Wind industry achieves record year, but more work required to reach renewables target

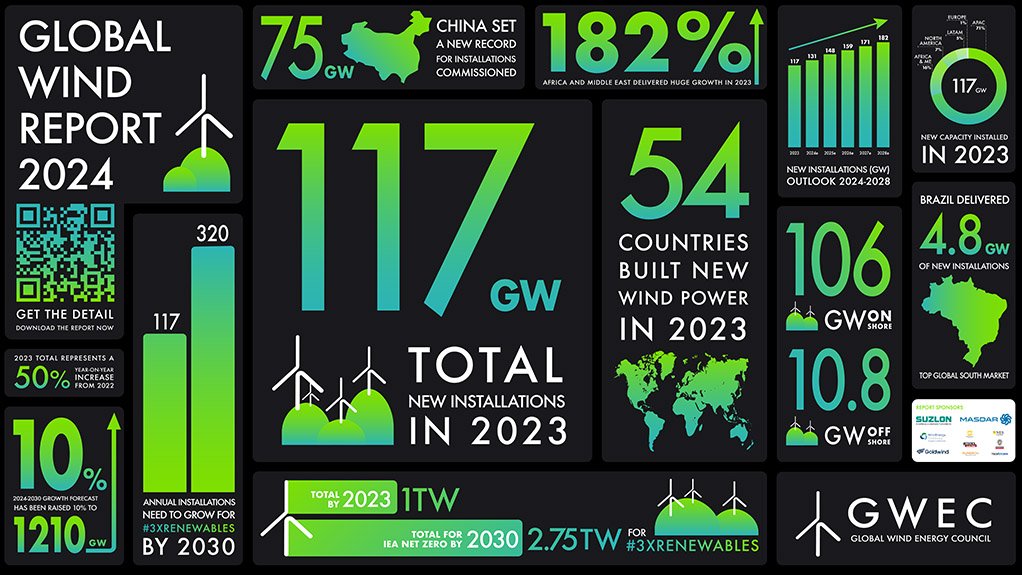

The global wind industry installed a record 117 GW of new capacity in 2023, making it the best year ever for new wind energy, the Global Wind Energy Council (GWEC) states in its ‘Global Wind Report 2024’.

Despite a turbulent political and macroeconomic environment, the report finds that the wind industry is entering a new era of accelerated growth driven by increased political ambition, manifested in the historic COP28 adoption of a target to triple renewable energy by 2030.

The report highlights increasing momentum in the growth of wind energy worldwide.

The total installations of 117 GW in 2023 represents a 50% year-on-year increase from 2022.

At a country level, China and the US remain the world’s two largest markets for onshore wind additions, followed by Brazil, Germany and India.

Together, the top five markets made up 82% of global new installations in 2023, collectively 9% higher than the previous year.

New additions in Europe and Africa and the Middle East did not surpass last year’s record.

However, both regions still experienced their second-best years in terms of new onshore wind installations.

In the offshore market, 10.8 GW of new offshore wind was commissioned in 2023, bringing total global offshore wind capacity to 75.2 GW.

Offshore wind additions were 24% higher than in 2022, making 2023 the second-highest year for new offshore wind capacity, with China being the biggest contributor.

Last year was also one of continued global growth – 54 countries across all continents built new wind power capacity.

Regionally, Africa and the Middle East installed nearly 1 GW of wind power capacity in 2023, almost triple the capacity installed the previous year.

With projects awarded through the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) Bid Window 4 auction coming online in South Africa, as well as GW-level onshore wind projects starting to be commissioned in Middle Eastern and North African countries – especially Egypt and Saudi Arabia – GWEC Market Intelligence predicts that new onshore wind additions for this region will grow fivefold by 2028, compared with 2023.

In total, 19 GW of new capacity is expected to be added from 2024 to 2028, of which 12 GW (63%) will come from Africa and the rest (37%) from the Middle East.

Globally, GWEC has revised its 2024 to 2030 growth forecast of 1.21 TW upwards by 10%, in response to the establishment of national industrial policies in major economies, gathering momentum in offshore wind and promising growth among emerging markets and developing economies.

Chairperson Jonathan Cole writes in the report that there is clear progress by the wind industry in commissioning huge volumes of renewable energy, with last year seeing the highest number of new installations in history for onshore wind (over 100 GW) and the second highest for offshore wind (11 GW).

“We passed the symbolic milestone of 1 TW installed globally and, at the current rate, we expect to hit 2 TW before 2030,” he acclaims.

However, Cole points out that this rate of growth is still far short of that required to triple the target and that the sector is being tested by the tough macroeconomic environment.

“Global inflationary pressures, rising cost of capital and fragility in the supply chain have affected our ability to ramp up in many regions. Given the urgency of the action needed, we do not have time to retreat and wait for these problems to go away – we need decisive action by our political and industrial leaders to address the big challenges before us.

“This means countries taking steps to derisk and accelerate deployment of renewables by prioritising early investment in the grid and transmission infrastructure and moving swiftly to streamline permitting processes,” Cole emphasises.

CEO Ben Backwell says the industry needs to accelerate wind energy installations from a level of 117 GW in 2023 to at least 320 GW/y by 2030, which will bring it to about 3 TW of cumulative wind energy capacity by the end of the decade.

“It took us over 40 years to reach the 1 TW mark of worldwide installed wind power. We now have just seven years to install the next 2 TW. While this is possible, it will require an unprecedented level of focus, determination, collaboration and ingenuity to reach the goal,” he avers.

Backwell points out that, thus far, growth has been overly concentrated in the key markets of China, the European Union, the US, India and Brazil.

“An unprecedented number of countries have now established ambitious national targets – particularly those with strong offshore resources – including major industrial economies and large emerging markets such as Japan, South Korea, Australia, Vietnam, the Philippines and Kenya.

“Supporting these countries to push through regulatory complexity and scale up investment will play a big part in accelerating wind installations beyond 300 GW/y,” he avers.

However, Backwell notes that there are still many parts of the world where growth has been sluggish or nonexistent, particularly in the Global South, and called for policymakers and investors to produce better solutions in areas such as sub-Saharan Africa, including frameworks to send funds to renewable energy.

The report points out that global investments in renewables, grid and storage infrastructure need to increase to about $2-trillion a year to realise the tripling renewables target.

KEY TAKEAWAYS

The report highlights 12 key takeaways that it posits the wind energy industry must pursue to achieve the global goal of tripling renewables by 2030.

Firstly, meaningful action is needed to mobilise larger volumes of investment into wind energy.

Secondly, growth at scale comes with stable and ambitious policy environments that offer reasonable returns on investment.

Thirdly, collaborate to build a secure global supply chain with healthy, managed competition.

Fourthly, trade policy should foster competitive industries, not push higher costs onto end-users.

Fifthly, new production models are needed to industrialise and decelerate the turbine platform race on size.

Sixth, ensure the advantages of artificial intelligence and machine learning outweigh the drawbacks.

Seventh, close the gap on grids.

Eighth, scale modern and flexible power systems.

Ninth, action is needed to accelerate permitting of wind projects.

Tenth, it says, is that community engagement is more critical than ever.

It also calls on industry to guard against misinformation and disinformation that sow doubt in wind and renewable energy.

Lastly, it emphasises that the global wind industry must fulfil its role in delivering a just and equitable transition.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation