Opinion: R47bn of South Africa's exports exposed to EU CBAM as EU climate wave reaches South Africa’s shores

In this opinion article, sustainability consultant Rhys Newton-Hill and Brundtland Consulting partner Henk Sa provide an in-depth analysis of the potential impact of the European Union's (EU's) Carbon Border Adjustment Mechanism (CBAM) on South Africa's exports and guidance on navigating this challenge.

The EU’s new carbon pricing mechanism imposes a carbon cost on products imported into the EU, based on the greenhouse-gas (GHG) emissions resulting from the production thereof.

About R47.6-billion of South African exports are at immediate risk, with the iron, iron-ore, steel and aluminium industries particularly in jeopardy. However, in the near future, more exports and more industries will be impacted, as the mechanism covers ever more products.

The EU CBAM aims to introduce a pricing mechanism for embedded emissions in products imported into the EU.

The objective is to ensure local EU producers, who are subject to a carbon price that forms part of their cost of production, can remain competitive with non-EU companies whose production does not incur a similar ‘carbon price’ at the location of production [1].

This carbon cost is applied to products imported into the EU and is based on the aggregate of all embedded GHG emissions along the value chain resulting from the production of these products outside of the EU. The EU CBAM will phase in at a rate which aligns with the phase-out of free allowances for EU producers.

Many countries have voiced opposition to the mechanism, including South Africa, as they believe it does not comply with the World Trade Organisation’s (WTO) rules and due to the additional cost burden [2].

SOUTH AFRICA IS AMONG THE MOST EXPOSED

The United Nations Conference on Trade and Development (UNCTAD) has highlighted India, Brazil and South Africa as the nations most susceptible to the impact of the EU CBAM. Additionally, various studies underscore South Africa's heightened exposure, followed by Egypt and Morocco as the countries facing the most immediate adverse effects on the African continent.[5]

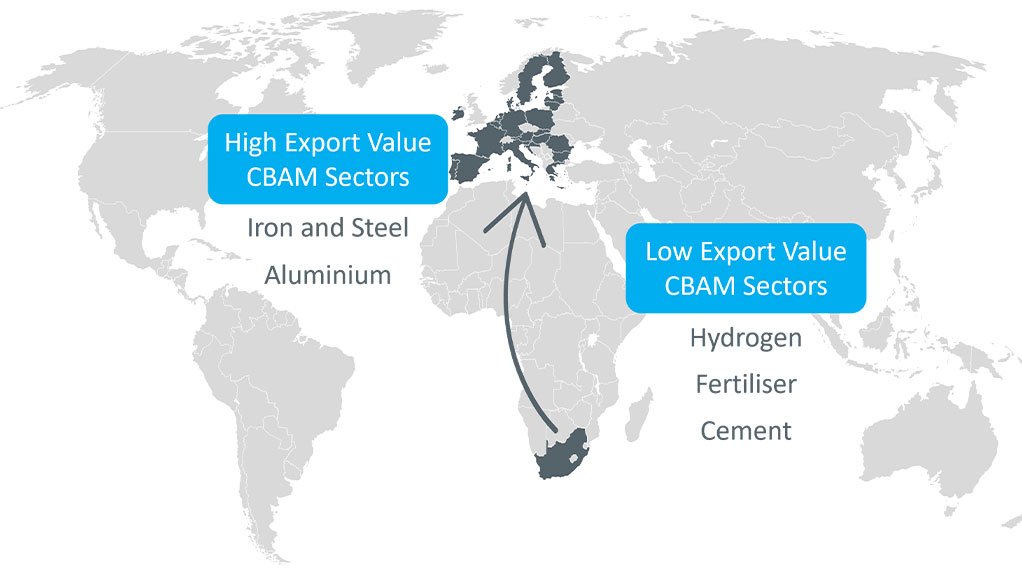

The mechanism currently covers the import of specific goods produced in the cement, fertiliser, iIron and steel, aluminium, hydrogen, and electricity sectors.

A total of US$3.2-billion (approximately R47.6-billion) of South African exports (based on 2021 data) are at risk in the short term, with this number set to increase as the CBAM covers more products.

The South African iron and steel and aluminium industries, exporting significant quantities to the EU, are particularly at jeopardy, in the short term [3] and in the region [5]. In 2021 alone, the value of goods which will now be covered by the EU CBAM, which were exported to the EU from South Africa, totalled R41-billion and R6-billion for each sector respectively.

Further, an increase in the quantity of iron and steel exports to the EU in the years leading to 2021 can also be observed. However, CBAM could potentially disrupt this trend.

Country Intensity (tCO2e/$1m) % of South African intensity South Africa 5 000 100% India 3 500 70% China 2 500 50% Russia 2 200 44% Other 200 to 1 400 4% to 28%

During 2022, the South African steel-making value chain employed approximately 261 000 individuals [3]. Considering the sector's high exposure to the EU CBAM, it becomes evident that these workers within the South African economy are inherently vulnerable to the repercussions of these developments.

HOW DOES CBAM WORK?

South African exporters to the EU will be required to surrender CBAM Certificates equivalent to the reported upstream emissions due to specific imported goods and their inputs. Each CBAM Certificate equates to one tCO2 emitted.

Fuel combustion and process emissions at production facilities will be monitored by suppliers and attributed to products in line with EU-accepted methodologies and defaults. Indirect emissions from the generation of electricity consumed during production will also be attributed to the goods produced. Emissions embedded in precursor goods or process inputs must be included, as required.

South African exporters to the EU must accumulate and surrender the required certificates, which are due by the end of May of the following year. For example, by 31 May 2027, CBAM certificates for all covered products imported in 2026 should be surrendered [4].

To reduce the number of certificates to be surrendered, domestic carbon costs, paid in the country of origin, can be claimed in CBAM declarations. The reduction may be claimed only if the carbon price has been effectively paid in the country of origin [4].

WHAT WOULD THE CARBON COST BE?

The CBAM cost hinges on the interplay of embedded emissions in goods, CBAM Certificate price (linked to EUA price), CBAM phase-in percentage, as well as the domestic carbon cost.

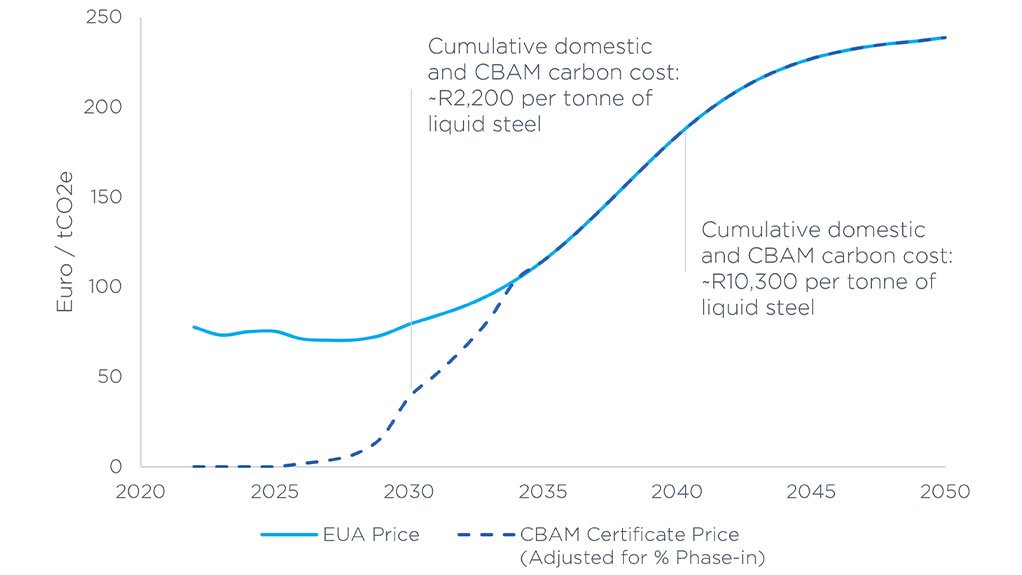

The EU CBAM certificate prices are linked to the European Union Allowance (EUA) prices. S&P Global Commodity Insights forecasts the EUA price to increase steadily from about €80 in 2030 to about €240 in 2050 [6].

As an example, let's consider a South African steel producer. With an assumed emission factor of 2.8[1][1] tCO2e per tonne of liquid steel, the cumulative domestic and CBAM-driven carbon cost is projected to reach about R2 200/t of liquid steel by 2030, R10 300/t by 2040 but could rise to R13 400/t in 2050. This calculation underlines the significance of CBAM's impact on cost structures within the industry.

WHAT DO EXPOSED COMPANIES NEED TO DO?

While the reporting and verification structures have not been finalised and tested, many important changes are apparent. To be compliant with the EU CBAM mechanism, organisations will have to match EU standards for monitoring, reporting, and verification, and build capacity to monitor product emissions.

Because it encompasses the embedded emissions of imported products, the EU CBAM requirements are different to those of the South African National GHG Regulations. EU CBAM requires a more comprehensive measure of environmental impact on a product basis, not on a facility basis. Simple goods have no emissions embedded in the product inputs and fuels used. But for complex goods, accounting for the emissions embedded in precursor products becomes pivotal.

This significant shift in emissions monitoring - from activities at a facility level to product-embedded emissions applying EU CBAM-approved methodologies – should be a major focus for exposed organisations.

Although reporting with EU CBAM default factors is supported, this is not in a company’s best interest. Timeous uptake of monitoring, reporting, and verification structures is the best preparation and short-term risk mitigation strategy.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation