Graphics confirm 2023 as loadshedding’s annus horribilis

South Africans are already painfully aware that 2023 has been a devastating year for power disruptions, with the latest bout of Stage 6 loadshedding having provided yet another traumatic reminder of just how far away South Africa is currently from fully addressing its supply deficit.

A pain that was reportedly felt even more intensely by the residents of Johannesburg, who were subjected to City Power’s new schedule, which some have concluded was implemented at a Stage 8 intensity. A claim that City Power has denied.

However, energy analyst Clyde Mallinson has taken the time and made the effort to provide a visual representation of the scourge by plotting the hours affected by loadshedding and the total amount of electricity, in gigawatt-hours (GWh), shed.

In addition, he has plotted one of loadshedding’s most high-profile direct costs: the costs associated with burning diesel in the open-cycle gas turbines (OCGTs) owned by Eskom and independent power producers (IPPs) to either avoid loadshedding or decrease its intensity.

The total costs, it must be stressed, are far higher, with the South African Reserve Bank estimating the daily economic cost of Stage 6 at nearly R1-billion.

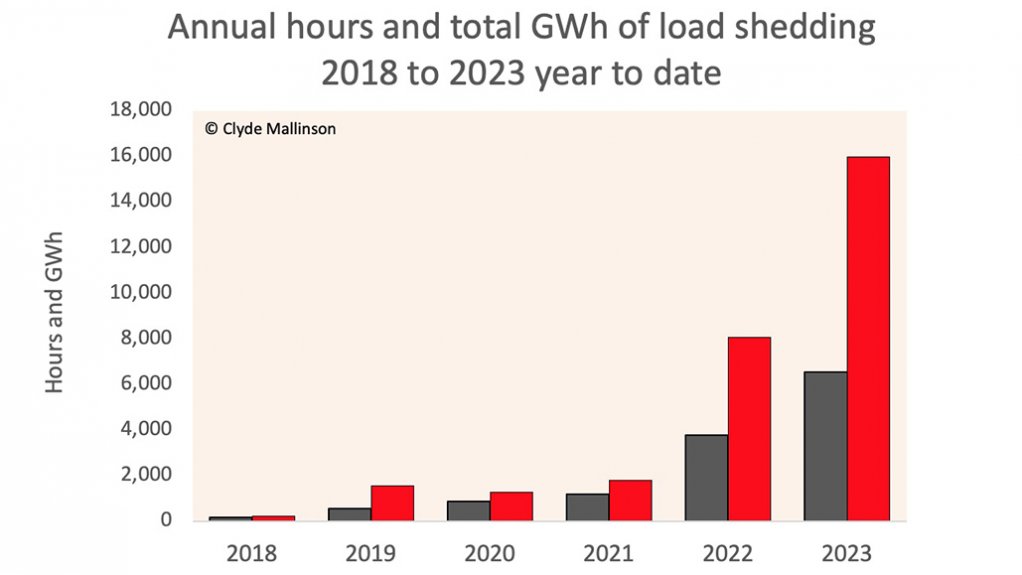

Now, it is no secret that the 2023 calendar has been the country’s worst-ever year for loadshedding, but Mallinson’s first graphic offers a visual depiction of just how devastatingly bad a year it has been, eclipsing 2022, the previous holder of the miserable record, by a big margin.

The graphic, which is headed ‘Annual hours and total GWh of loadshedding 2018 to 2023 year to date’, shows a scarily steep climb in both components, as well as the deterioration from 2022 to 2023.

While there were some 4 000 hours afflicted by rotational power cuts last year, the figure stands at close to 7 000 hours in 2023, with more than a month to run. There are 8 760 hours in a normal year, of which 2023 was one, with 2024 being the next leap year.

It also shows that just shy of 16 000 GWh of energy have been shed, which is double the 8 000 GWh of 2022 and eight times the 2 000 GWh of 2021.

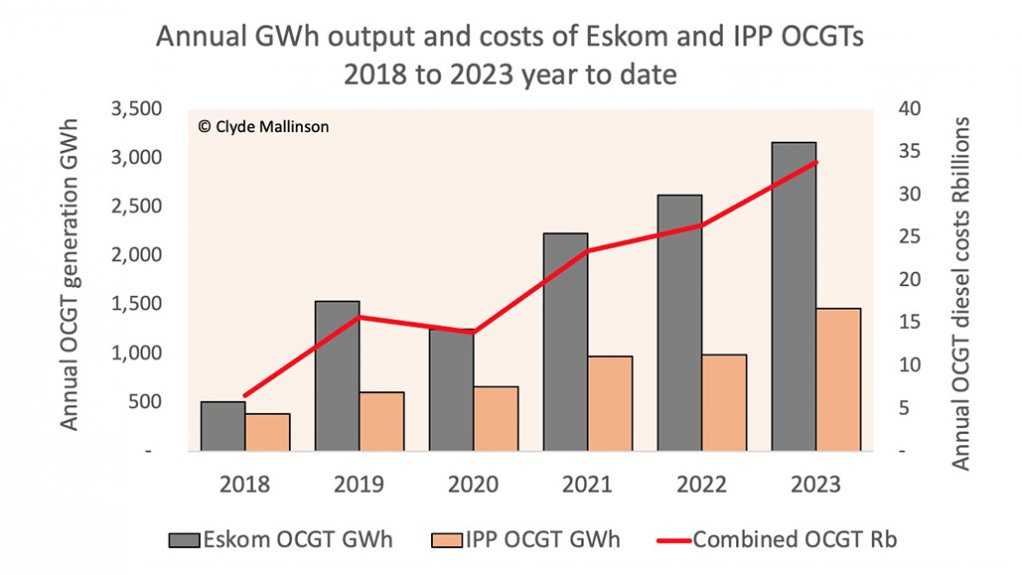

The diesel-cost picture, provided in a graphic titled ‘Annual GWh output and cost of Eskom and IPP OCGTs 2018 to 2023 year to date’, is equally dire.

Rising from a combined value of about 900 GWh in 2018 to above 2 500 GWh for the Eskom fleet alone in 2022, when the IPP OCGTs produced more than 1 000 GWh, the 2023 OCGT production is shown as about 3 200 GWh for the Eskom fleet and 1 500 GWh for the IPP plants.

The combined cost of production from the OCGTs has also risen sharply over the period, from about R5-billion in 2018 to close to R35-billion this year, up from about R30-billion in 2022.

Eskom has said it has a R30-billion diesel budget for its current financial year to March 2024, while the graphs estimate the diesel costs for the calendar year.

Mallinson reports that about half of the 16 000 GWh shed in 2023 can be directly attributed to the fact that Koeberg Unit 1 has been down for refurbishment for most of the year, mainly to carry out work required for a proposed 20-year life extension of the facility.

Unit 1 was taken out of service for an extended maintenance outage on December 10 last year with an initial target of resuming production 180 days later in June.

By March, however, Eskom admitted that the June deadline was “no longer achievable” and indicated that it would only resume production ahead of a similar long-duration outage at Unit 2, which was initially scheduled for September.

The deadline was then shifted again several times and Unit 1 was eventually synchronised to the grid on November 18, with an expectation that it would ramp up to full production over a two-week period, after which Unit 2 would be taken down for its outage.

Mallinson is a vocal critic of the life-extension under way at the nuclear plant, having written to the Eskom board in 2021 warning that the economic costs associated with an additional stage of Koeberg-outage-induced loadshedding would be so extreme as to be “unconscionable”.

There has been loadshedding almost daily since Unit 1 went on outage, with the absence of the unit adding a stage each time loadshedding is declared. By implication the forecasted costs have materialised, placing an ongoing drag on gross domestic product.

Without power outages, the South African Reserve Bank has indicated that it would have projected South Africa’s growth in 2023 to be 2.3% rather than 0.3%.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation