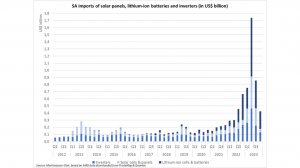

Solar, battery, inverter imports surged to a record R70bn in 2023 as wind turbines recovered from two-year lull

A consolidated view of South Africa's solar panel, battery and inverter imports from 2012 to 2023

Photo by Gaylor Montmasson-Clair

South African imports of solar panels, lithium-ion batteries and inverters climbed to a record $3.8- billion last year, or about R70-billion, while imports of wind turbines began to recover following a two-year lull, analysis compiled by Trade & Industrial Policy Strategies senior economist Gaylor Montmasson-Clair shows.

Imports in 2023 were double the $1.7-billion of 2022 and lifted the overall value of the three energy components imported over the ten years from 2014 to 2023 to above $10-billion.

The analysis points to an extremely strong rise in solar-panel imports last year, which was also the country’s worst-ever year for loadshedding.

He describes panel imports of $947-million, or R17.5-billion, as “mind boggling”, while noting that imports peaked in the second quarter at $450-million.

Over the full year, about 5 GW worth of panels were imported, up from 1.3 GW in 2022.

Montmasson-Clair, who is also facilitator of the South African Renewable Energy Masterplan (SAREM), a multistakeholder initiative aimed at stimulating industrialisation around South Africa’s renewables and battery storage investments, believes South Africa should be considering its localisation options more seriously while recognising that some of the demand may have been stimulated by the National Treasury’s tax incentive.

He reports that SAREM is considering various localisation drivers that boil down to ensuring that public demand from the large-scale renewables procurement programme and the roll-out of solar at public facilities play an anchoring role by supporting localisation.

“Any public support should come with a degree of localisation,” he argues.

For manufacturers to be competitive across markets, including the private market, Montmasson-Clair says various supply-side support measures will be required, including investment incentives and possibly even carefully calibrated tariffs on a limited set of products.

There is also a need to sort out the broader ecosystem, particularly through skills development, improved testing and certification facilities and a mandatory quality standard to fight substandard imports.

The value of lithium-ion battery imports, meanwhile, reached $1.75-billion last year, more than double the $730-million recorded in the prior year.

“At an average of $139/kWh, that’s about 12.5 GWh, or about 3.8 GW to 5.0 GW of capacity.”

As with solar, the demand was underpinned primarily by loadshedding, but it also coincided with a strong rise in the registration of distributed plants with the National Energy Regulator of South Africa.

Montmasson-Clair says local manufacturing, based on imported cells, is booming and should be actively supported to grow domestic production and to phase out the import of battery packs.

“Once the market has consolidated or stabilised, we will have a better idea whether cell manufacturing is viable for this market segment.”

Meanwhile, South Africa’s wind industry started importing again in 2023, following two years of inactivity, with demand underpinned by projects procured under the much-delayed Risk Mitigation Independent Power Producer Procurement Programme, alongside wind farms being built on the back of corporate power purchase agreements.

Wind turbines with a combined value of $200-million were imported, mostly in the fourth quarter of last year.

Montmasson-Clair argues that industrial development in the wind sector requires constant demand, which has been absent even after the resumption of public procurement in 2020 and dampened further by the fact that none of the wind projects that bid for a 3 200 MW public-auction allocation progressed to preferred bidder status. This, after Eskom claimed that there was no remaining grid-connection capacity in the Eastern, Northern and Western Cape provinces, where the country’s best wind resources are found.

Eskom has since published the highly anticipated curtailment addendum to its latest Generation Connection Capacity Assessment, which will unlock 3 470 MW of additional grid capacity to connect wind generation, including 2 680 MW in the Western Cape and 790 MW in the Eastern Cape.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation