Sales drop 14% in June as new vehicles become increasingly unaffordable

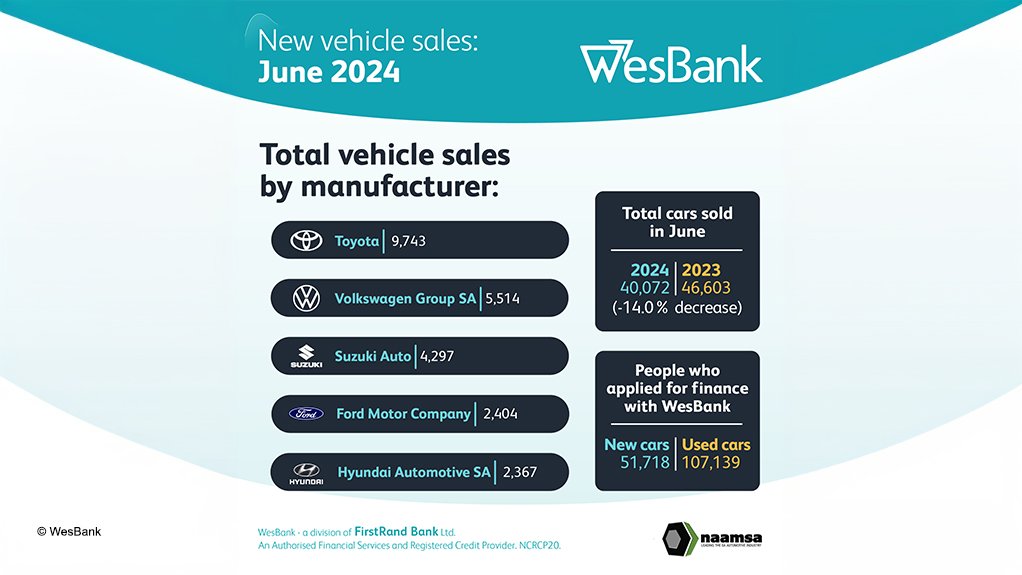

New-vehicle sales in South Africa dropped by 14%, to 40 072 units, compared with the same month last year.

The new-passenger-car market reached 26 928 units last month – a decline of 9% over June last year.

Sales of new bakkies, vans, small trucks and minibus taxis – light commercial vehicles – fell by 24.3% to 10 552 units.

June medium-truck sales shrunk by 27.7%, reaching 531 units, while heavy-truck and bus sales dropped by 11.7% to 2 061 units.

In contrast to these negative numbers, June export sales, at 28 306 units, inched up 3.6% compared with the same month last year.

For the first half of this year, however, exports are 9.6% below the corresponding period last year.

Naamsa | The Automotive Business Council says South African households continue to grapple with high costs in a weak economic environment, with affordability remaining a decisive factor in new-vehicle purchasing decisions.

Cumulative new-vehicle sales for the first six months of the year were now tracking 7.6% below the corresponding period in 2023.

Some good news is that the markets have responded positively to the announcement of the new Cabinet, a third month of no loadshedding, further welcomed relief at the fuel pumps and the increasing likelihood of lower interest rates before year-end.

“It is tough out there,” notes National Automobile Dealers’ Association chairperson Brandon Cohen.

“The few green shoots we saw after the elections dried up due to the time it took to appoint the Cabinet.

“The taxi market is slowly starting to recover, with sales over the past few months dropping from around 1 400 a month to almost zero.

“This decline is due to banks being risk-averse in this sector. This cautious approach has extended across the industry, with approval rates remaining under pressure.”

“Additionally, the trend of approved loans not being taken up by consumers has increased, reflecting a lack of confidence in the market," adds Cohen.

In the heavy-vehicle space, banks are also reluctant to finance trucks, and most of the bigger operators are not buying any vehicles.

“Conversely, the used-vehicle market continues to show an increase in demand, with a definite trend of buying down, negatively influencing new-vehicle sales.

Cohen says it is now a game of wait-and-see to gauge the effect of the new government, but he concurs with Naamsa that there “have been several positives of late which will help boost the economy”.

“All signs are pointing towards a brighter second half of the year for consumers and dealers alike.”

Affordability a Big Issue

Vehicle and asset finance house WesBank says affordability remains the biggest factor limiting new-vehicle sales growth, with many households opting for one multipurpose vehicle rather than maintaining multiple vehicles.

WesBank’s own data shows the average loan amount on a new vehicle increasing by 3.5% during June; the average deal duration increasing by 3.8%, to over 51 months; while the average contract period is now also more than 73 months.

“These are all signs of affordability challenges that either indicate that consumers are holding onto their existing vehicles for longer, or that they are forced to lower instalments by extending the loan period,” says WesBank marketing and communication head Lebo Gaoaketse.

One of the primary factors impacting on debt remains high interest rates, with relief only expected during the second half of the year, he adds.

“Consider June’s average loan value at WesBank of R410 000.

“Over 72 months at the prime lending rate (11.75%) the instalment is an estimated R8 054.83.

“An indebted customer who had financed the same value vehicle in 2020, linked to a prime rate of 7%, would be paying R1 015.81 more per month today, which, at current interest rates, equates to about R75 730.32 more for the same car over the same contract period.

“Layer in the other inflationary costs of living to that consumer, and you can imagine the pressure on household budgets,” says Gaoaketse.

“Those with an option to delay a purchase decision, or to opt for alternative mobility solutions, including e-haling, sharing, or the preowned market, are voting with their feet and exiting the new-vehicle market.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation