Mega gold producer, copper aspirant Harmony flags cost-offsetting silver, uranium value

Harmony CEO Peter Steenkamp, who retires at year-end.

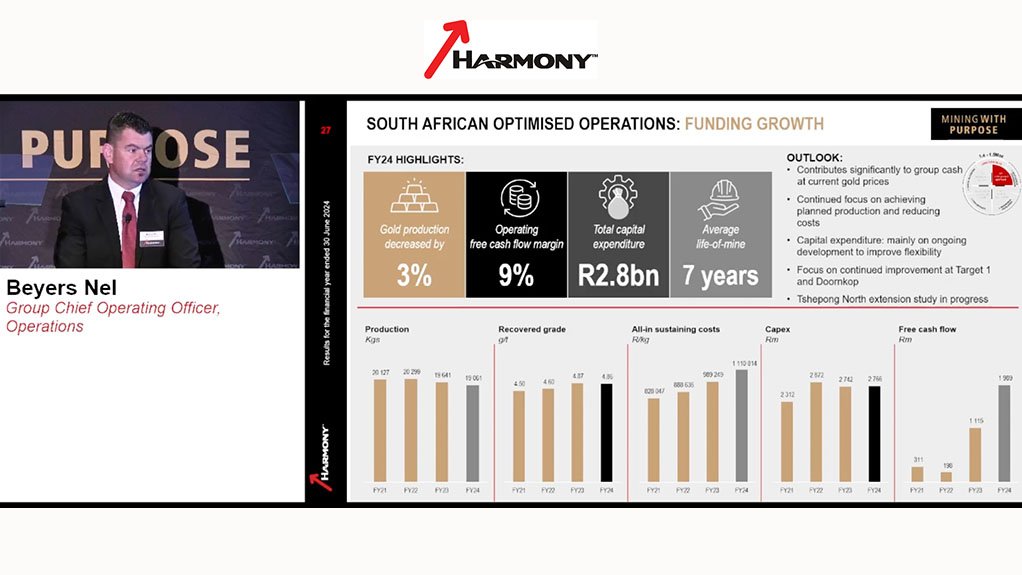

Harmony COO Beyers Nel.

Harmony FD Boipelo Lekubo.

JOHANNESBURG (miningweekly.com) – Johannesburg Stock Exchange-listed Harmony, which has 74 years of mining experience in South Africa and two decades in Papua New Guinea (PNG), is not only a mega gold mining specialist with an emerging copper footprint, but on Thursday also flagged the cost-offsetting value of its silver and uranium production.

While 96% of revenue is from gold, byproducts play a role in cost offsetting, with silver produced at Hidden Valley in PNG contributing 3% and uranium mined at Moab Khotsong in South Africa 1%.

Silver production rose by 39% to a record 3.7-million ounces, generating revenue of R1.7-billion and uranium production increased by 13% to 590 000 lb, generating revenue of close to R900-million.

Interestingly, Harmony mineral reserves of 130-million ounces of gold and gold equivalents are being boosted significantly by gold recovery from surface tailings, Harmony CEO Peter Steenkamp outlined during Thursday’s presentation of superb operational performance that was lifted sky-high by a very strong gold price tailwind. Steenkamp, who has served the company since 2016, will retire at the end of this year.

Interestingly, surface operation production increased by 21% to around 9 000 kg, representing 11% of group production, with all-in sustaining costs declining to R700 000/kg, illustrating how profitable these operations are at current gold prices. They generated R2.6-billion in operating free cash flow at a 2024 financial year margin of 25%.

“South African surface operations delivered a phenomenal performance,” Harmony COO Beyers Nel reiterated at the presentation covered by Mining Weekly.

Once the Legacy streaming contract comes to an end before the end of this calendar year, the gold price received for gold sales at Mine Waste Solutions is poised to increase by 20%, generating more than R900-million in additional cash flow.

Moreover, further feasibility studies are under way to determine whether another mega tailings treatment operation can be created in the Free State, where old tailing dams host a 5.7-million-ounce resource.

“We believe there's good potential to remine our old tailing dams in South Africa for possibly another 100 years,” Nel posited.

Nine underground mines, two opencast mines and tailings dumps make up Harmony's gold-heavy portfolio of diversified operating assets that also promise a 20% copper contribution within the next ten years from the Eva copper project in Australia as well as the long-delayed Wafi-Golpu project in PNG.

Capital expenditure of R10.8-billion, more than Harmony has ever spent in one year, has been allocated for South Africa’s Moab Khotsong and Mponeng gold mines as well as Wafi-Golpu and Eva.

In the 12 months to June 30, conscientious mining has enabled above-plan output to make the best of the fortuitously high gold price and soar to record revenue, margin and cash flow heights.

Mineworkers are benefiting from a R1.2-billion employee share ownership scheme and the planet is being spared with 30 MW of green power already being generated and more than 500 MW of more renewables wanted.

The 1.65-million ounces of gold produced once again outstripped guidance as did underground gold grades at 6.11 g/t and all-in sustaining costs at R901 000/kg. Operational free cash flowed, river-like, to more than R13-billion.

The Mponeng extension has already put 2% on to mineral reserves and the lives of Mponeng and Moab Khotsong have been extended by at least 20 years and that of surface operation Mine Waste Solutions by 14 years.

Decline work at Moab Khotsong and development of Mponeng’s carbon leader section are under way. Rehabilitation of the Tau Tona shaft pillar, which will be mined from Mponeng, has begun.

These projects have together added 5.2-million ounces to gold reserves and ensure steady-state production at each mine of more than 200 000 oz at a recoverable grade of 9 g/t.

COPPER

With the feasibility study update at Eva Copper progressing, the Queensland government has provided A$20.7-million in conditional grant funding to help accelerate the project.

Early works have begun, with Eva expected to produce between 50 000 t and 60 000 t of copper a year and 14 000 oz of gold over its 15-year life-of-mine.

At Wafi-Golpu, negotiations are taking place to convert the signed memorandum of understanding into a mining development contract.

“We’re continuing to invest in productivity enhancements and infrastructure reliability to reduce stoppages and maintain momentum,” Nel pointed out.

“Not only have we benefited from having a rand cost base, but the five-year wage agreement ensures fixed labour escalations. Our supply from Eskom is also regulated, with further savings expected from our renewable-energy programme.

“We've delivered a consistent increase in revenue over the past three years and headline earnings per share have also increased by over 700% in the past eight years.” Harmony FD Boipelo Lekubo reported.

“The majority of our costs remain predictable and manageable. It is split between labour, consumables and electricity. Sustaining capital represents only 10% of our total all-in sustaining costs, and we've not seen any major changes in the split year on year.

“Going forward, we anticipate cost escalations to remain in line with planned inflationary increases due to our rand cost base,” Lekubo added.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation