South Africa set to lower inflation target in 2026, poll shows

South Africa will probably wait until next year to lower its inflation target to address more pressing issues such as weak economic growth and fiscal consolidation, according to a survey of investors and analysts.

The South African Reserve Bank and National Treasury have been working on revising the inflation goal for almost a year, and will hold a conference on the matter next month.

Inflation averaged 2.9% in the last three months of 2024, its lowest level since the second quarter of 2020 and below the current 3% to 6% target range.

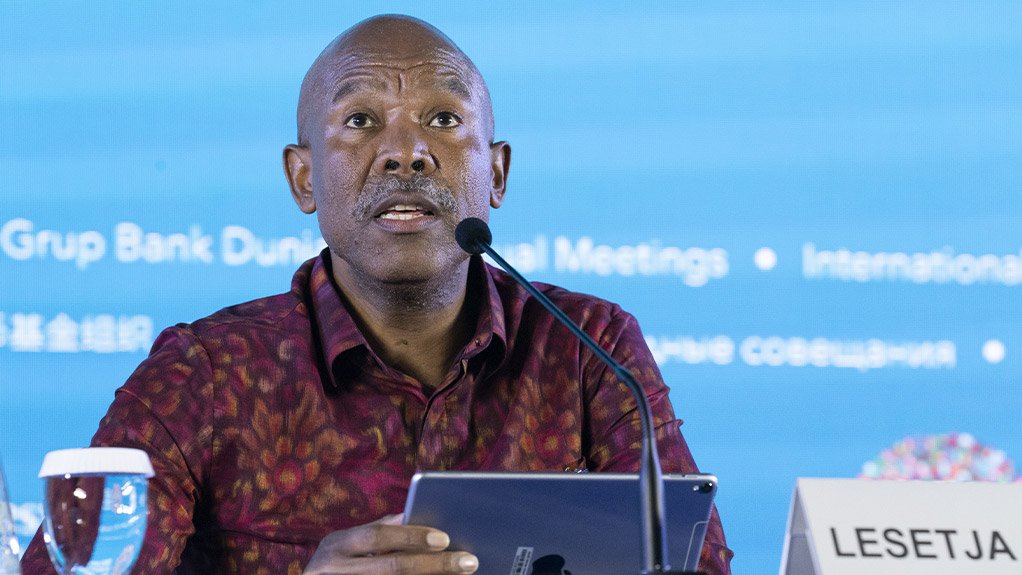

Governor Lesetja Kganyago wants to update the goal that’s been in place for a quarter of a century. He has argued that a single-point target of 3% would be in line with South Africa’s peers and allow for lower interest rates.

His counterpart at the Treasury, Finance Minister Enoch Godongwana, said he is unlikely to announce a new inflation target when he delivers the national budget on February 19, as more work needs to be done to achieve political consensus.

Of the 13 investors and analysts surveyed by Bloomberg on the matter, most agree with Godongwana that the process shouldn’t be rushed.

“I don’t see a problem that if you don’t change the target now, given that inflation is under control, that you’ve missed the opportunity,” said Kevin Lings, Stanlib’s chief economist. “The target is a long-term objective.”

The median estimate of the 13 participants in the Bloomberg survey is for the target to be lowered next year to 3% in a phased manner.

Bigger Priorities

They argue that the Treasury has bigger fish to fry.

“My view is it will be a debate, but we won’t see a change anytime soon,” said Elna Moolman, head of South Africa macroeconomic research at Standard Bank Group. “It’s partly because ultimately it’s a Treasury decision and I think that Treasury is rightly focused on other political battles at this stage, primarily fiscal consolidation.”

South Africa’s debt-service costs have become its largest spending item and are rising faster than economic growth, crowding out funds for health and education.

Those surveyed also argue that the Treasury would be reluctant to agree to a new inflation target now as it may have repercussions for growth, even if they were to be minimal as Kganyago has argued.

“We need growth as a matter of urgency,” said Carmen Nel, head of multi-asset at Terebinth Capital. “There are long-run benefits toward low and stable inflation, but we should not rush it because you do risk curtailing what is an ascent recovery or upswing in being overly hawkish.”

Economic growth has averaged less than 1% annually in the past decade because of logistic and energy constraints and is foreseen accelerating to 1.7% this year and 2% next.

The low growth and high debt burden also need to be addressed to attract investment, said Rashaad Tayob, portfolio manager and macro strategist at Foord Asset Management.

South Africa’s “higher risk premium is due to debt risk — higher debt burden and persistent fiscal deficits — and the lack of growth orientated economic policies from the government,” not inflation Tayob said. “The markets are now looking for a better policy framework out of government which can improve the growth outlook, rather than SARB reducing inflation further.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation