Miner prioritises value of Zim mine

TANGIBLE PROSPECTS Quarterly dividends affirm gold miners commitment to Southern Africa region

In focusing on its Zimbabwean assets, gold miner Caledonia Mining has strongly affirmed its focus on gold in optimising the net present value of its Blanket mine in Gwanda, in south-west Zimbabwe.

The company is also open to considering every legal funding option for its Bilboes gold project, 75 km north of Bulawayo.

In highlighting the historical timeline of the miner’s operations in Zimbabwe, Caledonia Mining CEO Mark Learmonth highlighted during the Junior Indaba – held in Johannesburg in May – that there had been a concerted effort to make the company more agile and efficient by focusing only on its gold assets.

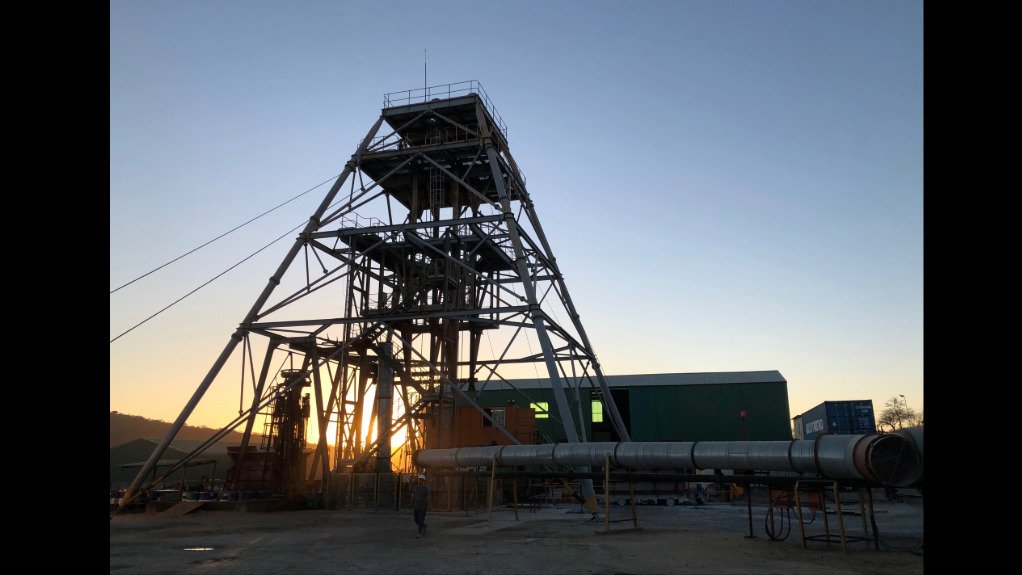

Despite a challenging investment climate in Zimbabwe, Caledonia has progressed its flagship Blanket mine, which reached a new development depth of 1 200 m after investment in the new central shaft had been undertaken in 2015.

Commissioning of the shaft was completed in the first quarter of 2021 and provides access to horizontal development in two directions on two levels below 750 m, thereby increasing production and extending the life-of-mine.

After initial operational challenges, having acquired the Blanket mine in 2006, Learmonth notes that the mine is running optimally, and the company is building a project portfolio.

He asserts that it is now more “straightforward” to mine gold in Zimbabwe, highlighting the ease of being able to sell 75% of what gold offshore, particularly through Dubai, in the United Arab Emirates, and receive payment in US dollars, while the remaining 25% is sold in Zimbabwe, for which payment is received in local currency.

The company has also affirmed its paying out quarterly dividends as a way of demonstrating the sound economic feasibility of its mining endeavours.

Learmonth highlights that this is done partly to reinforce the message primarily outside of Zimbabwe that the company is making money. He adds that this sends a powerful message to investors and, similarly, inside the business when making capital allocation decisions and investment decisions.

Caledonia stresses that its most fertile equity market is in Zimbabwe, where it has raised more money than anywhere else in the world – more than in New York and London. The Zimbabwe market is entirely focused on the dividend.

“You have to cut your cloth according to the recipient that you are talking to. The Zimbabweans love the dividend and paying the dividend sends a powerful message to investors. It is also a very powerful message to the Zimbabwean government, and it is something that is front of mind right now,” he continues.

He also lauds the mine’s strong workforce, which employs about 2 000 citizens, as “. . . there is no shortage of highly competent, well-qualified, diligent, hardworking Zimbabweans to do the job.”

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation