the looming deficit.

The declining gas supply is expected to impact ROMPCO, Sebake acknowledges.

In particular, he explains that the decline in gas volume affects the pipeline’s ability to transport gas as the pipeline is designed and built for a specific volume of gas to be transported.

Sebake explains that the pipeline has operational thresholds, whereby if gas volumes fall below the threshold, the pipeline will not be able to transport gas efficiently owing to a lack of pressure.

Without sufficient gas volumes in the pipeline, the asset is at risk of becoming stranded.

Discussing alternatives, Sebake notes that LNG, which can be shipped into the country on LNG ships, presents an attractive alternative energy source.

However, he expresses concern that LNG might not be an affordable alternative as LNG is trading at high prices owing to international pricing dynamics and heightened global demand, particularly in Europe and Asia.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation