How to finance the green hydrogen value chain

MATERIAL INTEREST The on-site workshops hosted by Sanedi, the GIZ and RENAC last month revealed substantial interest and willingness to participate in the local green hydrogen sector across the value chain

RICH WITH RENEWABLE POTENTIAL Renewable energy is the most important hardware component in the production of green hydrogen. South Africa has large tracts of sparsely populated land with little alternative use that can be dedicated for renewable energy production

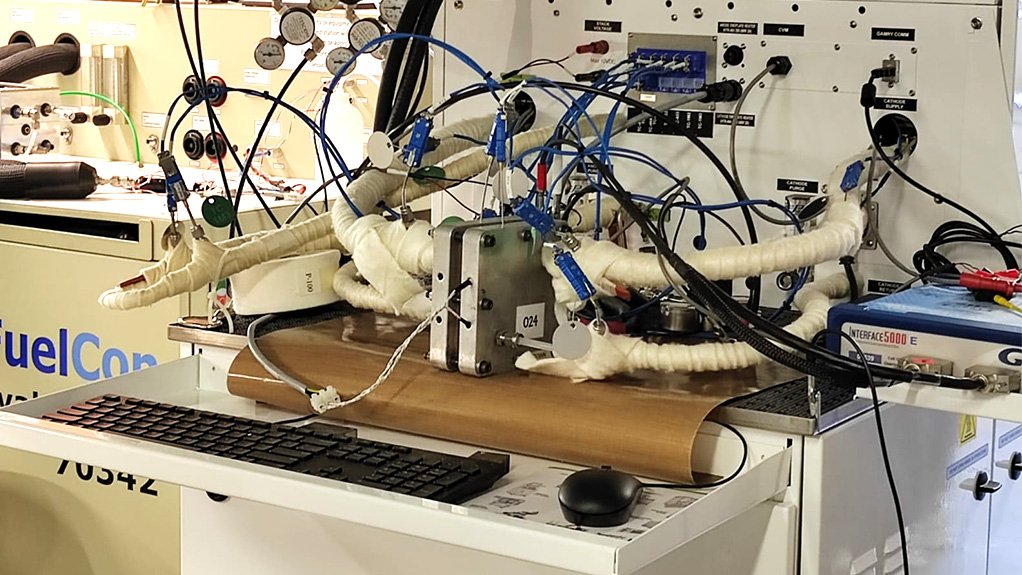

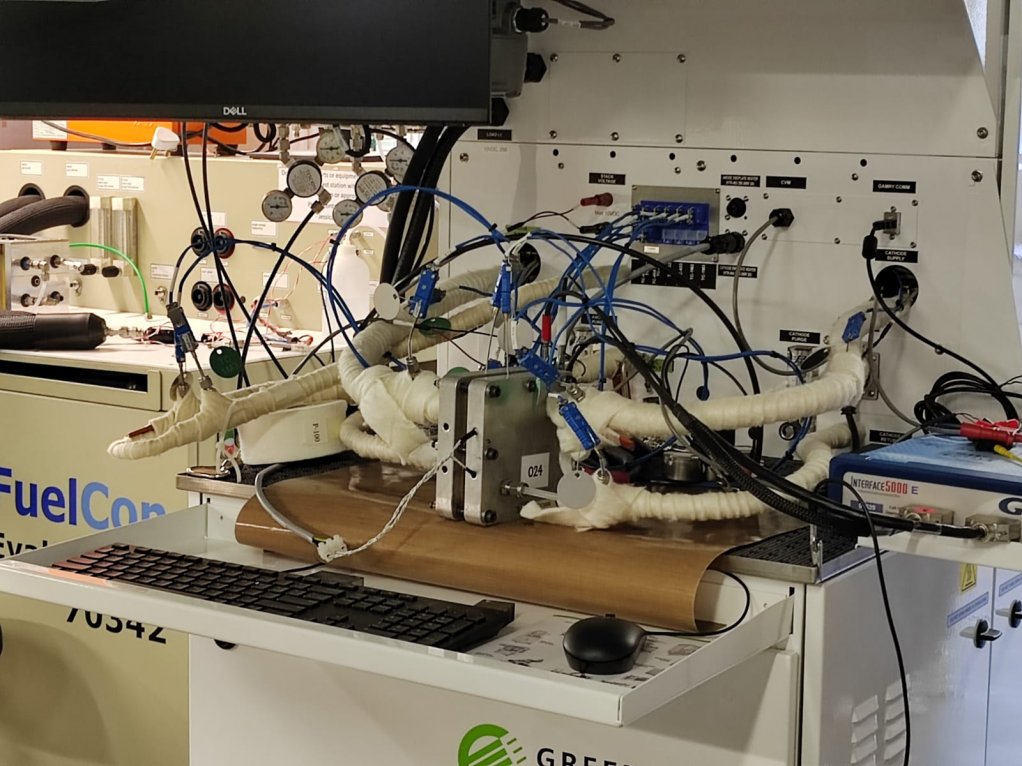

INVESTING IN INNOVATION To secure funding to develop green hydrogen innovation, companies must prove that there is very low risk of the technology implementation failing and that it has secure offtakers in place to create and serve a market

INVESTING IN INNOVATION To secure funding to develop green hydrogen innovation, companies must prove that there is very low risk of the technology implementation failing and that it has secure offtakers in place to create and serve a market

Derisking and understanding the technology, its requirements and cost benefits are critical factors that need to be considered when reviewing the financial feasibility of, and support for, the green hydrogen value chain, says South African National Energy Development Institute (Sanedi) renewables and cleaner fossil fuel manager Dr Karen Surridge.

“Significant financial backing is required when entering any new sector, especially one as complex as the green hydrogen space, which will require substantial capital investment.”

However, unlocking the necessary funding inherently depends on proven, low-risk business case investment. Therefore, the company in question needs to prove that there is very low risk of the technology implementation failing and that it has secure offtakers in place to create and serve a market.

Sanedi hosted on-site workshops from March 14 to 17, in collaboration with German development agency GIZ and Berlin’s Renewables Academy (RENAC), to bring selected stakeholders together to share ideas, understandings and experiences on research and development (R&D), pilot and demonstration projects, as well as the full value chain, including skills, for the green hydrogen sector.

“The financiers who attended generally came to the consensus that the technology is of great importance and should be supported. However, the key to unlocking the finances required for full implementation and operationalisation of the green hydrogen value chain will be reducing risk and increasing benefit,” elaborates Surridge.

The three organisations started hosting a webinar series in mid-March last year. The monthly webinars address a particular topic of interest in the green hydrogen space, with the aim of developing the local green hydrogen value chain.

“Green hydrogen is an area of great interest to South Africa and has excellent developmental potential for the country moving forward. Sanedi, the GIZ and RENAC saw the need to facilitate information exchange in support of this sector.”

She explains that while the Fisher-Tropsch technology, on which most green hydrogen demonstrations are based, is not new to South Africa and developing its application and integration into this value chain warrants, and will warrant, support, ranging from regulatory compliance to market creation. Therefore, any financial institution could be expected to have some reticence towards full financing.

In response to whether the country should look to foreign markets for assistance to grow the sector, Surridge says any market support would be beneficial and foreign markets are most definitely a target in business case and market development considerations.

With green hydrogen-related businesses still in the pilot and feasibility stage in South Africa, local financial institutions need to understand the full value of their return on investment (RoI) based on prediction models only.

“This means that the more technology is piloted and demonstrated to convey a good RoI, the more it will be derisked and the more attractive it will become to financial institutions.”

The on-site workshops conducted last month revealed substantial interest and willingness to participate in the local green hydrogen sector across the value chain, adds Surridge. Additional webinars will also be hosted in April, May and June, virtually, and are open to anyone who wishes to attend.

“It was also evident that R&D, in conjunction with pilot projects, demonstrations and skills development, is paramount to proving that the technology has a good business case.”

Strategic Advantages

South Africa has at least seven strategic advantages, which could make it a globally competitive green hydrogen production area.

Surridge says the first advantage is the country’s superior renewable-energy endowment of onshore wind and solar, and highlights that renewable energy is the most important hardware component in the production of green hydrogen.

Large tracts of sparsely populated land with little alternative use that can be dedicated for renewable energy production is the second advantage.

Thirdly, the country boasts one of the largest concentrations of known platinum group metals reserves, with platinum being a major component in the manufacture of fuel cells and electrolysers.

National oil company PetroSA and global chemicals and energy company Sasol’s deep expertise in the Fischer-Tropsch process used to produce synthetic fuels, such as diesel, petrol and jet fuel, as well as range of chemical products, is the fourth advantage.

In addition, South Africa also has a large electric grid for the wheeling of renewable energy, although the initial approach will be based on large-scale, behind-the-meter, renewable-energy production, adds Surridge.

The sixth and seventh advantages comprise the country’s strategic geographic position relative to Europe and Asia, and its large, carbon-intensive, domestic industrial base as a source of local demand and significant decarbonisation gains.

South Africa is the biggest carbon dioxide emitter in Africa and has been researching the potential of the hydrogen economy since 2007 through Department of Science and Innovation-led Hydrogen South Africa’s (HySA’s) centres of competence – HySA Catalysis, HySA Infrastructure and HySA Systems.

“This work has, predominantly, been focused on hydrogen’s application in mobility, with a focus on hydrogen-powered fuel cell electric vehicles as an alternative to internal combustion engine (ICE) vehicles.

“To date, this work is supported by the platinum group metals sector, as about one-third of platinum sales are used in the production of catalytic converters for ICEs. Fuel cells require platinum to convert hydrogen into an electric current and are an alternative market for platinum of comparable or greater size,” concludes Surridge.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation