Royal Bafokeng Platinum delivers top performance, declares maiden dividend

RBPlat CEO Steve Phiri

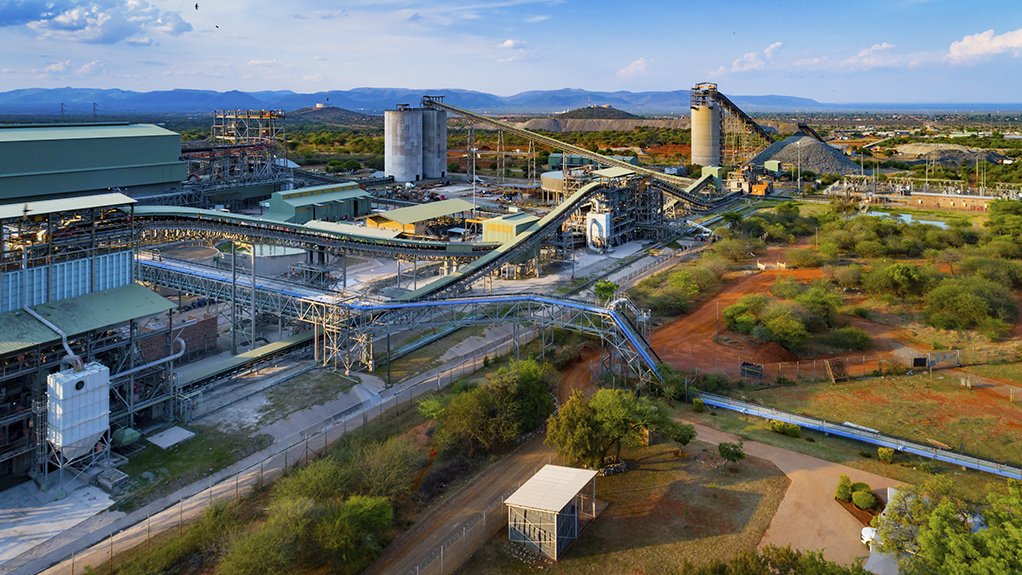

Concentrator at RBPlat's BRPM mine

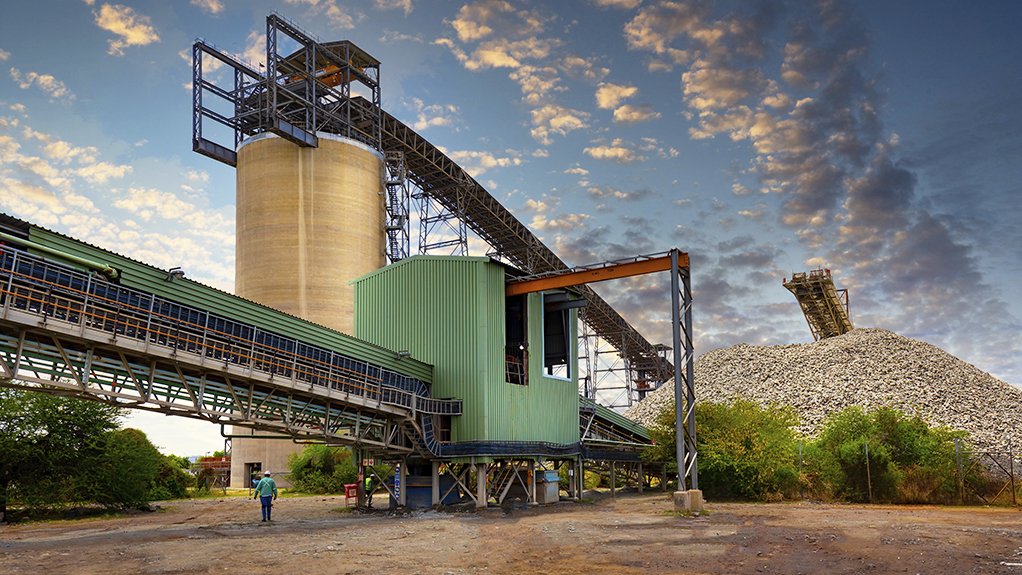

Silo at RBPlat's BRPM mine.

JOHANNESBURG (miningweekly.com) – Platinum group metals (PGMs) mining company Royal Bafokeng Platinum (RBPlat) on Tuesday reported a record performance and declared its maiden dividend on the back of a 2 734.2% increase in 2020 headline earnings to R3.5-billion.

The JSE-listed black-controlled, black-led and black-managed company, headed by RBPlat CEO Steve Phiri, reported 78.6%-higher revenue to R13.4-billion for the 12 months to the end of December.

Earnings before interest, taxes, depreciation and amortisation (Ebitda) increased by 278.4% to R6.6-billion.

“In 2020, we commemorated our first ten years on the JSE, and also saw the global spread of the Covid-19 pandemic, which really tested our flexibility and our ability to protect the sustainability of our business.

“Notwithstanding the negative impact of the pandemic on our operations and the business as a whole, our More than Mining philosophy helped us deliver a record performance with enhanced shareholder returns.

“Our growth and optimisation of our operations continued to deliver a more robust business, supported by a strengthened balance sheet,” Phiri stated in a release to Mining Weekly.

In addition, guided by its dividend policy, and given the strong R3-billion of free cash flow before growth capital expenditure, the board declared a final gross cash dividend of 575c a share, equating to R1.5-billion.

“This ensures that we remain in a position of strength and are well placed to continue with appropriate, value-creating and disciplined investment in our business,” Phiri added.

One hundred per cent of capital expenditure was funded from cash generated by operations, where there was a 4.5% increase in four element (4E) PGMs production to 419 000 oz. Platinum metal in concentrate was up 4.2% to 272 000 oz.

THE YEAR PAST

Last year was characterised by a significant improvement in the PGMs market, a weaker South African rand and strong operational performance resulting in record production with a year-on-year increase in tonnes hoisted of 9.2% to 4 140 000 t, a 3.7% increase in tonnes milled to 3 990 000 t, and a 4.5% increase in 4E metals in concentrate to 419 000 oz.

Merensky tonnes hoisted increased by 4.7% to 3 335 000 t in line with the increased contribution from Styldrift. Upper group two (UG2) tonnes hoisted increased by 32.6% to 805 000 t, as the transition to UG2 at South shaft gained traction.

The increased Styldrift volumes offset the impact of the Covid shutdown on BRPM production and declining South shaft Merensky reserves.

Styldrift built-up head grade increased by 3.2% to 3.89 g/t 4E whilst BRPM head grade reduced marginally by 1.0% to 3.97 g/t 4E. The reduction in the BRPM head grade is attributable to a higher off-reef dilution on the South shaft Merensky due to geological complexity experienced in current mining areas and the increased contribution of lower grade South shaft UG2 to the overall ore mix.

Cash operating costs for the business increased by R838-million, or 14.8%, year-on-year to R6 513-million compared with 2019, which was attributable to higher production volumes, industry inflation and additional Covid pandemic management costs. Also included is R900-million of operating costs expensed during the managed shutdown and ramp-up of operations, resulting from the national lockdown.

Cash unit costs per tonne milled increased by 10.6% to R1 632 and 4E ounce tonnes milled by 10.1% to R15 560, mainly owing to an increase in surface stocks, together with the impact of the national lockdown on production and Covid-related costs.

STRONG FOCUS ON ‘MORE THAN MINING’

Despite the total injury frequency rate improving by 34.5% with the lost-time-injury frequency rate and serious injury frequency rate improving by 30.6% and 48.6%, RBPlat regrettably recorded a fatal injury at Styldrift on December 9 when Sipho Kopedi Mokgopa lost his life in a fall-of-ground accident.

During the past year, RBPlat implemented several measures to minimise the risk of Covid outbreaks amongst its employees and partnered with government in investing R10-million in converting an unused change house at the Maseve mine, into a 200-bed field hospital, provided quarantine and isolation facilities, and supported those in need and vulnerable in the community with food hampers and education assistance during the pandemic.

IMPROVED FINANCIAL PERFORMANCE

The strong PGMs basket price helped boost revenues for the period by 78.6% to R13 379.4-million. Ebitda increased by 278.4% from R1 756.4-million to R6 646.5-million, with the Ebitda margin increasing to 49.7% from 23.4% in the previous comparative period.

Consolidated gross profit increased by 697.1% to R5 430.7-million from R681.3-million in the comparative period.

STRONG BUT UNPREDICTABLE OUTLOOK

“Despite the strong underlying market outlook, the ultimate duration of the pandemic and its impact on the global economy remains unpredictable,” said Phiri.

To date, RBPlat has enjoyed strong cash flow generation, and will continue to optimise returns through ongoing improvements in the business and disciplined allocation of capital, while managing risk through focused cash and balance sheet management, he added.

“Going forward, our focus will continue to be on operational excellence, extracting value for our shareholders through the ongoing optimisation and continual improvement of our competitive assets and in delivering on our purpose of creating economic value for all our stakeholders, by delivering More than Mining,’ Phiri concluded.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation