Trump’s tariffs and AGOA uncertainty: what African supply chain managers need to know

This article has been supplied.

President Donald Trump’s return to the White House has been accompanied by aggressive trade policies. Expanded tariffs on Chinese imports, universal import levies and uncertainty around multilateral trade agreements are reshaping global supply chains. For African supply chain managers, the impact is far-reaching, and it goes beyond imports, says supply chain industry body SAPICS.

With the African Growth and Opportunity Act (AGOA) also set to expire this year, many African exporters face additional uncertainty over their preferential access to US markets. As global trade routes shift and geopolitical tensions rise, Africa’s supply chains, which are already vulnerable, must rapidly adapt, SAPICS cautions.

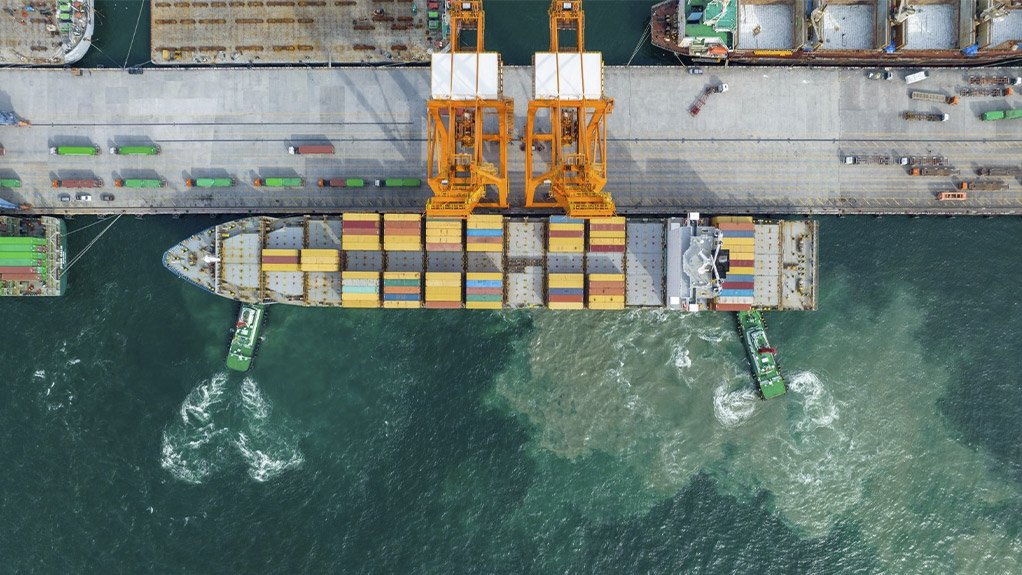

Rising import costs, congested supply routes, rising freight prices and currency volatility are some of the negative impacts that Trump’s policies are having on African supply chains, the organisation notes.

“Even if African countries aren’t directly targeted by tariffs, they will feel the ripple effects. Many goods imported into Africa - especially machinery, electronics and raw materials - come from Asia. When the US applies tariffs to China, for example, costs rise globally as supply chains reroute, production shifts and suppliers face higher demand elsewhere.

“As US firms seek alternatives to Chinese suppliers, Southeast Asian capacity is stretched thin. African businesses face longer lead times and increased costs when sourcing from the same regions. Freight rates may climb due to reconfigured global logistics patterns.

“Trade disputes between superpowers unsettle currency markets. Many African countries already struggle with currency instability, so supply chain managers must now navigate not only rising prices but also fluctuating exchange rates, making cost forecasting a nightmare.”

This is compounded by AGOA hanging in the balance, SAPICS states. This Act allows eligible sub-Saharan African countries to export thousands of products to the US duty-free. It has been critical to the growth of Africa industries, including the agriculture and automotive sectors.

Trump’s 2025 administration has yet to confirm AGOA’s renewal. If it is not renewed or restructured unfavourably, African exporters could lose critical price advantages in the US market. “For supply chain managers, this represents a serious threat, not only to export volumes, but to production planning, workforce stability and customer confidence,” warns SAPICS.

The not-for-profit supply chain body advises African supply chain managers to mitigate their risks by diversifying sourcing and export markets, by building regional value chains, strengthening supplier and buyer relationships, monitoring policy and engaging proactively, and reassessing their contracts and inventory. SAPICS also recommends that organisations accelerate their digital transformation in order to improve visibility, transparency, decision-making and collaboration across their supply chain.

“Relying on one export market or import region is now a major risk. Managers should explore alternative suppliers outside of high-demand regions and within Africa itself via the African Continental Free Trade Agreement (AfCFTA). Trump’s policies highlight the need to reduce dependency on global imports and build African self-reliance. Sourcing from or manufacturing within Africa, even if is more expensive initially, helps protect supply chains from external shocks.

“Strong relationships mean better access to capacity, more favourable terms and early warnings of disruption. Now is the time to negotiate long-term agreements, collaborate on forecasting and co-invest in resilience. Reviewing terms with suppliers and buyers to ensure flexibility in pricing, currency adjustments and delivery timelines should also be on the agenda. Holding additional inventory for critical items may be worth the cost,” SAPICS states.

The organisation urges supply chain professionals to stay close to developments around AGOA. “Belonging to an industry association or collaborative network is more critical than ever,” SAPICS stresses. “In a volatile global trade environment, African supply chain managers cannot afford to operate in silos. Being connected, engaged, sharing knowledge and collaborating across supply chains and sectors is vital. The advocacy provided by an industry body, the collective voice and the risk mitigation enabled by collaboration are among the benefits, particularly amid the current uncertainty and challenges. Industry bodies also ensure that members are kept abreast of significant developments and updates, and that they have access to vital training and skills development to navigate supply chain shifts and challenges.”

Since 1966, SAPICS’s mission has been to elevate, educate and empower supply chain professionals in South Africa and across the continent. The upcoming annual SAPICS Conference, which takes place in Cape Town from 8 to 11 June 2025 is the leading learning, knowledge sharing and networking event in Africa for supply chain professionals.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation