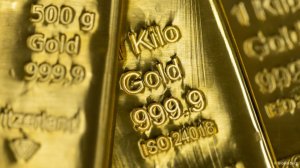

Gold players keep faith despite trade truce-induced correction

Gold prices have fallen almost 10% from a record high just above $3 500/oz in April as a de-escalation in US-China trade tensions punctured momentum, but analysts are sticking with a bullish outlook due to strong underlying support for the metal.

Spot gold XAU= was trading around $3,180 an ounce on Friday, leaving prices on track for their worst week in six months.

The U.S. and China agreed to a truce over the harsh tit-for-tat tariffs they announced in April, prompting a surge in risk sentiment and denting the need for safe-haven assets such as gold.

The dollar index .DXY and US benchmark ten-year Treasury yields also rose on the news, denting gold's appeal.

On the geopolitical front, US President Donald Trump said the United States was nearing a nuclear deal with Iran.

"We're seeing that the geopolitical environment is becoming less turbulent globally and less trade aggression from the US, which is moving investors away from the safe haven gold and increasing risk appetite in the market," said Ricardo Evangelista, senior analyst at brokerage firm ActivTrades.

"However, nothing is set in stone and the risks still remain very high... Overall it's too early to call out the top in gold prices."

Gold, often used as a safe store of value in times of political and financial uncertainty, rose to an all-time high of $3 500.05/oz on April 22 and is up 21% so far this year after a 27% increase over the whole of 2024.

"Gold prices are more likely to rise than to fall from this stage onwards as other factors like central bank demand and very strong investor demand from China are not going away anytime soon," said Nitesh Shah, commodities strategist at WisdomTree.

The inflow into physically backed gold exchange-traded funds in April was the largest since March 2022, with China-listed funds leading the move, data from the World Gold Council showed last week.

China's central bank added gold to its reserves in April for the sixth straight month, official data from the People's Bank of China (PBOC) showed earlier this month.

"I wouldn't be surprised if data indicates that this correction in gold we've seen right now has been cushioned by fresh and continued central bank demand," said Ole Hansen, head of commodity strategy at Saxo Bank.

"We need to see the economic data that will start to support the belief that the tariffs is having a negative impact on the economy. That will not only raise pressure on the Fed to cut rates, which should be positive. It may also lead to some fresh haven demand into gold," said Hansen.

Data on Thursday showed a deceleration in the US economy, the world's largest, in April, including drops in producer prices, manufacturing output, and a slowdown in retail sales.

Markets are currently expecting the US Federal Reserve to cut interest rates at least twice this year, beginning from September. FEDWATCH Non-yielding gold tends to thrive in a low-rate environment.

"Longer term, we remain constructive (on gold) from a hedging perspective as geopolitical tensions are unlikely to disappear completely, real interest rates are expected to decline, the US dollar is forecast to weaken, and central bank buying remains strong," said UBS analyst Giovanni Staunovo.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation