Eskom’s new grid plan says 53 GW of new generation must be connected by 2032

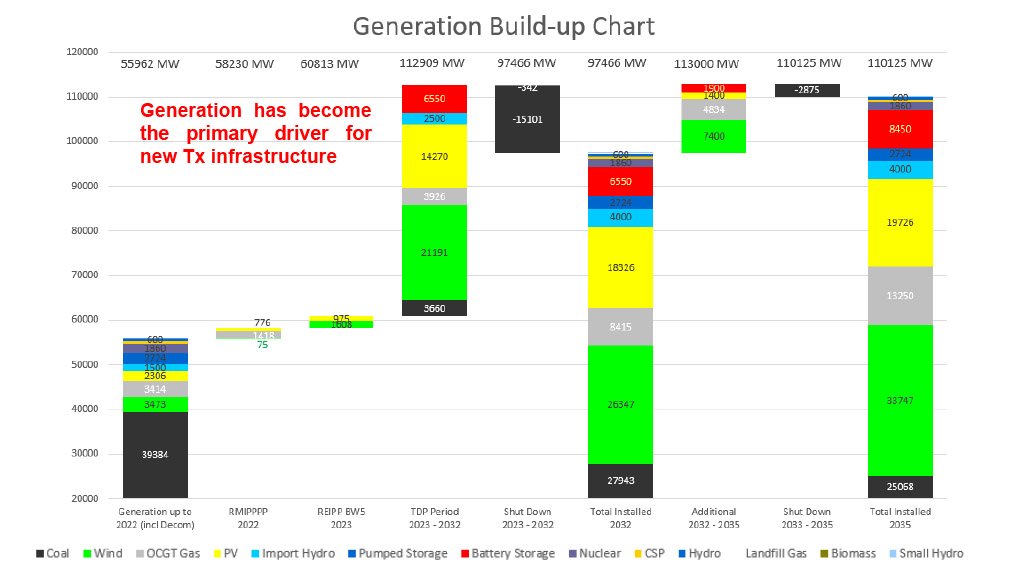

Generation build up as outlined in the TDP2022

Photo by Eskom

Eskom Transmission MD Segomoco Scheppers

Photo by Creamer Media's Donna Slater

Eskom’s latest Transmission Development Plan (TDP2022) includes assumptions that deviate materially from those contained in the outdated Integrated Resource Plan of 2019 (IRP2019) and points to the need for a significant acceleration in grid-related investments to facilitate the integration of 53 GW of new generation capacity, mostly renewables, over the next ten years.

Covering the period from 2023 to 2032, the latest edition of the plan, which is published yearly, points to the need for the construction of 14 218 km of new high-voltage transmission lines over the period.

It also outlines the need for the deployment of 170 transformers, with a capacity of 105 865 MVA, along with 40 capacitors and 52 reactors to support stable and reliable grid operations and the integration of new generation capacity and load centres.

However, it deviates from earlier editions by proposing a front-loading, in the coming five years, of investments in new transformers to unlock 16.6 GW of grid capacity ahead of the introduction of major new power corridors, owing to delays in securing the necessary servitudes for such lines.

Eskom estimates that 12.1 GW of additional capacity can be unlocked in the north-eastern parts of South Africa through 23 transformation projects across multiple sites in the Mpumalanga, Gauteng, Free State, North West and Limpopo provinces.

A further 4.5 GW is earmarked to arise from 13 projects in the Northern, Eastern and Western Cape provinces, where South Africa’s wind and solar resources are at their most potent but where the grid has either reached its limits or is close to full capacity.

Transmission MD Segomoco Scheppers reports that, overall, the TDP2022 points to the need for investments with a combined value of R72.2-billion over the coming five years to add 60 transformers, with a capacity of 26 970 MVA, and 2 890 km of new high-voltage lines. The 11 325 km of line outlined in the ten-year plan are backloaded to between 2028 and 2032.

Scheppers told stakeholders that the revised assumptions were prompted by changes in the environment since the publication of the IRP2019, which was also being reviewed by government, as well as the fact that the TDP2022 extended beyond the IRP2019’s 2030 horizon.

The latest TDP has also been aligned with Eskom’s corporate plan to 2035, which has been shared with government and which incorporates an accelerated decommissioning of the existing, poorly maintained and unreliable coal fleet relative to the schedule outlined in the IRP2019.

The plan assumes that the energy gap will be closed largely using electricity derived from variable wind and solar photovoltaic (PV) generators, supported by some diesel and gas plants and a large deployment of battery energy storage.

Senior manager for strategic planning Ronald Marais indicates that, relative to the IRP2019, the TDP2022 assumes an accelerated decommissioning of an additional 3.4 GW of coal by 2030, largely on the back of an accelerated shutdown of Tutuka. However, Eskom is also assuming that the private coal plants included in the IRP2019 will not feature in the 2030 mix.

By 2032, the TDP2022 assumes that there will be 27.9 GW of coal, down from 39.4 GW currently, and that South Africa will have a 97.4 GW installed based, comprising coal (27.9 GW), wind (26.3 GW), solar PV (18.3 GW), open cycle gas turbines (8.4 GW), batteries (6.55 GW), imported hydro (4 GW), pumped storage (2.5 GW) and nuclear (1.86 GW) with landfill gas, small hydro, biomass and concentrated solar power making up the balance.

“Generation has become the primary driver for new transmission infrastructure, and we are aiming to capacitate the grid for new generation connections, of which wind and solar will be the two dominant technologies,” Marais says.

However, the transmission unit, which is in the process of being unbundled to become the National Transmission Company South Africa, is also prioritising the acquisition of ancillary services to ensure a stable system as more variable generators are integrated into the network.

The technical requirements for instantaneous, regulating and ten-minute reserves have been published by Eskom and the system operator has become increasingly active in stipulating these services in the independent power producer procurement programmes.

The TDP2022 also deviated from the IRP2019 by assuming that the energy availability factor (EAF) of the Eskom fleet will be below 75%; an EAF level that has been controversially set as a shareholder-compact target for the new Eskom board, despite warnings that it is not feasible and could have unintended consequences if pursued.

No specific EAF number is assumed in the plan, as the EAF is expected to vary between 65% and 72% over the period, particularly with the shutdown of plant.

Senior manager for transmission grid planning Leslie Naidoo says the TDP2022 calls for a significant acceleration in the development of the transmission network to address both the new generation capacity, as well as the network strengthening requirements across the country for security of supply.

This will require Eskom to secure funding to implement the plan, as well as ongoing maintenance of the network.

“We have our work cut out for us. It's a huge challenge,” Naidoo says, noting that the constrained resource capacity across the engineering, procurement and construction value chain represents a significant risk to implementation.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation