Africa must navigate more fragmented, multipolar geopolitics to secure opportunities

Major political actors are increasingly looking at how they can entice African countries to align with various key geopolitical affairs, and African countries are trying to play all sides and have, at least, secured investment pledges from these actors.

Many African countries are finding it a challenge to navigate this more adversarial, transactional and multipolar system, although some countries are managing this with greater aplomb than others, risk consultancy Control Risks' eighth Africa Risk-Reward Index has found.

"African countries are securing investment pledges not only from western actors, such as the US and European Union (EU), but also from Russia and China. China remains the largest investor in the infrastructure and mining sectors in Africa, although its investments have started to decline," Control Risks East Africa associate director Patricia Rodrigues noted during a September 19 webinar to launch the results of the index.

"African countries are resisting pressure to align, even as the fault lines between global geopolitical powers deepen. Further, competition for access to critical minerals from the region is heating up.

"African countries have an opportunity to leverage their collective position to elevate their profile and influence policy globally but will also need to balance their desire for neutrality and their need for external financial support."

Most African countries have pragmatically chosen to remain non-aligned, allowing them to continue to benefit from financing from multiple sources. Most of the continent’s larger economies, such as South Africa, Nigeria and Kenya, maintain fairly balanced relationships with China, Russia and the US.

"South Africa, this year, found itself at the centre of a geopolitical storm, with the US and its other western allies viewing it as being too close to Russia. This proved difficult for the South African government to navigate at a time when it is pushing for financing, primarily from western sources, for its energy transition," Rodrigues said.

Kenya and Nigeria, meanwhile, have been navigating the changes in geopolitics as well, on one hand attracting investment from China and on the other from the US, which had been keenly engaging these economies on a host of issues, from counterterrorism to investment promotion. Simultaneously, many EU and European countries viewed Kenya and Nigeria as pivotal for their Africa strategies, she said.

The report also highlighted Kenya's emerging role as a climate champion, having hosted the Africa Climate Week and generated a lot of excitement about the Nairobi Declaration, which seeks to get more finances on climate-related issues into the African continent and the developing world in general.

The declaration, which was unanimously agreed upon by leaders at the three-day summit, calls on the world's biggest emitters of greenhouse gases and its richest countries to keep their promises, in particular an unfilled pledge of $100-billion in yearly climate finance to developing nations, made 14 years ago, and for today's world leaders to rally behind a global carbon tax on fossil fuels, aviation and maritime transport.

"Kenya is playing an interesting and neat game while trying to secure the benefits from geopolitical interests and rivalries because it is managing to secure pledges of investment from a range of geopolitical actors," said Rodrigues.

CRITICAL MINERALS INTERESTS

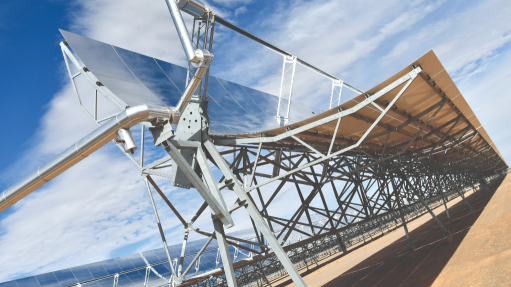

In the context of the energy transition, geopolitical competition had, so far, been most visible in the area of critical minerals. This was also where the continent had its strongest card to play, said Control Risks sub-Saharan Africa political and business risk analysis team head Vincent Rouget.

"The EU, the US and other western actors are scrambling to reduce China’s dominance over the mining and processing of these metals, and to tap new sources of supplies from friendly or neutral countries.

"As their geopolitical stock rises, African countries are individually becoming more assertive in negotiating mineral deals with external actors," he added.

African countries have large reserves of critical minerals, with an estimated 20% of the minerals required to produce electric vehicle batteries being located on the continent.

"Therefore, there is huge potential for mineral exploration, which is currently low, and potential to drive exploration to identify new deposits that are highly prized for the global energy transition," he noted.

Seen in the context of tense geopolitics, there are moves by all major actors to engage with Africa to secure access to critical mineral resources. This is particularly visible on the side of the US, which has made the search for sources of critical minerals one of the main drivers of its foreign policy so far this year.

Similarly, the EU is also negotiating some agreements with mineral producers.

"Perhaps reading the African mood, Japan has followed the EU’s lead in emphasising a collaborative approach in this new endeavour and is reportedly looking to develop Africa-based supply chains for critical minerals in exchange for preferential access," he said.

The rationale behind this was the drive to host mineral production domestically in these parts in parallel with the move by companies to friend-shore or near-shore supply chains or to identify friendly countries in which minerals projects could happen more quickly, Rouget said.

"Africa has a card to play there, because some of the critical minerals producing countries have fairly benign political risk profiles.

"African countries are taking heed of their rising geopolitical stock. In the past few months, we have seen more assertive moves by countries to try to ensure this surge in interest also benefits their economies. We are also seeing some critical resource nationalism coming back in some economies where we see an insistence on local processing, more stringent local content requirements and generally attempts to integrate these critical mineral supply chains with a broad drive for industrialisation," he said.

The dynamics in the development of critical minerals supply chains demonstrate that countries in Africa are unlikely to choose to align with either old or emerging powers but will continually seek the best deal for themselves.

"There are multiple opportunities for savvy investors to capitalise on these inflows into the mining sectors. The dearth of infrastructure, desire to establish value chains locally and need for technical expertise on the African continent will necessitate the involvement of private companies," Rouget added.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation