Blue Label satisfied with Cell C progress as turnaround yields results

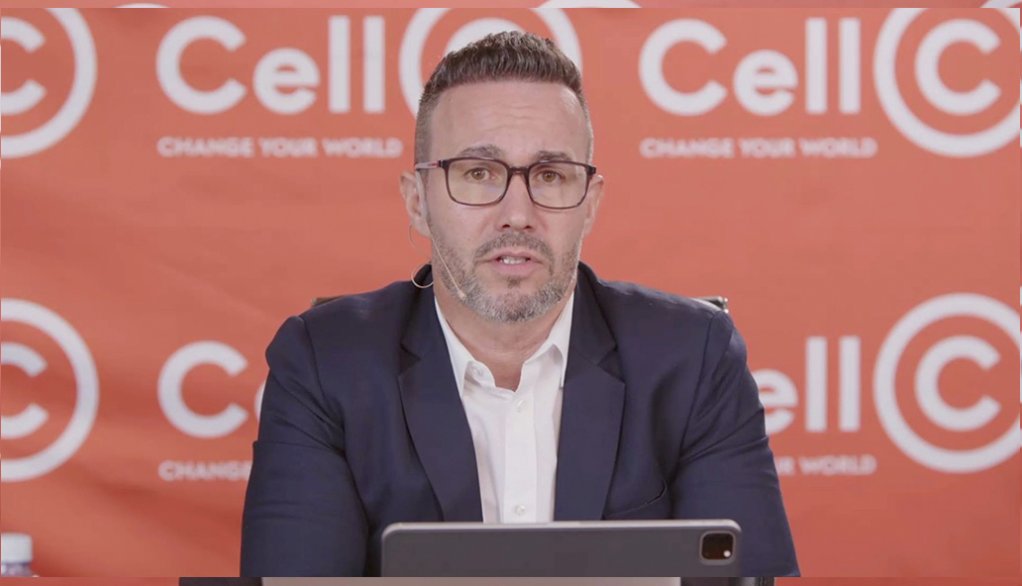

JSE-listed Blue Label Telecoms joint CEO Brett Levy on Thursday said he was satisfied with the performance of Cell C during the six months to November 31, 2024, as the mobile operator’s extensive turnaround started producing results.

During the six months under review, Cell C’s capital expenditure-light model yielded positive results as the company focused on executing strategic priorities, which drove double-digit growth and a robust financial performance.

During the first half of the year, the group continued to address its network quality and perception, reinforce its value perception to drive growth, leverage partnerships to boost revenue, deliver best-in-class experiences and drive an infectious brand connection, said Cell C CEO Jorge Mendes.

This led to a 13% increase in revenue from R5.9-billion in the six months to November 2023 to R6.7-billion in the half-year to November 2024, with a 7% increase in service revenue.

Broadband revenue increased 26%, while mobile virtual network operators’ revenue increased 22% and mobile data traffic increased 27% during the six months under review.

Earnings before interest, taxes, depreciation and amortisation (Ebitda) increased 87% from R419-million to R783-million, while Cell C’s gross margin and cash balance was up 23% and 111% respectively.

Cell C’s blended average revenue per user (Arpu) increase 14% to R102.

Meanwhile, Blue Label posted a 2% increase in gross profit, from R1.59-billion to R1.62-billion, corresponding with an increase in margins from 21.08% to 22.44%, during the six months ended November 30, 2024.

This is partially attributed to the growth in "PINless top-ups", prepaid electricity, ticketing and universal vouchers, where only the gross profit earned thereon is recognised as revenue.

Blue Label’s Ebitda decreased 6%, from R697-million to R653-million, while core headline earnings recorded a marginal 1% increase from R419-million to R424-million.

The decline in Ebitda and the modest growth in core headline earnings were primarily driven by a reduction in the Comm Equipment Company (CEC) subscriber base, a lower Arpu and increased finance costs associated with the sale of a portion of the CEC handset receivable book.

The proceeds from the sale were transferred from CEC to The Prepaid Company and ultimately to Cell C through the acquisition of airtime.

Meanwhile, Blue Label’s earnings a share declined 4% from 45.67c in the six months to November 2023 to 43.98c in the corresponding period in 2024, while headline earnings a share were maintained at 46.01c, a fraction up from 45.91c in the prior corresponding period.

During the six months under review, core headline earnings of 47.20c a share was recorded, compared with 47.15c a share in the same six-month period last year.

Group revenue decreased 4% from R7.58-billion to R7.24-billion. Including the gross revenue earned on "PINless top-ups", prepaid electricity, ticketing and universal vouchers, the effective increase equated to 8% from R43.8-billion to R47.4-billion.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation