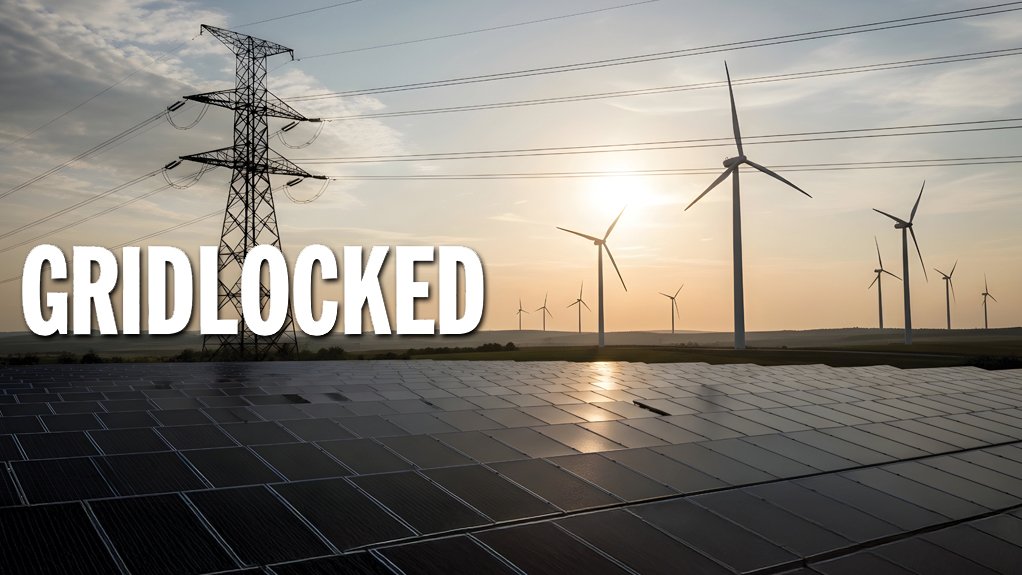

Step-change in grid construction seen as key to unlocking big renewables pipeline

POWER BOTTLENECK Insufficient grid capacity is holding back more electricity generation

Photo by Bloomberg

MASOPHA MOSHOESHOE Critical steps need to be taken to address the blockages in the delivery of renewable energy

KILIAN HAGEMANN A competitive wholesale electricity market in South Africa could help drive down the cost of electricity

ANDRE NEPGEN South Africa is seeing a rapid adoption of, and demand for, renewable energy

KYLE DURHAM There are significant investments forecast in the electricity and renewable energy landscape

NIVESHEN GOVENDER South Africa is in the midst of redesigning its energy system

South Africa can unlock an additional 53 GW of electricity generation capacity by constructing 14 000 km of transmission infrastructure – a critical step in enabling the electricity sector to transition to more sustainable energy generation.

“While this will be a significant addition of new generation capacity, it is important to understand the scale of the challenge we are facing. This will probably be the largest build programme in the country over the next decade in a context in which the national fiscus is constrained,” says Department of Electricity and Energy renewable and green energy adviser Masopha Moshoeshoe.

A business-as-usual approach cannot be taken, given the scale of development required, he adds.

South Africa’s current build rate is about 300 km of new transmission lines a year, but this must accelerate to 1 400 km each year for a decade to close the current gap.

“This means that it is not an incremental improvement, but a step-change, that is required. A key challenge is that large-scale build programmes typically need some government guarantee and contingent liability, which may be problematic, given the constrained national fiscus.”

On July 31, the National Treasury confirmed that it would inject 20% of the $500-million initial funding required to set up the Credit Guarantee Vehicle being established to derisk South African public infrastructure projects to be built by private investors without recourse to government guarantees.

Grid Constraints

Independent power producers (IPPs) are best placed to enable a competitive wholesale electricity market in South Africa – one that could help drive down the cost of electricity – because they have become accustomed to intense price competition from successive rounds of public procurement, says utility-scale hybrid renewable energy company G7 Renewable Energies CEO Dr Kilian Hagemann.

However, IPPs face various electricity- grid-related barriers to project development, including a lack of grid capacity and unsuitable rules governing access to the grid.

There is no remaining grid capacity in the Northern Cape, Western Cape and Eastern Cape – provinces with the highest solar and wind resources – and tariffs for electricity generated by projects built in provinces where grid capacity is still available will be higher in the long run, he notes.

Additionally, provinces where grid capacity is available, such as the Free State, Limpopo and North West, will be next to run out of grid capacity, if this has not happened already, he highlights.

“We will have to wait for the National Transmission Company South Africa’s (NTCSA’s) new Grid Capacity Connection Assessment report to get a picture of where grid capacity is available across the provinces,” suggests Hagemann.

Further, he describes grid capacity allocation rules as counter-productive and not aligned with industry developments.

For example, the South African Wholesale Electricity Market (SAWEM), set to launch in 2026, will allow IPPs to bid power transparently and competitively through a day-ahead market auction. However, grid allocation rules require a developer to have heads of terms and an agreement with an offtaker that will consume the full output of the plant being connected, he notes.

There are also grid-related challenges facing rooftop and embedded generation. The absence of grid feed-in mechanisms and trading rules for electricity generated by solar systems is stifling project development, says financial services firm FNB Commercial head of sustainability Kyle Durham.

For example, citrus farmers benefit from their solar systems only during seasonal use, when they need the power, and cannot trade excess power, reducing the financial viability of these projects.

“Lots of projects are ready to be developed, but the environment around access to the grid remains a challenge,” he notes.

Alternative Model

In recognition of the problem that inadequate grid capacity poses, an alternative model for infrastructure development, in the form of independent transmission projects, was presented to Cabinet, resulting in the establishment of the NTCSA, says Moshoeshoe.

“This is a radical shift from how transmission infrastructure has been built for decades. Market soundings needed to be taken so that all parts of the ecosystem were understood. Then, we could craft a process that responds to market dynamics and which is transparent and well regulated.”

The NTCSA is developing a programme of transmission infrastructure projects, so that the projects are not implemented in an ad hoc manner. It also aims to mitigate the challenges with permitting and help to derisk projects, he says.

“Critical steps need to be taken to address the blockages in the delivery of renewable energy. We must additionally ensure that the system not only boosts energy availability, but also affordability, while meeting the country’s decarbonisation goals and commitments,” he says.

Further, there is an opportunity to increase the integration of the region’s electricity grids through the expansion of transmission infrastructure, which would also expand the industrial opportunities presented by grid development.

The South African government aims to develop a diversified energy system – one that is focused not only on energy security and availability, but also affordability and lower emissions, says Moshoeshoe.

Achieving this vision will contribute to the drive to expand renewable-energy penetration, which must be underpinned by enabling transmission infrastructure, he points out.

Rapid Adoption

South Africa is seeing a rapid adoption of and demand for renewable energy. Over the past few years, the process has largely been IPP-led for large energy users, says electricity demand aggregator and trading company Discovery Green head André Nepgen.

“This has set a good pathway for broader participation in the market. But what is particularly exciting is that the liberalisation of the market has enabled businesses to move from requiring long-term offtake contracts to requiring only monthly contracts,” he notes.

Additionally, some of the biggest innovations will arise from easing the requirements to access renewable energy.

“We will see more innovations as more banks, IPPs, electricity traders and investors become comfortable with taking the risks and offering new products and services to clients,” he says.

The past decade has seen transformation of the electricity sector, says industry organisation South African Wind Energy Association CEO Niveshen Govender.

The Renewable Energy Independent Power Producer Procurement Programme was an early success, but the market is now rapidly evolving, driven by regulatory reform, private offtake agreements and a shift to a liberalised electricity landscape, he says.

“We are talking not just about adding megawatts, but redesigning South Africa’s energy system for resilience, inclusion and long-term sustainability,” he says.

Investment Certainty

Policy stability is crucial to support the transition of South Africa’s electricity market. Stimulating demand and investment requires that businesses and consumers feel comfortable with the technology, says Durham.

From IPPs at the commercial and industrial scale to the rental and solar-as-a-service offerings, all stakeholders must be confident in the market outlook, which hinges on policy factors such as grid access, he says.

“We can now see the cycle shift, with power purchase agreements at the commercial and industrial scale, and rent-to-own and solar-as-a-service in the residential market,” Durham points out.

Further, in the residential market, rent-to-own and solar-as-a-service are moving into lower-living-standards-measure segments. This is a positive development for energy inclusion, and underscores the ongoing opportunities in this market, especially as the solutions move from being on par with the costs of grid electricity to becoming economically viable, he notes.

“The commercial and industrial market has exceptional opportunities. Research undertaken by [green economy nonprofit organisation] GreenCape has forecast up to R12-billion a year in investments in this segment of the market by 2030,” says Durham.

This represents a significant level of yearly investment, especially if combined with opportunities for off-balance-sheet financing vehicles such as power purchase agreements and wheeling opportunities through electricity traders, he notes.

Similarly, utility-scale renewable-energy projects offer significant opportunities to help bring about the macroeconomic environment that South Africa needs and to support the country’s energy transition, he adds.

Confidence remains a key factor among many needed to stimulate the local renewable-energy market, emphasises Nepgen.

“We need the demand and supply sides to feel confident for investors to put money into this space. This is how we will get the prices down, as well as drive innovation and greater value.

“A wholesale electricity market is a critical mechanism to support the transition and drive innovation. Similarly, solving grid access will also serve as a mechanism to support the transition to a diversified, reliable, competitive and resilient energy landscape.”

Govender, Moshoeshoe, Hagemann, Nepgen and Durham spoke during the ‘How is South Africa’s renewable energy landscape changing?’ webinar hosted by Creamer Media on July 30.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation