Investment in mining crucial to ensure continued contribution to economy – PwC

PwC presentation covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

Andries Rossouw

PwC mining division partner Marcia Mokone

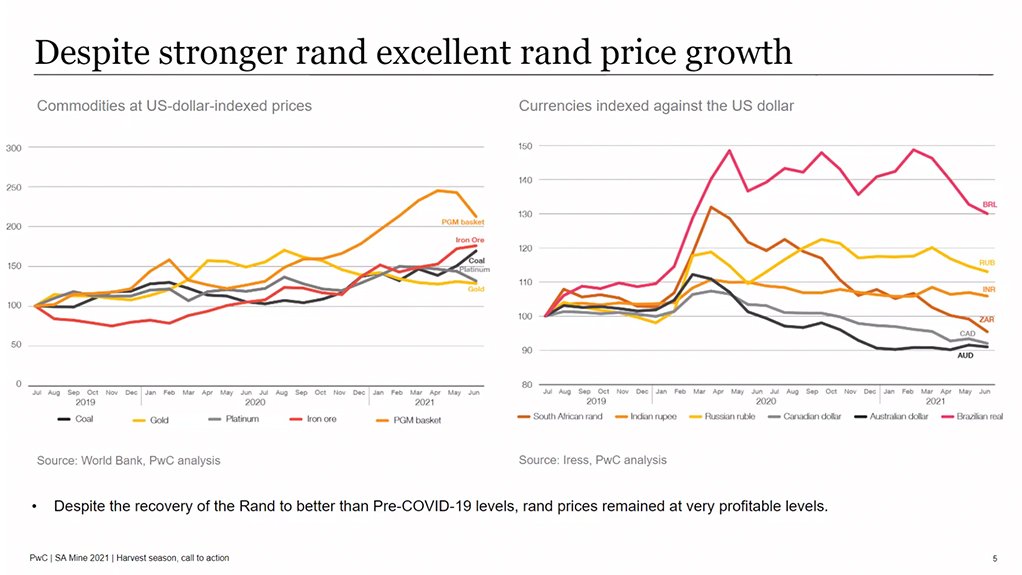

Rand price growth highlighted by PwC.

Photo by Creamer Media

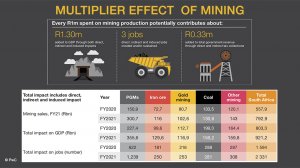

JOHANNESBURG (miningweekly.com) – Investment in the mining industry is crucial to ensure its continued contribution to the South African economy, says PwC in its thirteenth edition of SA Mine 2021, a series of publications that highlights trends in the South African mining industry.

In a year of doom and gloom on so many fronts, the mining sector delivered a sterling performance with value delivered to all stakeholders, PwC Africa energy, utilities and resources leader Andries Rossouw stated. (Also watch attached Creamer Media video.)

PwC mining division partner Marcia Mokone stated that in order to prepare the workforce for future roles and to upskill employees with the skills and competencies they needed to stay relevant, upskilling and learning and development within mines needed to be carefully rethought with rapid technology adoption in mind.

Net profit grew to R274-billion, which represents a 285% increase, because of the increased commodity prices and improved production after mines largely returned to pre-Covid production levels.

As global supply and demand jostled to find their way back to pre-pandemic levels, demand and therefore prices were the outright winner, Rossouw said.

With record rand prices for gold, the platinum group metals (PGMs) basket, iron-ore and more recently, coal, it was no surprise that the industry’s financial performance exceeded expectations on most fronts, he added.

The global low-carbon energy and Fourth Industrial Revolution agendas would result in increased demand for a number of commodities, with global constraints in the supply of these increasing prices and the need for investment in supply.

Stakeholders often refer to the need for a just transition when faced with massive demand shifts away from fossil fuels. Globally though, the pace of the transition, he said, was likely to be limited by the availability of resources needed for the transition. Understanding the supply constraints would be key to mapping a realistic transition for the future.

“In South Africa, we stand to benefit from the demand growth. Whether South Africa and other resource-rich countries will benefit to the full extent will depend on their ability to address bottlenecks in supply,” Rossouw said in the presentation covered by Mining Weekly.

“There is an obvious need to invest in the right skills, infrastructure, energy and water and, in general, creating an enabling environment for exploration, mine development and production,” he said.

“Realising the full potential benefit of our resources and creating long-term sustainable outcomes will depend on our ability to mine cost competitively and to integrate various value chains profitably.

“The excellent financial performance resulted in mining companies being in a very strong financial position. Debt has largely been repaid and returns to shareholders reached record rand levels for many companies. The fiscus benefited from increased direct and indirect taxes and mining royalties to the extent that it could support ongoing socioeconomic support during the pandemic.

The remaining free cash flow and available cash resources leave mining companies with interesting capital allocation decisions.

The growth in the mining industry confirms the resilient nature of the sector and the opportunities that exist in rebuilding the South African economy, PwC stated in its overview.

The South African economy started rebounding in the third quarter of 2020 (July–September) coinciding with the easing of Covid-19 lockdown restrictions.

All industries recorded an increase in economic activity compared with the second quarter of 2020. Mining was the strongest contributor to growth among all sectors, recording 271% growth in the third quarter compared to the second quarter.

This growth was attributable to an increase in the production of PGMs, iron-ore, gold, manganese ore and diamonds, as well as strong commodity prices.

The latest gross domestic product numbers show that the mining sector has once again recovered, recording a growth rate of 18.1% in the first quarter of 2021, from increased production and prices of PGMs, iron-ore and gold.

These levels were maintained in the second quarter of 2021 with a marginal growth of 0.1%. Infrastructure development and energy transition strategies adopted by a number of countries to bolster economic growth, are supporting the demand for these commodities. South Africa’s mining sector delivered a solid financial performance for the 2020 and 2021 financial years with value delivered to all stakeholders despite the current challenging pandemic environment.

The excellent financial performance resulted in mining companies being in a very strong financial position, with record distributions to shareholders and more than a tripling in taxes paid.

Debt has largely been repaid and returns to shareholders reached record rand levels for many companies.

Other key SA Mine findings included:

- total market capitalisation increased in the current year to R1.470-billion from R1.047-billion;

- the average earnings before interest, taxes, depreciation and amortisation (Ebitda) margin of the mining companies included in this analysis was 46% compared to 27% in the prior year.

- for the companies in the analysis, revenue in rand terms grew by 63%. This was mainly driven by higher prices for PGMs and iron-ore; and

- the aggregate tax paid by the mining companies was R91-billion with an effective tax rate of 27%, which represents a staggering 250% increase from the previous period and was driven by the increased mining profitability.

PRODUCTION UP 6%

The period saw production increase by 6% year-on-year. Although the overall production for the year to June was still marginally below 2019, monthly production levels over the last six months were above the 2019 levels.

Manganese ore was the largest positive contributor with an average of 20% increase in output as operations recovered from an extended shutdown in response to Covid restrictions and market conditions. Diamond production grew the largest by 30%. Coal has seen the biggest drop in production from the prior year at an average of 6%.

MINING’S ROLE IN TRANSITIONING TO CLEANER ECONOMY

As South Africa navigates its way through its transition to a cleaner economy, there are several factors to consider. The transition comes with employment opportunities in cleaner energy industries, such as renewable energy and battery storage. It is key that these opportunities are maximised to the fullest to generate economic growth and employment opportunities for all. Employees need to be skilled and reskilled for this transition.

“The just transition concept has put a lot of focus on the plight of communities in the coal mining areas. In a country with record unemployment and where the socio-economic challenges probably post the biggest risk, not only for the mining sector, but for the country as a whole, this focus might be too narrow. We believe the socio-economic challenges need to be addressed on an integrated basis,” the PwC report stated.

The limitations of supply of key commodities required for the total green energy value chain are likely to limit the pace of the energy transition to the extent that a realistic transition will result in most of the existing coal mines closing on their normal life-of-mine planned times. In fact, in the next decade, the country stands to lose more jobs from planned mine closures in the gold sector than in the coal sector.

The mining industry is well positioned to use the global energy transition opportunity to enable growth in South Africa. This includes the opportunity for research and development and industries to support the renewable energy industry in general and the green hydrogen economy.

TRANSFORMING WORKFORCE FOR SMART MINING

The mining workforce – from a job role, digital skills, and behaviour perspective – is evolving continuously, with most respondents to a recent PwC survey of digital transformation in the South African mining sector believing that there will be a change in the nature of the workforce to more skilled employees over the next five years.

As major mining organisations think about their strategy and transformation journey from a digital and mining operations automation perspective, it is critical to understand, identify and start developing skills to support and undertake this transformation. The report identifies some of these roles, skills and competencies.

“Mining companies have a unique opportunity to manage digital transformation proactively and to minimise the potential negative impact on the workforce and operations through upskilling and reskilling,” said Mokone.

“Although digitised training has a number of benefits, in the South African mining context there are some challenges that need to be considered: language barriers and literacy levels; workforce age groups, generational expectation differences, and cultural norms; physical infrastructure, and asset development and operating costs; and scalability, adaptability and accessibility of training,” she said.

“As mining organisations think about new ways of learning, they will need to put plans in place to future-proof their workforces in order to address these factors and, more importantly, the realities of diverse workforce generations, cultures and literacy levels,” Mokone added.

ESG ENTERS MINING MAINSTREAM

Many large mining companies are protecting their investments by diverting investments away from coal towards investments that are likely to support the net-zero agenda, the PwC report noted.

Shareholders and other stakeholder scrutiny were turning up the heat on how mining companies operate, which is becoming a concern for the industry.

PwC reported widespread recognition in the industry that for South Africa to achieve its net-zero ambitions, environmental, social and governance (ESG) would have to be a core component of any mining company’s strategy and policies. Mining companies had often been criticised for not doing ‘enough’ on ESG and consequently were increasingly challenged to make changes to their boardrooms.

“While the transition might present challenges, it also presents substantial opportunities for mining companies to create shared value and economic benefits for the communities in which they operate,” Mokone stated.

INFRASTRUCTURE, ENERGY AND WATER

PwC reported an obvious need to invest in the right skills, infrastructure, energy, and water and, in general, to create an enabling environment for exploration, mine development and production. Realising the full potential benefit of South Africa’s resources and creating long-term sustainable outcomes would depend on the country’s ability to mine cost competitively and to integrate various value chains profitably.

SHARE OF VALUE ADDED

PwC described 2020/21 as having been rewarding for mining industry stakeholders on top of record distributions to shareholders. Company value added statements pointed to employees continuing to take a 20% share of value added and government increasing its share through direct taxes (14%), employee taxes (3%), as well as royalties (5%).

“What was evident this year is that growing the pie is a much more successful way to share value with stakeholders than trying to increase stakeholder share from a shrinking pie,” the reported stated.

Mining companies for the first time in a number of years were able to retain value created.

This strong financial position and available cash resources had left mining companies with interesting capital allocation decisions.

Strategies would include expansions and new development, acquisitions, strengthening of local infrastructure and host communities, market development and investments up and down the value chain. Execution on these strategies would require disciplined long-term sustainable mindsets, the report commented.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation