Project finance clinched for 520 MW South African wind, solar projects – Anglo

Anglo American's Africa and Australia regional director Themba Mkhwanazi.

Anglo American Management Board chairperson in South Africa Nolitha Fakude.

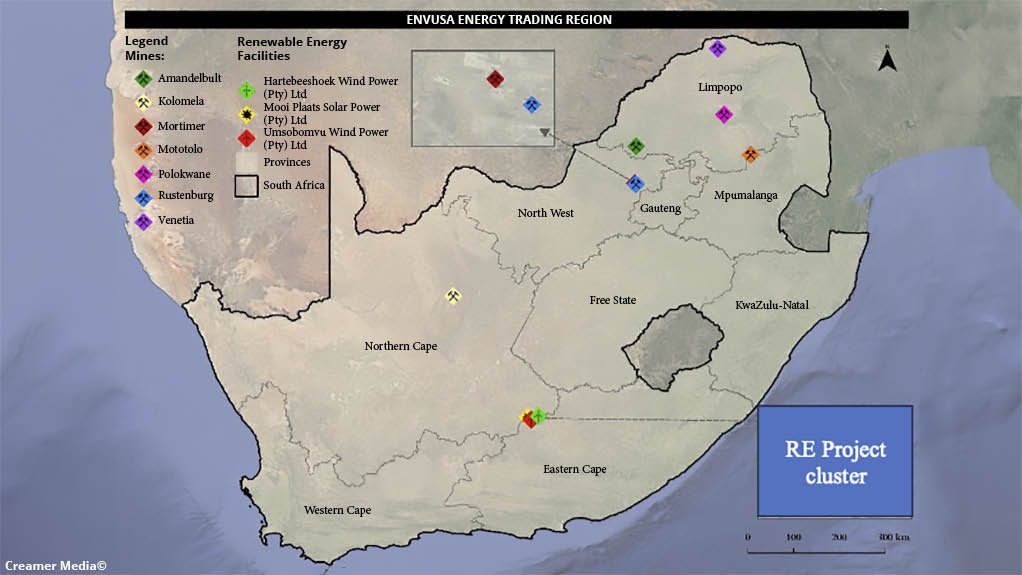

Envusa Energy Trading Region.

Anglo Platinum's green hydrogen-powered mine truck.

JOHANNESBURG (miningweekly.com) – Johannesburg- and London-listed diversified mining and marketing company Anglo American announced on Thursday that jointly owned renewable energy venture with EDF Renewables, Envusa Energy, has completed the project financing for its first three wind and solar projects in South Africa.

The terms and structure of this non-recourse project financing are typical of high-quality renewable energy infrastructure assets. These three renewable energy projects, known as the Koruson 2 cluster of projects and located on the border of the Northern and Eastern Cape provinces of South Africa, will have a total capacity of 520 MW of wind and solar electricity generation.

Anglo Africa and Australia regional director Themba Mkhwanazi described the successful project financing of these initial projects as Anglo’s first major step towards addressing the largest remaining source of its Scope 2 emissions – its electricity supply in Southern Africa.

As Anglo makes progress towards its 2040 carbon neutral operations commitment, it also sees the opportunity to enhance energy reliability and grid resilience in South Africa.

“We expect that energy availability to help catalyse extensive socio-economic activity, playing a critical role in unlocking South Africa's economic development and growth prospects,” Mkhwanazi added in a release to Mining Weekly.

The projects – the Umsobomvu wind project (140 MW), the Hartebeesthoek wind project (140 MW), and the Mooi Plaats solar project (240 MW) – form part of Envusa's mature pipeline of wind and solar projects in South Africa.

The renewable energy ecosystem that Envusa plans to develop is expected to supply a mix of renewable energy, generated both on Anglo's sites in the Southern African region, and from other sites from which renewable energy will be transmitted via the national grid.

The Koruson 2 wind and solar projects benefit from outstanding yield resources, coupled with a robust Eskom grid connection. This configuration promises considerable electricity cost savings compared to existing tariffs.

Anglo's three businesses in South Africa – Anglo American Platinum (Amplats), Kumba Iron Ore and De Beers – have committed to 20-year offtake agreements with Envusa.

These agreements will see Amplats receiving 461 MW of supply, Kolomela mine 11 MW, and Venetia mine 48 MW. All projects are to reach commercial operation during 2026. This inaugural phase of contracts is expected to abate about 2.2-million tonnes of carbon dioxide a year.

Anglo management board chairperson in South Africa Nolitha Fakude, who also chairs Envusa, expressed delight with the progress made in setting up Envusa as a major long-term renewables powerhouse in South Africa.

Achieving financial closure for these three high-quality renewable energy projects marks, Fakude said, a crucial milestone in support of Anglo's global decarbonisation journey and bolsters South Africa's pursuit of a resilient and clean energy future.

"We believe that the energy transition offers a unique opportunity to generate substantial new economic opportunities as part of South Africa's journey towards an inclusive, sustainable and low-carbon economy,” Fakude added.

EDF Renewables CEO in South Africa Tristan de Drouas highlighted as “immensely rewarding” the collaboration with Anglo to implement EDF’s extensive global expertise in renewable energy infrastructure development, design and delivery.

"The financial close of this initial cluster of projects is the first step towards Envusa's ambition to roll out 3 GW to 5 GW of wind, solar and storage projects by 2030,” De Drouas noted.

These collective initiatives align seamlessly with EDF Group's CAP 2030 strategy, which is ambitiously focused on doubling its net renewable installed energy capacity globally, including in hydropower, from 28 GW in 2015 to 60 GW by 2030, a significant environmental plus.

JUST ENERGY TRANSITION

In line with both companies' commitment to supporting the just energy transition, Envusa is exploring a range of black economic empowerment (BEE) and community partnership models that will enable businesses and host communities to share in the benefits created by the development of the renewable energy ecosystem, along its value chain.

The first of these empowerment initiatives includes the incorporation of a 20% equity investment by Pele Green Energy, an established South African independent power producer (IPP), into each of the three project companies delivering the development of the Koruson 2 assets, alongside the establishment of a community trust to manage the financial interests of local communities in the Koruson 2 assets.

Envusa is also implementing the incorporation of a BEE partner at the business level to further demonstrate its impressive empowerment commitment.

The development of the renewable energy ecosystem is seen as presenting an opportunity to help build a more collaborative and inclusive economy that places people and the principle of shared prosperity at the heart of development.

EASTERN CAPE ENERGY DEAL

In an entirely separate deal, Hive Hydrogen South Africa this week announced the signing of an agreement with Genesis Eco-Energy to implement 372 MW of wind power in the Western Cape, in support of the development of its R105-billion green hydrogen and ammonia project at Coega in the Eastern Cape.

Interestingly, Amplats is also implementing green hydrogen heavy haulage at its Mogalakwena mine in Limpopo province and, importantly, last week German car manufacturer put the first fleet of green hydrogen-powered cars on South Africa’s roads.

Meanwhile, the Coega green ammonia hub announced for the Eastern Cape is a flagship investment project led by Hive Energy and co-developer BuiltAfrica, which has a 25% stake in Hive Hydrogen South Africa.

BuiltAfrica was founded in 2009 by former Eskom CEO and former Standard Bank chairperson Thulani Gcabashe as an investment and development business focused on sectors that support sustainable development and Gcabashe is the current chairperson of Hive Hydrogen South Africa.

The two wind farms of IPP Genesis Eco-Energy are expected to bring with them significant employment opportunities.

Hive Hydrogen South Africa’s green ammonia project, which has been tabled at the Presidential Investment Summit in Sandton, was awarded Strategic Integrated Project status by the Ministry of Public Works in November 2022.

A total of 3 480 MW of power will be generated to supply the plant and will bring much-needed investment to the transmission network.

The project development will also enable other IPPs in the Beaufort West region to connect their power generation assets to the grid which will reduce loadshedding.

“We’ve been working with Genesis on these two outstanding projects of theirs for over a year and are delighted to have finalised implementation terms with them to ensure a meaningful supply of power is secured for the project,” Hive Energy Africa CEO Colin Loubser stated in a release to Mining Weekly.

Hive Hydrogen South Africa will continue working with Genesis to secure additional power for the Coega green ammonia project which, once the first phase is built, will require three further phases to supply power.

“The Hive Green Ammonia project will incorporate our large-scale wind farms to deliver significant benefits to the Eastern Cape province, creating large numbers of jobs in a struggling economy. We’re thrilled to be part of delivering this energy solution,” said Genesis MD Davin Chown.

BuiltAfrica participated in the early rounds of renewable energy procurement under the South African government’s Renewable Energy Independent Power Producer Procurement Programme, or REIPPPP.

During this period two solar generation plants were built and are in operation. In addition to this, BuiltAfrica, which has been chaired by Gcabashe since its inception, was involved in energy efficiency projects aimed at lowering peak demand on the power system.

Hive Energy, headquartered in the UK, is the 75% stakeholder of Hive Hydrogen South Africa and is the principal funder and co-developer of the project, which is located in Midrand, Gauteng, and Nelson Mandela Bay, Eastern Cape.

Hive Energy was founded in 2010 by Giles Redpath to participate in the significant solar photovoltaic expansion across England. The company now operates in 17 countries globally with its largest projects in Spain. It is developing eight green hydrogen/ammonia projects globally. Once complete, the projects will have the capacity to produce some 8.5-million tonnes of hydrogen/ammonia each year to support the global drive to net-zero emissions by 2050. The UK’s largest solar park is on its list of developments and it is currently developing Spain’s first green hydrogen/ammonia hub.

In addition to its eight gigascale green hydrogen/ammonia projects, more than 28 000 MW of renewable energy projects feature, so far generating more than £1.9-billion capital expenditure in green energy, saving 1.9-million tonnes of carbon dioxide each year.

Genesis Eco-Energy Developments, which is part of the Genesis Infrastructure and Renewable Energy Group, is headquartered in Cape Town and is developing 6.5 GW of renewable energy generation and energy storage projects in South Africa.

PLATINUM GROUP METALS

As reported by Engineering News & Mining Weekly earlier this year, the hydrogen economy is an important new growth area for South Africa’s platinum group metals (PGMs) and, in turn, PGMs are pivotal for hydrogen production and application across a broad front.

In the article, Heraeus Precious Metals new business development executive VP Dr Philipp Walter, who is closely linked to South Africa's Northam and Sibanye-Stillwater PGM producers, highlighted the strong global momentum of the hydrogen economy – “politically, socially and technologically” – which saw yet another green hydrogen-driven car launched by Honda this week.

In South Africa, it is estimated that the hydrogen economy has the potential to add 3.6% to gross domestic product (GDP) by 2050, along with 370 000 jobs.

South Africa is already acting with purpose to harness the potential of green hydrogen and if investment is significantly scaled up, green hydrogen can deliver the equivalent of more than one-third of Africa’s current energy consumption, increase the collective GDP, improve clean energy supply and empower communities.

The Southern African region already has 33 green hydrogen-linked projects charted, 26 of them in eight provinces in South Africa and seven in Namibia. This region has world-class conditions for generating renewable energy through solar and wind power, which are key drivers of the production of green hydrogen.

Innovative financing structures, sourced from multiple stakeholders, are available for green hydrogen projects that can collectively provide energy sovereignty and export opportunities.

To date, the largest public finance commitment to South Africa’s green hydrogen sector is the Just Energy Transition Partnership (JETP). Conceived as an $8.5-billion multi-donor agreement, the JETP is a novel climate finance programme to deliver a just transition to affected groups.

Further, through its green ammonia export project in South Africa’s Eastern Cape, the leadership of Hive Hydrogen South Africa intends to show how a just energy transition is possible, Gcabashe highlighted at this year’s signing ceremony for the $5.8-billion Coega green hydrogen and green ammonia development.

Hive Hydrogen South Africa and Itochu Corporation of Japan signed a memorandum of cooperation (MoC) to advance Hive’s Coega green ammonia export project and have agreed to work together on matters of viable green hydrogen and ammonia project development, production, operation, marketing, offtake and distribution.

JAPAN AND SOUTH AFRICA

Today being Japan’s National Day, it is fitting to report that the Japan External Trade Organisation (Jetro) last week hosted key South African private and public sector delegates and a high-profile Japanese business delegation at a green hydrogen seminar, in Johannesburg.

The event followed last year’s signing of an MoC between Japan’s Ministry of Economy, Trade and Industry and South Africa’s Department of Science and Innovation (DSI) in October last year.

The MoC was signed to advance the interests of both countries in the development of green hydrogen and ammonia.

“The issue is how do we begin to implement some of the principles encapsulated in the MoC, because those will be the principles that will enable the business that is here from South Africa and Japan to be able to actually commercialise some of the investments that we've made on both ends,” DSI multilateral cooperation director Cecil Masoka said at the seminar.

After the conference, Jetro took 27 members of the Japanese delegation, who represent a range of Japanese corporate and public organisations, across South Africa to look at the business potential in the country’s rapidly developing green hydrogen industry.

The Japanese delegation visited key green hydrogen sites in Gauteng and the Western Cape, and used the trip as an opportunity to engage with relevant South African private and public stakeholders in the green hydrogen space.

The ultimate goal of these exchanges is to promote cooperation and information sharing between South African and Japanese stakeholders with a view to seeing the green hydrogen sector expand.

Speaking at the event, Department of Trade, Industry and Competition (dtic) green economy investment promotion director Annelize van der Merwe highlighted that the Green Hydrogen Commercialisation Strategy, which was developed between the dtic and the Industrial Development Corporation (IDC), was approved by South Africa’s Cabinet last year.

Cabinet also approved the South African Investment Strategy, which identifies hydrogen as a catalytic sector, as well as the New-Energy Vehicle White Paper.

“This all means that we are now well on our way to position South Africa as a key player in the hydrogen market and we are really keen to collaborate with companies from Japan on capitalising on these opportunities,” she said.

Masoka added that it was hoped that engagements with the Japanese delegation would lead to finding ways of partnering in supporting domestic use partnerships in hydrogen and ammonia in South Africa, while exploring the possibility of technology transfer inbound into South Africa.

“We're looking also at how we can identify large-scale commercial opportunities or large-scale infrastructure investments as demonstration plants that we can develop in South Africa, jointly with Japan. We’re also looking at how we can support our private entities to be able to get and secure offtake agreements from Japanese entities that will enable the partnerships to grow,” he said.

IDC industrial strategist and planner Mahandra Rooplall said the South African government had supported the development of several green hydrogen projects, which were now progressing along the development phase.

“However, although the private sector has come on board and initiated projects, which is very encouraging, there are challenges. There are partnerships required, as well as additional funding needed, to get these projects over the line. So, we're looking forward to Japanese stakeholders assisting us in that regard and partnering with us on projects,” he said.

Rooplall said there was potential to also initiate new green hydrogen projects in South Africa, which he hoped could also yield potential collaborations with Japan.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation