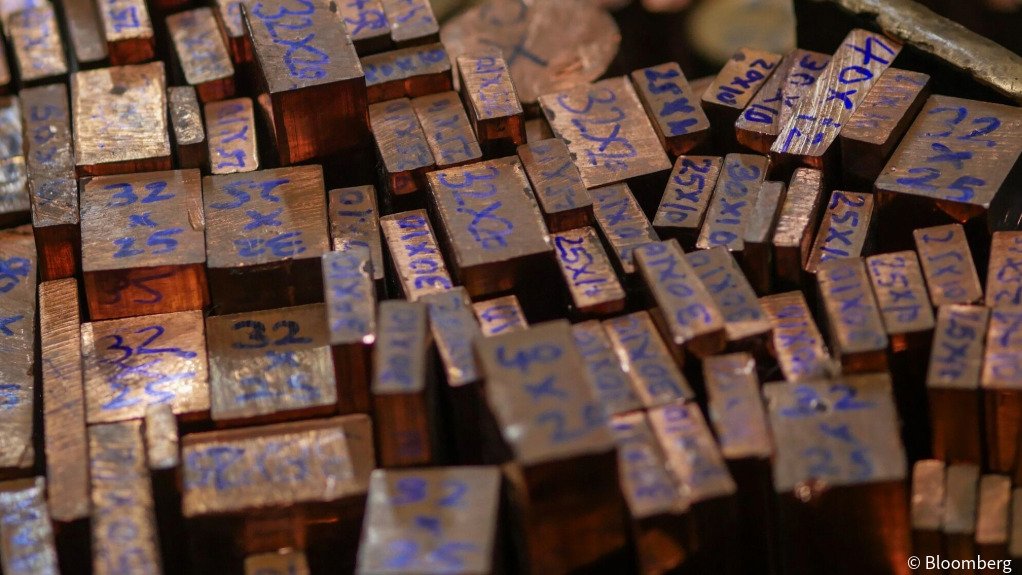

Copper hits record high above $14 000 as speculators pile in

LONDON - Copper prices hit a record high of more than $14 000 a metric ton on Thursday, as speculators extended their buying spree, encouraged by expectations of strong demand and supported by a weak dollar and geopolitical concerns.

They ignored warnings by some analysts that high prices would chill physical demand by industrial consumers and was not being supported by current supply/demand fundamentals.

Benchmark three-month copper on the London Metal Exchange jumped 9% to an all-time high of $14,268 a metric ton, paring gains to $14 147 by 13:15 GMT.

In LME official open-outcry trading, copper gained 6.6% to $13 950 a ton.

"Copper posted its biggest one-day gain in years... driven by intense speculative trading by bulls in China," Neil Welsh at Britannia Global Markets said in a note.

"Investors are piling into base metals on expectations for stronger US growth and more global spending on data centres, robotics and power infrastructure."

Copper, used in power and construction, is a key metal needed for the energy transition, but global exchange-monitored inventories are at high levels, especially in the US.

The most-active copper contract on the Shanghai Futures Exchange closed daytime trading 6.7% higher at 109 110 yuan ($15 708.77) a ton, after setting a record of 110 970 yuan.

The gains came despite weak spot physical demand in the biggest consumer market China. The Yangshan copper premium, a gauge of Chinese demand for imported copper, declined to $20 a ton on Wednesday, the lowest since July 2024 and down from $55 in December.

Copper is also rising due to a spillover of interest for hard assets, which have sent gold and silver to records, partly due to geopolitical tensions, traders said.

Also supporting metals was a weaker dollar index, which was close to multi-year lows, making commodities priced in the U.S. currency cheaper for buyers using other currencies.

LME aluminium gained 2.1% in official trading to $3 325.50 a ton, the highest since April 2022, zinc surged 4.4% to $3,513, the strongest since August 2022, lead added 1.6% to $2 049, nickel jumped 3.6% to $18 025 and tin climbed 1.5% to $56 795.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation