Affirma, Norfund and KLP provide $145m for CEC to build additional capacity

Private equity firm Affirma Capital, development finance institution Norfund and Norwegian pension fund Kommunal Landspensjonskasse (KLP) have invested $145-million in Zambian independent power producer and transmission company Copperbelt Energy Corporation (CEC).

The aim is to build on CEC’s success by strengthening its leadership in the Africa decarbonisation programme, building additional renewable capacity, extending access to power in Zambia and the Democratic Republic of Congo (DRC) and helping CEC to play a role in the liberalisation and evolution in the electricity market in Southern Africa, the companies say.

CEC's core business entails distributing power to the majority of mines operating in Zambia’s Copperbelt province and the bordering Katanga province in the DRC. It also transmits power for Zambia power utility Zesco, and is engaged in trading, buying and selling electricity from public and independent electricity generation companies in the Southern African Development Community as part of the Southern African Power Pool.

Further, CEC is investing heavily in renewable energy, with a 34 MW operating solar plant and another 60 MW plant due to be commissioned this month.

With this transaction, Affirma Capital, Norfund and KLP want CEC to expand its investments in both transmission infrastructure and renewable energy in the years to come, the companies said.

Affirma Capital originally invested in CEC in 2014 through a structured equity investment backing the company’s controlling shareholder and, in March 2018, it converted its investment into a 34.64% shareholding in CEC.

CEC is one of Affirma Capital’s most successful investments to date, and the deal demonstrates its continuing long-term relationship with the company, the private equity firm says.

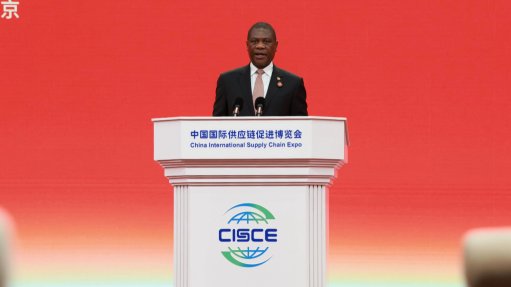

“We are excited to partner with Norfund and KLP on CEC, an asset which we are extremely bullish on. We look forward to continuing the journey with existing shareholders, management and the board in building a leading energy company in Africa,” says Affirma Capital founding partner and sub-Saharan Africa head Ronald Tamale.

“Hopefully, a transaction of this nature will be testament that private equity firms can team up with like-minded investors from different spheres to be long-term owners of businesses in Africa,” he adds.

Since its investment in CEC in 2014, Affirma Capital has led a number of initiatives to strengthen the business.

Recent initiatives have seen CEC deploying significant capital in developing its own solar projects. As part of the transformation, a high-performing independent local management team was inserted in addition to best-in-class governance systems.

This has catalysed a systematic approach to decision-making and strategy development which has driven growth amid a tough macro environment, says Tamale.

Further, from 2014 to 2023, CEC generated about $600-million in cash, paid $285-million in dividends, reduced debt by about $120-million, while investing heavily in critical infrastructure, like the two solar plants, the interconnector into the DRC and extending its infrastructure to reach new customers, he points out.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation