Rosh Pinah Zinc secures $150m for Namibia expansion project

Mining company Rosh Pinah Zinc (RPZ) has secured a $150-million debt facility underwritten by Standard Bank to finance the development of its expansion project, RP2.0, at its underground mine in Namibia.

The financing is highlighted as a key milestone for the expansion, which is expected to modernise the Rosh Pinah mine’s infrastructure and nearly double the mine’s production output to 170-million pounds a year of contained zinc metal.

Construction is over 80% complete and remains on budget, with completion expected in quarter three 2026, and ramp-up starting in quick succession.

Investment adviser Appian Capital Advisory, the majority shareholder of RPZ, undertook a competitive tender process with multiple parties partnered with Standard Bank in this transaction.

The financing will fund the remaining construction costs of the mine’s expansion, with the project now funded through to ramp-up.

Standard Bank’s backing of the expansion builds on its established relationship with RPZ and follows extensive technical, legal, environmental and social due diligence, Appian points out, adding that it offers a strong endorsement of the commercial viability and environmental, social and governance standards of RP2.0.

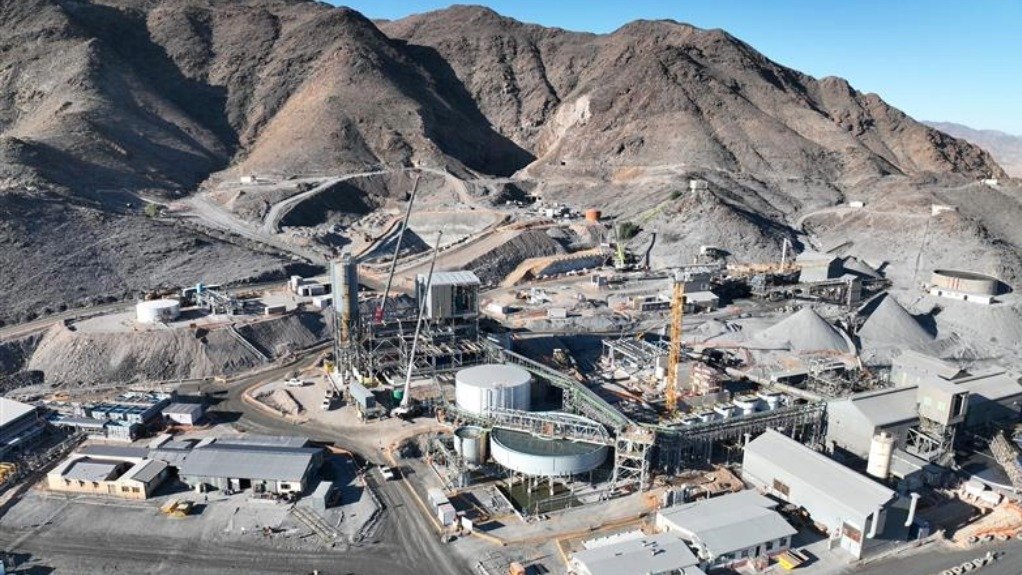

The RP2.0 expansion project comprises further development of the underground mine, as well as the construction of new surface facilities, including a new processing plant, the addition of a paste fill and water treatment plant and a newly developed portal and decline to extended underground deposits.

“RPZ is pleased to have concluded this important deal, which will provide us with financial flexibility as we continue to progress the construction of RP2.0. Standard Bank is a longstanding supporter of RPZ and a leading financial partner for the metals and mining industry in Africa. We are encouraged by their confidence in the project and our long-term vision,” says RPZ GM Alex Mayrick.

“Securing this financing is a major step forward for RPZ and RP2.0. The expansion is a key component of our strategy to optimise operations and extend mine life at RPZ. With this funding, we can continue to focus on developing an asset that will deliver value for all stakeholders for many years to come,” says Appian base metals head Ignacio Bustamante.

Endeavour Financial acted as Appian’s financial adviser for the transaction.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation