Hulamin reports improved performance in 2021

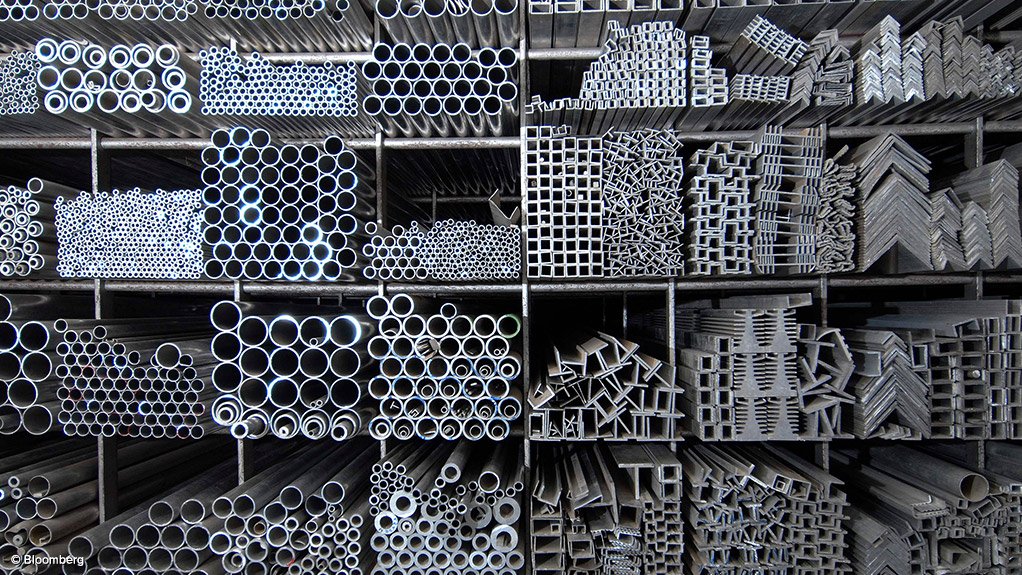

A higher rand London Metal Exchange aluminium price was one of the contributing factors to Hulamin's improved profitability.

Photo by Bloomberg

JSE-listed Hulamin says it responded to the tough trading conditions of 2019 and 2020, producing improved results for the year ended December 31, 2021.

In a business review and trading update published on March 14, it notes that the company’s focus for the year was on increasing volumes, realising higher prices and growing local sales, the company indicates.

Both a higher rand London Metal Exchange (LME) aluminium price and the recognition of assessed losses of R115-million (37c a share) contributed to the improved profitability.

Group sales totalled 222 000 t, including 209 000 t from Hulamin Rolled Products.

Local can stock sales grew by 109%.

Total local rolled products sales reached close to 90 000 t, up by 54% from 2020.

Hulamin and diversified miner South32 signed updated conditional agreements in 2020 for the period 2020 to 2024 for the supply of molten and solid ingot aluminium.

This agreement was subject to the conclusion of an electricity supply agreement between South32’s Hillside smelter and State-owned utility Eskom by the National Energy Regulator of South Africa. This approval was published during 2021.

Hulamin expects to report a profit for the year of between R576-million to R606-million and headline earnings of between R546-million and R574-million, both of these being increases from the previous year.

Moreover, earnings a share are expected to increase year-on-year to between 187c and 197c.

Headline earnings a share are also expected to increase to between 176c and 186c.

Normalised headline earnings a share are expected to decrease year-on-year to between 80c and 84c.

ROLLED PRODUCTS

Hulamin Rolled Products grew its local sales by 65% on the back of the increase in can stock and other rolled sheet and plate products and local foil by 30% and 35%, respectively.

Sales in the second half of the year amounted to 112 000 t, an increase of 17% from 96 000 t in the first half.

The increase in local beverage can stock demand is in line with global trends, driven by the environmental impact of single-use plastics (largely in the carbonated soft drink market) and the recognition of aluminium as a 100% recyclable material, as well as a shortage of glass in the region.

HULAMIN EXTRUSIONS

Following the implementation of its 2020 turnaround plans, Hulamin Extrusions performed well in 2021, with sales growing by 17%, resulting in a meaningful increase in profits, the company notes.

The business finalised its sale of the Olifantsfontein property, which contributed to this profit.

OUTLOOK

Hulamin notes that the underlying health of the business has improved.

Increases in the LME price of aluminium will likely constrain the balance sheet and may constrain volumes should further increases occur. This risk is heightened by the energy crisis and aluminium supply constraints arising from the Ukraine conflict.

Hulamin anticipates that the disruptive effect of Covid-19-related lockdowns will continue to subside during this year.

It notes that its order books are healthy going into 2022, supported by a firm market for beverage can products.

Hulamin expects to publish its 2021 financial results on March 28.

Its share price on the JSE increased by more than 10% on Monday following the publication of its trading statement.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation