Stimulus plan, more efficient processing to promote steel construction growth

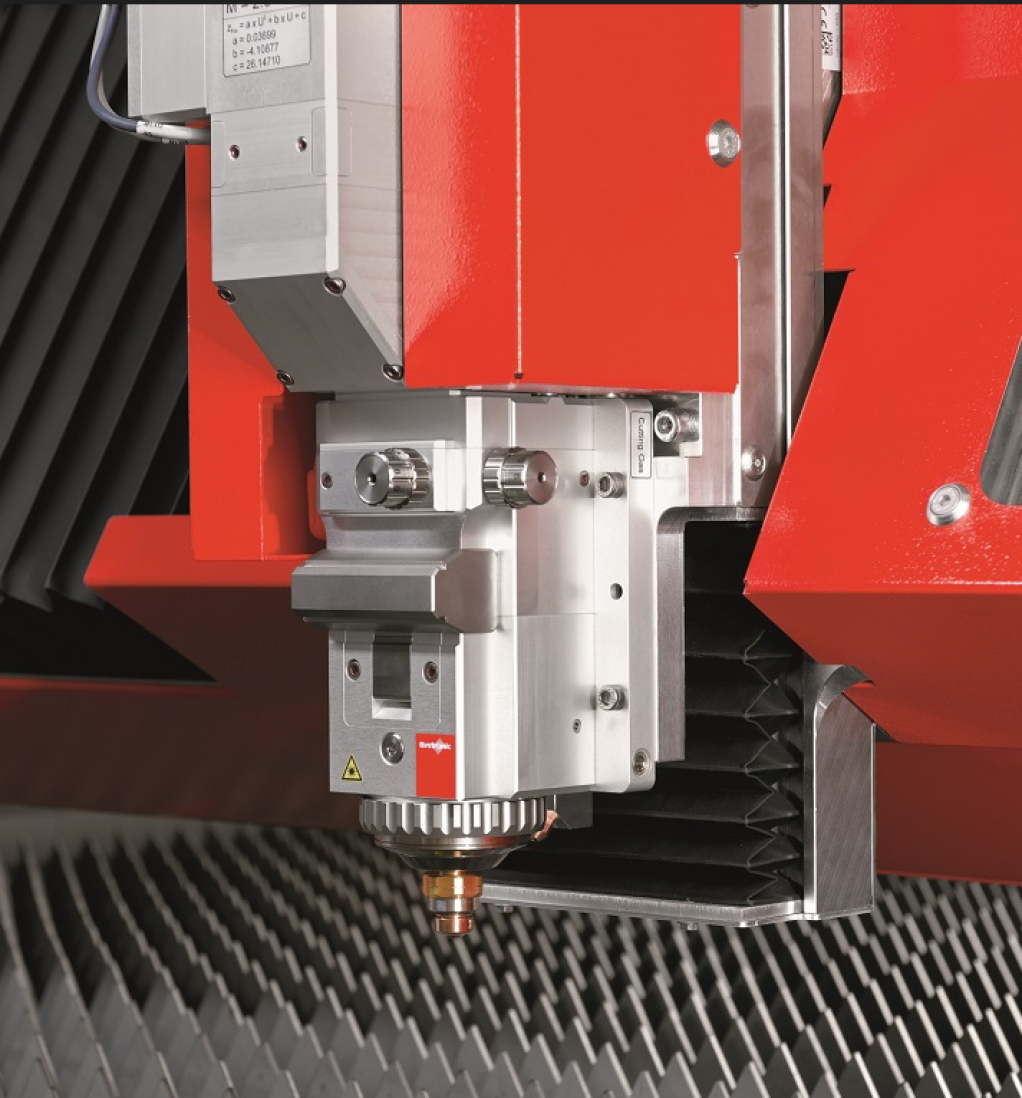

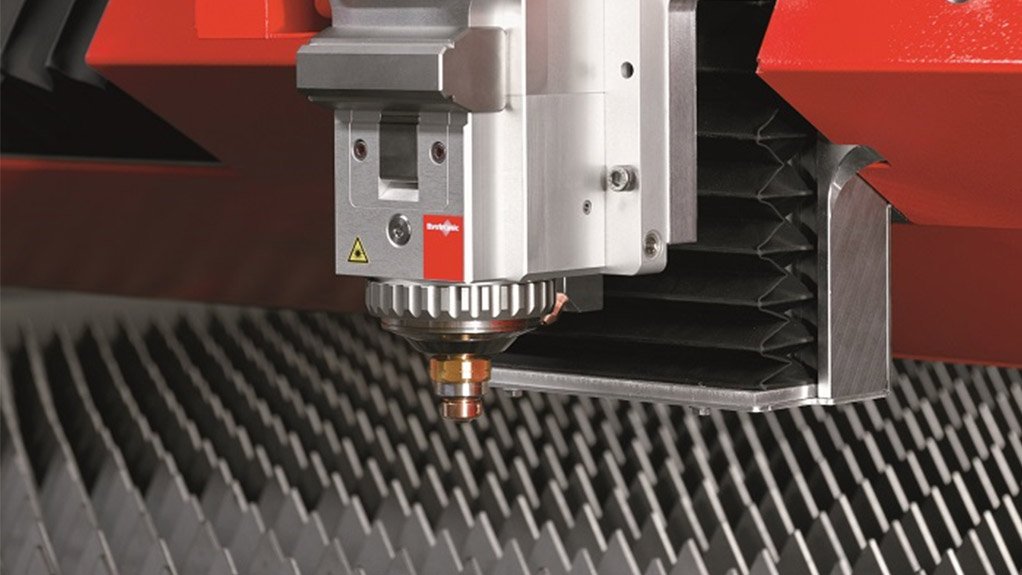

SOLUTIONS PROVIDER First Cut supplies processing solutions, which comprise its latest-generation fribelaser solutions that cut sheet steel

SOLUTIONS PROVIDER First Cut supplies processing solutions, which comprise its latest-generation fribelaser solutions that cut sheet steel

With the new stimulus plan announced under President Cyril Ramaphosa’s leadership, South Africa’s economy is poised for an upturn, which will inevitably promote growth in the steel construction sector, says cutting consumables and capital equipment distributor First Cut MD Andrew Poole.

“This will, in turn, signal the start of projects to improve and rehabilitate the nation’s infrastructure.”

These improvements and additions, he tells Engineering News, will enable South Africa to be more globally competitive.

However, regarding the global challenges that the steel industry faces, Poole says the principal issue is the cyclical nature of the South African economy, which impacts its ability to compete internationally.

The cyclical nature of the economy, for example, is when the economy does well, the demand for steel increases, and conversely, when the economy slows down, the demand for steel decreases.

He refers to China, the world’s largest steel producer, whose steel mills moved into an over-supply situation towards the end of 2014 with its economy slowing down. China subsequently exported its surplus steel at low prices, which in turn, has had a knock-on effect on many steel-producing countries, including South Africa.

Following the closure of Germiston-based steel fabricator Highveld Steel, South Africa has only one operational primary steel mill, which has not had sufficient new investment in its plant and equipment for many years.

“As a result . . . government introduced tariffs ostensibly to protect the steel industry. However, these tariffs appear to protect only the primary steel producer, to the detriment of the downstream steel sector, which, amid local challenges, is looking to import more of its steel requirements from abroad,” Poole explains.

Unfavourable foreign exchange rates have also contributed to the widely reported crisis that the downstream steel sector currently finds itself in, he adds.

This crisis has been severely exacerbated by a lack of major infrastructure projects in South Africa, which has resulted in some of the country’s large construction companies being placed under business rescue, Poole notes.

However, he warns that before steel construction can start, extensive manufacturing has to take place, which initially requires cutting raw steel into sections which are then further beneficiated or manufactured into components; or bent into various shapes and welded together to make finished structures.

In this regard, in terms of consumables, First Cut provides the steel manufacturing sector with an extensive range of blades for cutting steel, as well as other consumables.

In terms of capital equipment, through its various capital equipment principals or original-equipment manufacturers, First Cut supplies high-speed, fibre and tube laser steel processing equipment for flat sheet and tubular steel.

Further, if government could effectively refocus the various State-owned enterprises (SoEs) – such as Transnet, Eskom, the Passenger Rail Agency of South Africa and Denel – it will significantly improve the state of the downstream steel sector, Poole adds.

These SoEs created various infrastructure projects that were major consumers of steel and “now that the country is recovering from the long period of political uncertainty, government needs to get its SoEs back on track as fast as possible, and as a priority,” he avers.

He further calls on the urgent improvement of South Africa’s ageing infrastructure.

“The infrastructure projects that the SoEs would generate, and the resulting demand for steel, would do much to place the downstream steel sector on a healthier footing.”

Poole laments the increasing popularity of cement as the new preferred choice of material in the construction industry, owing to its relative affordability.

All Not Lost

However, Poole points out that there are some potential solutions or good-news factors to consider.

He explains that SoEs will need to gear up, particularly with the upcoming 2019 national elections, and “get their house in order”, which he believes could conceivably lead to some substantial new infrastructure projects and the attendant requirement for steel.

If a more competitive steel price from the primary producer, together with improved quality, can be successfully negotiated because of current lobbying on the part of the downstream steel sector, a broad spectrum of steel-consuming micro-industries would also arise, Poole states.

This, in turn, would generate greater revenue, growth and demand for steel, he points out.

The local automotive sector, which exports, and the renewables sector, are also contributing to the continued demand for steel.

“This highlights the importance of highly efficient steel processing, which can accelerate manufacturing processes considerably and, thereby, reduce costs while dramatically optimising operational and logistical efficiencies,” Poole adds.

In this regard, First Cut supplies South Africa with processing solutions, which comprise its latest-generation fibrelaser solutions that cut sheet steel with speed and accuracy; while its tube laser solutions allow for cost-effective innovation in a variety of engineering and architectural applications.

First Cut also offers tube-bending equipment that offers a combination of speed, quality and cost-effectiveness.

“All the technology and capital equipment in our portfolio offers the downstream steel fabricator the promise of greater productivity and ultimately, improved profitability,” Pool concludes.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation