Rich copper intercept in N Cape sends Orion’s shares soaring on Australian exchange

JOHANNESBURG (miningweekly.com) – The richness of South Africa’s copper assets were emphasised on Monday when Northern Cape mine developer and explorer Orion Minerals published a standout intercept that sent its shares rocketing up 58% on the Australian Stock Exchange (ASX).

Orion, headed by CEO Errol Smart, is primarily listed on the ASX, where it has 1 300 shareholders, and secondarily listed on the Johannesburg Stock Exchange (JSE), where it has 28 000 shareholders.

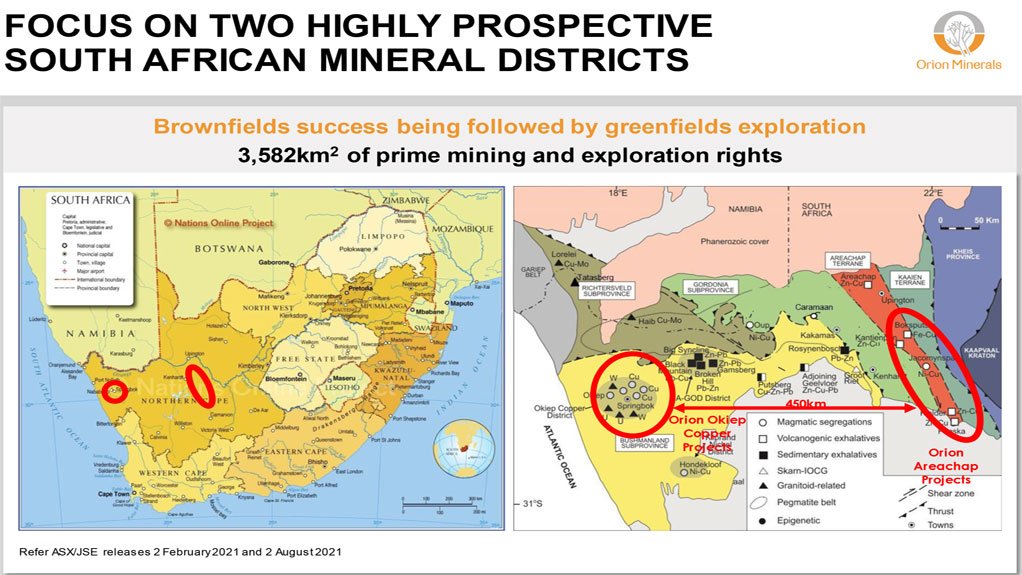

Prieska is its flagship development, where trial mining is already under way, and Okiep will be the district of its Flat Mines mining development, while two exploration projects are also under way.

“Prieska is the big chocolate cake. There are not very many cherries in Prieska, it’s just a massive chocolate, whereas Okiep is a chocolate cake with a whole lot of cherries mixed in and you keep finding these, and that’s what we’ve seen today,” said Smart.

Nothing like the high-grade copper intercept in the Flat Mines area of Okiep copper project, of 4.89% copper at 49 m and including 12.47% copper at 10.23 m, has been seen in South Africa in the last 40 years.

“Yes, it’s in a zone where there were known intersections but at least now we’ve proved that it isn’t a fluke, it isn’t a one-off. There’s a large zone of very high-grade mineralisation at this site,” Smart during a webinar in Australia, covered by Mining Weekly.

“I had a trader in Sydney last week that was saying to me if you guys have got anything above 11%, we’ll take it as direct shipping ore, they’ll collect the broken rock at the mine portal and drive it away. That puts us into the context of what it is and it puts Okiep in the context of what this district is.

“The original Okiep mined over 900 000 t of hand-sorted ore at 21% copper. That’s just unheard of. There aren’t deposits like that in the world.

“But on our properties, the Okiep mine is also on one of our prospecting rights. There are deposits like this and we’ve got large known mineralised bodies that haven’t been drilled out, and we see huge opportunity here,” Boksburg-born Smart added.

Orion has a large undrawn facility from South Africa’s Industrial Development Corporation (IDC) and from Triple Flag, a precious metals streaming and royalty company, for its Prieska project, and has just done an IDC drawdown for Okiep as well.

Okiep has two development projects and two exploration projects that are well advanced and can add value relatively quickly in the Northern Cape, which has 30% of South Africa’s land mass and only 3% of its population.

Historically, the Prieska and Okiep districts, which currently hardly produce at all, have collectively produced about 2.5-million tons of copper.

In consolidating over the last seven years, Orion has done more than 17 acquisitions involving mineral rights and data in an area that was strongly explored by mining majors such as Newmont, AngloVaal, Anglo American and Gold Fields in the 80s and 90s, which opens a door to advanced-stage projects for development.

Orion’s flagship is the Prieska mine, which produced 46-million tons from a single, consolidated orebody.

Orion, with 31-million tons of resource there currently, expects this to rise to 50-million tons of resource.

AngloVaal, which developed the mine, in 1971 took it down to 1 200 m, with stoping stopped at 970 m. The mine’s deepest ore is predeveloped with shafts and decline roadways to the bottom of the orebody.

Orion believes that it can produce 22 000 t/y of copper and about 79 000 t of zinc for 12 years at Prieska.

The feasibility study that determined this was done at a time when the copper price was $6 600/t and the zinc price $2 300/t, compared with today’s zinc prices of $2 850/t and the copper price was touching on $10 000/t on Friday.

A team of 200, including 20 professionals, run Prieska, which is in a trial mining phase of up to 40 000 t a month.

The cornerstone of the financing is in place and the new plan is concentrated on an area of 2.4% copper.

While the mine is dewatered over three years to provide access to the bottom orebody of 29-millon tons, mining will take place at a rate of 40 000 t a month.

“We’ve proven the ground conditions, we’ve recruited the team, we’ve got no expats, there’s no fly-in, fly-out internationally, it’s all South African nationals running this.

“We’ve established power, water, all the services and we’ve got a mining contractor on site; we’re developing on ore and on a good day we’ll put 300 t of ore on surface very easily,” Smart outlined.

In a telephone interview, Smart expanded on today’s major intercept announcement.

“We were always convinced there was high-grade mineralisation in that area of the Flat Mine East.

“The old Gold Fields results certainly indicated that, but the independent experts always take a very conservative view and are insistent that we have to drill our own holes to show that we could rely on Gold Fields’ drilling.

“That's sort of one of these things of being ASX listed. The Australian Stock Exchange and ASIC, the Australian companies office, is a lot more prescriptive and strict than the JSE, so we had to go through this process of drilling.

“Fortunately, it turned out that we've actually got better results than those that were there previously. But more importantly, given the comfort that's required, and the fact that we’re only two holes into the 11-hole programme, so far, both of those approved exactly what our expectations are, so we're very close to being at the point that we can sign off the reserve and publish the bankable feasibility study (BFS)," Smart said.

"This is part of the BFS for Okiep, where the first mine into production will be Flat Mine, followed very shortly by Flat Mine East, where we drilled this intersection and then Flat Mine South will probably come on three or four years later."

Mining Weekly: When do you think you'll go beyond the trial mining and begin producing copper for sale, zinc for sale, and getting into full-scale mining?

Smart: It all goes about getting the funding completely finalised and all of that is waiting for the BFS’s to sign off. The sign-off of both is expected in about three months from now. Then we continue, we have been having discussions with financiers. They’re all waiting for the BFS report. Generally, it takes three to four months to bed down the balance of the financing and then we start construction. With both projects, the long lead time items are the construction of the processing plant and the tailings facility. Both of those will take about 12 months to get the first startup constructed. Realistically, from now, probably 18 months to maybe 24 months to be in production and first sales. The first one off the ramp will almost certainly be Prieska because it's just got a big head start on Okiep now because we’re doing the trial mining; we've got the entire staff and labour forces there, all the legal appointments are in place, contractors are in place and we're drilling and blasting every day and delivering ore to surface. So Prieska is ahead by a short country mile at the moment and Okiep will catch up very quickly.

Have you been able to get all the skills you need?

Skills have come with difficulty, I will admit. Skills are massively short in South Africa but also worldwide. Just here in Australia over the last week, I've been speaking to all sorts of people and there's a massive skill shortage. The Aussies are actively recruiting to steal the best of the South Africans, but we getting the skills we need at Prieska. We've been fortunate that during this trial mining phase we were able to do everything normally done in a startup when you go into production, but we don't immediately have the revenue. We were able to filter and there were people that we needed to replace with better skills, and we've got those better skills, and now we've got a really good well-oiled team and they’re delivering what's needed from them.

What funding is under way and what further funding could emerge as projects advance?

Triple Flag is funding the mining at Prieska, and at Okiep, we have the Industrial Development Corporation. What is interesting is concern around not having copper concentrates available in the world. Traders are very active and offering all sorts of offtake-related financing, pre-production financing, advance purchases and the like, so that will probably be a very important part of our financing equation. Then, we’re having good discussions around the introduction of build, operate and transfer arrangements with the engineering companies, essentially giving you the comfort that they will build. They take the financial risk on operating processing plant and if it is successful, you pay it off in five years and they transfer it to you. It's an extreme version of an engineering, procurement, and construction contract and it brings its own financing.

Will traders that help to fund the business become the sole offtakers?

We probably wouldn't go with just one trader unless there is a very compelling reason. We will have quite substantial production, and traders are looking at our five-year outlook, which is looking at nearly 30 000 t/y of copper production, and everyone would like to get into that because it's long-term production.

Is there keenness on the zinc side as well?

Yes, zinc is still one of the critical metals and today’s zinc price has risen to $2 850/t compared with the $2 350/t on which we based our original studies, so there's a very substantial uplift in the zinc price as well.

Looking a few years ahead, how are your projects likely to help the Northern Cape and South Africa?

Our activity is already having an impact. At Prieska, we’ve created long-term jobs and nearly 30% of our procurements is from local companies and communities. If you go into Prieska now, it's a completely different place to what it was two years ago - that includes a KFC drive-through. You see growth in these little Karoo dorpies as soon as there’s substantial cash flow. We've got 200 people spending their salaries in Prieska every month. You can imagine the impact of that in a place that hasn’t had any earnings other than agriculture for a long time.

What, in your view, should be the biggest takeaway from this interview?

That South Africa has got awesome base metal opportunities and future-facing mineral opportunities, and Orion has got the two best copper opportunities, both for early-stage and sustainable long-term development and growth. Those are two things being sought at the moment that we’re able to deliver them.

THE HIGH-GRADE COPPER INTERCEPT

With the Okiep mine having in the past reportedly milled 907 000 t with a grading of 21% copper from hand-sorted ore, Orion has very many outcropping mineralised bodies, where previous owners Newmont and Gold Fields intersected strong copper mineralisation in dozens of bodies with scout drilling.

However, drilling out the discoveries was never completed owing to the low copper prices at the time, which resulted in management decisions to curtail exploration.

In a district which produced over two-million tons of contained copper metal historically, the Okiep region, which has lain dormant for decades, is now undergoing a major revitalisation with the application of modern exploration and mining technologies.

The diamond drilling programme in the Flat Mines area from February this year has been designed to confirm historical drilling information and resultant interpretations, provide geotechnical information, and provide additional material for confirmatory metallurgical test work.

On completion of the programme, the geological and mineralisation envelope interpretations will be reviewed and adjusted where necessary, followed by an update of the resource estimate including the new information.

New geotechnical information will be used for input for mine design, with planned confirmatory metallurgical testwork including comminution, flotation optimisation, locked cycle tests, tailings characterisation and sorting.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation