Samarco to invest more than $1bn to resume full capacity

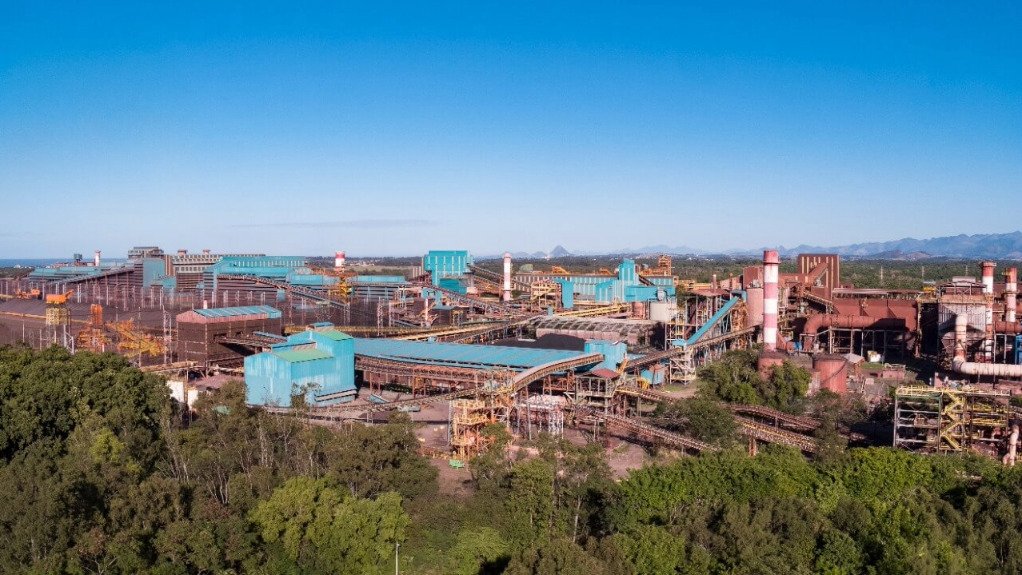

Samarco Minercao expects to invest more than $1-billion to return its iron-ore operations to full capacity by January 2028 — a date that’s more than 12 years after the operation was first sidelined after a deadly mining tailings dam disaster.

That’s according to some of the company’s top executives, including CEO Rodrigo Vilela, who spoke with Bloomberg News in an interview. The exact budget will be confirmed next year. The producer is a joint Brazilian venture between Vale and BHP Group. It first halted production in November 2015 after the dam break and only began resuming operations five years later.

Since then, Samarco has spent about $260 million restarting the facility, which is located in the town of Mariana, in Minas Gerais state. On Monday, the site reached the milestone of being back to 60% of capacity. Operations are restarting at a second concentration facility and a new tailings filtration plant.

Earlier this year, Vale and BHP signed a 170-billion-real ($28-billion) settlement with Brazil over the deadly dam collapse. It was the largest-ever deal of its kind globally, according to Brazil’s attorney general. When the tailings dam collapsed it unleashed a torrent of waste that killed as many as 19 people and contaminated waterways in Minas Gerais and Espirito Santo. Fallout from the disaster has hung over both companies for years, but the settlement has helped to remove significant legal overhang.

Samarco expects to produce 15 million tons of iron ore pellets in 2025, returning to a top-3 ranking for global exporters of the steelmaking ingredient alongside LKAB and top producer Vale. That would compare with roughly nine-million tons for this year, with output shipped to steel mills in Japan, Europe, the Middle East and the Americas.

The company is also working toward the shutdown of Germano dam in 2026, the last one in the mining complex, Vilela said. The closure was originally scheduled for 2029. The $580-million plan will bring more safety to the operation, where tailings instead are now filtered and dry-stacked.

Vilela said the first quarter of 2025 will be “undoubtedly” more challenging for iron ore prices than the current one. The slowdown in the Chinese economy and tighter margins led to a decrease in premiums clients pay for higher quality pellets. Samarco’s strategy to keep market share is to improve efficiency and reduce costs, while also having flexibility to adapt to steel mills’ product demands.

Samarco, which is under bankruptcy protection, saw its net revenue drop 20% in the third-quarter from a year earlier, driven by lower iron ore prices and weaker pellet sales.

Despite the challenging scenario, Chief Financial Officer Gustavo Selayzim sees no risk to the company’s contribution to the settlement signed with Brazil. The company has generated “a cash surplus of over $2 billion” since operations resumed, he said.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation