Madison acquires large Canadian antimony deposit

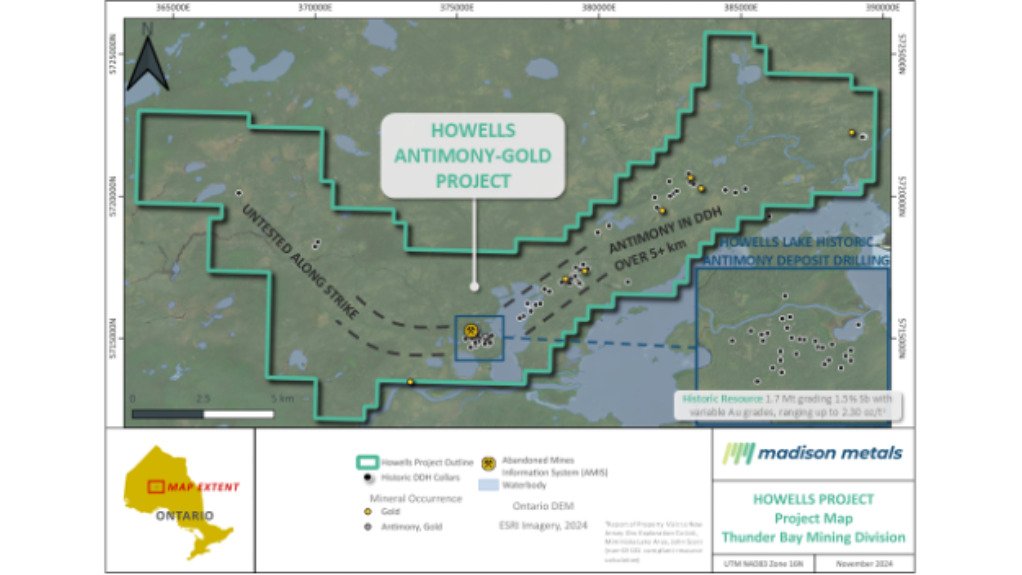

Canadian critical minerals company Madison Metals announced on Monday that it had secured agreements with three entities to acquire a significant antimony/gold project located in the Howells Lake area of Thunder Bay, Ontario.

Antimony, a key strategic mineral, has seen its price triple over the past year, driven by a surge in demand and recent Chinese export restrictions. The Howells Lake project is one of the few large, historically recognised antimony resources available, making it an attractive addition to Madison’s portfolio.

“Micro-cap companies rarely, if ever, have the opportunity to obtain complete control of a large, belt-scale asset like the Howells Lake project, covering such an extensive area of known mineralisation that seems to have been overlooked for decades,” said Madison chairperson and CEO Duane Parnham.

The discovery of antimony at the Howells Lake project dates back to the early 1970s when it was found alongside gold mineralisation during drilling activities. Since then, the deposit has remained relatively unexplored.

Antimony is considered a critical mineral by Canada, the US, and the EU owing to its vital role in numerous industrial applications. It is increasingly used in defence technologies, including in the manufacturing of military ammunition, hardening bullets, reinforcing shell casings, and enhancing advanced military screens. Beyond defence, antimony plays a key role in semiconductor production, fire retardants, and solar panel manufacturing.

The sharp rise in antimony prices has been attributed to supply-demand dynamics, with growing global demand for the mineral and the imposition of export restrictions by China on September 15.

“Expanding our portfolio to include this high-impact, high-grade project complements our existing uranium assets and positions us as a first mover in the space,” said Durnham.

As part of the deal, Madison will acquire a 100% interest in the Howells Lake project through agreements with three vendors.

The terms of the acquisition include a combination of cash payments, shares, and royalties. The first vendor will receive 50 000 common shares and a 2% net smelter return (NSR), with the option for Madison to repurchase 1% of the NSR for C$1-million.

The second vendor will be paid C$25 000, issued 125 000 common shares upon signing, and will receive three equal anniversary payments. This vendor will also receive a 2% NSR with a buyback option for 1% of the NSR for C$1-million.

The third vendor, which holds claims over the area containing the antimony deposit, will receive two-million common shares upon signing, 1.5-million common shares on the first anniversary, and one-million common shares on the second anniversary. Madison will also enter into consulting contracts for drilling, geophysical surveys, and geological services with the third vendor group. This vendor will receive a 2% NSR, with the company retaining the option to repurchase 1% of the NSR for C$2-million.

Further, Madison announced that Bruce Durham has been made special technical adviser to the board of directors and lead technical manager of all activities at the Howells Lake project.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation