Mining firms with higher ESG ratings outperform market – PwC

PwC Mine 2021 Report covered by Mining Weekly’s Martin Creamer. Video: Nicholas Boyd

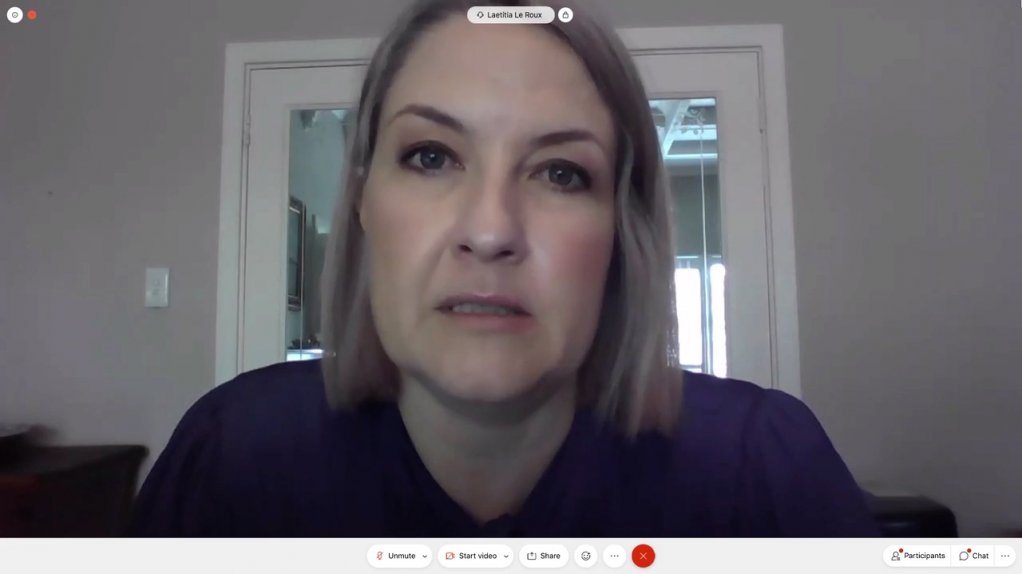

PwC South Africa mining tax leader Laetitia le Roux

Photo by Creamer Media

Market capitalisation of mining's Top 40 rose nearly two-thirds to $1.46-trillion.

JOHANNESBURG (miningweekly.com) – Mining companies with higher environmental, social and governance (ESG) ratings outperformed the broader market during the peak of the Covid-19 crisis, delivering 34% average total shareholder return over the past three years — ten percentage points higher than the general market index, PwC Africa mining leader Andries Rossouw said on Tuesday.

Companies with higher ESG ratings are demonstrating stronger long-term performance in shareholder and market value, benefiting from capital access at lower interest rates, and attracting premiums on low-carbon inputs.

This information is from PwC’s 18th annual review of the Top 40 mining companies - 'Mine 2021' – which examines the global trends in the mining industry and which includes South Africa’s Anglo American in ninth place, Sibanye Stillwater in 24th position, Impala Platinum 29th, AngloGold Ashanti 31st and Gold Fields 39th. (Also watch attached Creamer Media video.)

Net profit in the sector was up 15%, cash on hand rose 40%, and market capitalisation rose by nearly two-thirds to $1.46-trillion, Rossouw added in a presentation to the media, covered by Mining Weekly.

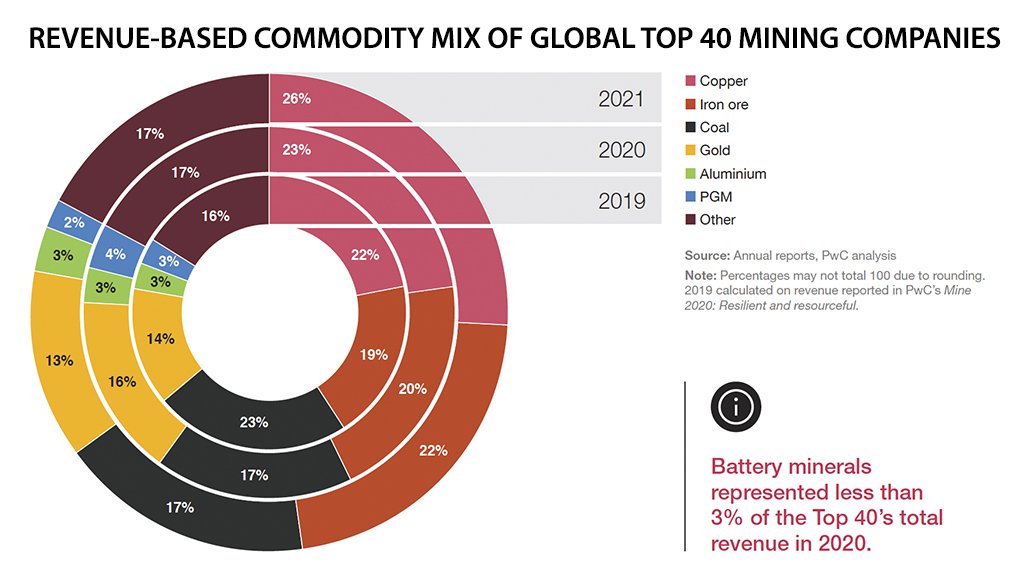

Copper was the standout performer, contributing $122-billion to group revenue. Based on consensus data, the average price of copper is predicted to increase by 40% in 2021.

Demand for iron-ore continues to expand on the back of national infrastructure initiatives, aimed at helping economies to recover from Covid’s impact.

There are further signs of optimism for 2021, with forecasts indicating that the Top 40 will report record-high revenue and earnings before interest, taxes, depreciation and amortisation, and the second highest net profit. Alongside this, the demand for the minerals that go into clean energy technologies is expected to increase six-fold in the next 20 years.

The survey also reveals that Top 40 coal production fell 12% in 2020. Deals fell from five in 2018 to zero in 2019 and 2020, highlighting the sector’s continued shift to net-zero.

“The past year has demonstrated how putting ESG at the core of a strategy is crucial for delivering growth. Looking forward, it’s clear that investors in this sector will continue to be increasingly drawn to companies that actively embrace ESG policies,” said Rossouw.

TAX TRANSPARENCY VITAL TO ESG

Only 30% of the Top 40 embraced tax transparency reporting in 2020, despite tax transparency being a fundamental way for companies to demonstrate their commitment to ESG issues.

The report finds a further 39% of mining and metals company CEOs are extremely concerned about tax policy uncertainty, more than double the number last year (18%), posing a long-term risk to the sector.

Tax transparency, a key ESG metric, gives miners the chance to highlight their significant financial contributions to their communities and the resulting improvements in education, infrastructure and quality of life.

“Customers, employees, communities, governments and suppliers now expect companies to create value that is sustainable. Mining companies should embrace tax transparency as an integral part of their ESG strategy. This will support the sector to be more transparent about the taxes and rents they pay and the social benefits these contributions deliver, such as hospitals, schools and infrastructure,” PwC South Africa mining tax leader Laetitia le Roux urged.

Tax has moved up on the agenda, globally as well as in PwC’s own content, with the firm linking tax strategy to ESG prowess.

It spelt out that the E for environmental in ESG is linked to carbon tax, which is used as a tax policy instrument to change carbon behaviour. Especially in the mining sector, the S for social is linked to the industry's contribution through paying tax to the building of schools, hospitals, roads and infrastructure, and, in South Africa, social and labour plans add significantly to that. In the G for governance, the focus is on how high tax affairs are on the agenda of mining companies.

“By avoiding discussion about taxes, miners are letting others tell their story,” said Le Roux, who regards it as very important that mining companies tell their own tax story and use that as an opportunity to have a seat at the table when tax policy is formulated.

FLOW-THROUGH SHARE INCENTIVE SCHEME

Tax transparency provided the benefits of reduced uncertainty and the putting in place of policy instruments to help investment into the South African economy.

“Recently, we have seen that the junior mining industry has been lobbying for the flow-through share incentive scheme. I think in South Africa our fiscus is a bit constrained when it comes to tax incentives.

“We’ve also seen in the past year and after every Budget speech that we do need to reduce our corporate tax rate. Well, the only way that we can do that is actually by broadening the base and incentives go against that policy framework. However, our economists actually indicate that a flow-through scheme will broaden the tax base and we believe it should be supported.

“It's important for miners to have that seat at the table and disclose their tax transparently. I think it’s also important that they use that as an opportunity to connect with the stakeholders. There’s a huge reputational upside when you are actually transparent about your taxes and show the difference that you actually made. By telling their tax story, mining companies can also attract ESG investors,” Le Roux said.

CHANCE TO GO GREEN

PwC reported that mining companies have now got more free cash flow than virtually at any time in their history.

As the world pivots towards a low-carbon, sustainable economy, few of the Top 40 are forecasting significant changes in the production of battery commodities — cobalt, lithium, graphite, nickel and manganese — despite a growing global appetite for them.

“We hope that they’ll make use of this opportunity to invest in decarbonisation, changing their strategy, getting the ESG agenda right, both on the energy side but also on a stakeholder side, and really to invest towards the green economy,” said Rossouw.

ESG UNLOCKING DEAL VALUE

Disposal and demerging of coal assets has been defensive and hoped for is mining companies moving on to the offensive by investing in long-term strategy.

Rossouw cited Fortescue, of Australia, as a good example of a company putting down $2-billion to invest in the hydrogen economy. He also highlighted the local example of Anglo American Platinum’s drive into the Platinum Valley.

Mining Weekly can report that the Platinum Valley Initiative, which is aimed at supporting small, medium-sized and microenterprises to take advantage of opportunities in the green economy in support of a just transition, dovetails with a feasibility study to develop a ‘hydrogen valley’ anchored in South Africa’s platinum group metals- (PGMs-) rich Bushveld geological area. The ‘hydrogen valley’ will extend about 835 km from Anglo’s Mogalakwena PGMs mine, near Mokopane, in Limpopo province, along the industrial and commercial corridor to Johannesburg and to the south coast at Durban. Spearheaded by South Africa’s Department of Science and Innovation, the collaboration includes energy and services company Engie, the South African National Development Institute, and clean energy solutions provider Bambili Energy.

PwC sees battery minerals as representing another ESG-driven opportunity, particularly given the medium term global shortage in these commodities. But the Top 40 would need to be nimble, it said, to capitalise on that opportunity. There are deposits with attractive grades that can deliver attractive medium-term returns, even though they may not have the long life that the big miners usually look for. Companies that can quickly bring these smaller-scale assets into production can realise value.

“We would really like to see the Top 40 getting into battery minerals, getting into rare earths, to supply that demand for the long term. That’s desperately needed,” said Rossouw.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation