Interest from IPPs aiming to connect renewables to grid surges to 133 GW

There is growing interest from renewables developers to connect projects to the grid

Photo by South African Renewable Energy Grid Survey 2024

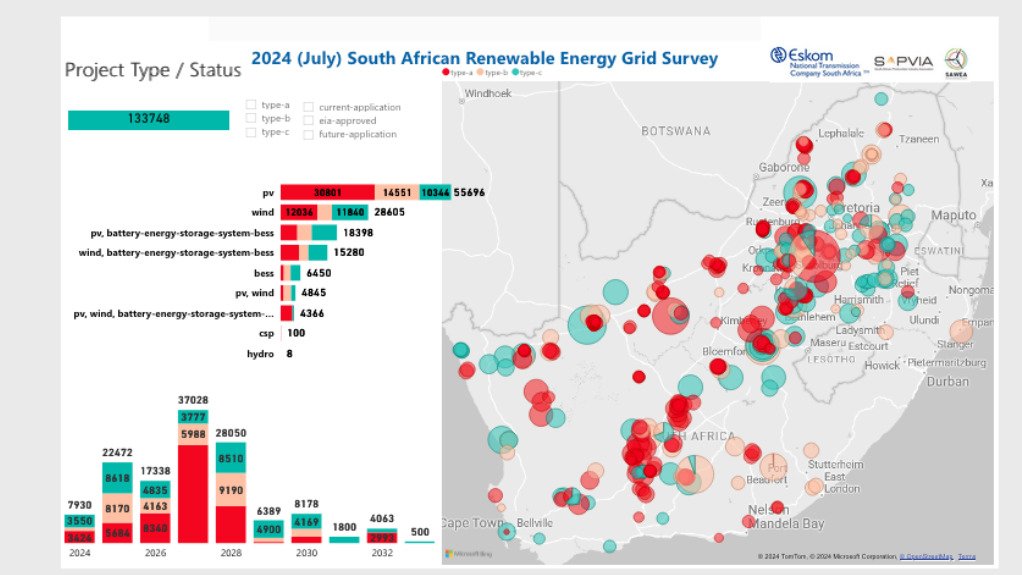

The latest edition of the South African Renewable Energy Grid Survey points to there being massive and growing interest from developers of solar PV, wind, battery and hybrid plants to connect to the South African grid.

Published jointly by Eskom Holdings’ National Transmission Company South Africa (NTCSA), the South African Photovoltaic Industry Association and the South African Wind Energy Association, the survey shows there to be projects with a combined capacity of 133 GW at various stages of development across the country.

The result represents a dramatic increase from the 66 GW highlighted in the 2023 edition, and also reflects a steep rise in the number of contributions to the survey, from 209 last year to 483.

It also points to a rise, from 18 GW to 66 GW, in that category of projects (termed Type A by the survey compilers) at an advanced stage of development in that environmental records of decision have been secured, feasibility studies completed and where the potential exists for the plant to enter into commercial operation within three years.

Also highlighted in the 2024 edition is that while independent power producers (IPPs) continue to have a strong appetite for government’s renewables and battery procurement programmes, with 45 GW being developed to satisfy demand emerging from public procurement, there is also a big increase in projects geared towards the private-offtaker market.

Projects with a combined capacity of 43 GW are being developed with an eye either to public or private procurement, while 28 GW is being advanced purely on the basis of private offtake.

From a technology perspective, solar PV dominates with more than 55 GW, followed by wind (28 GW), PV-battery projects (18 GW), wind-battery projects (15 GW), battery projects (6.4 GW), hybrid wind-PV plants (4.8 GW), hybrid wind-PV-battery plants (4.3 GW), concentrated solar power (100 MW) and hydropower (8 MW).

The Northern Cape remains the most attractive to developers with 29 GW of interest, followed by the Free State (20 GW), what NTCSA terms Hydra Central, which crosses provincial boundaries in the centre of the country (18 GW), North West (15 GW), Mpumalanga (11.6 GW), Limpopo (11 GW), Eastern Cape (8.8 GW) Gauteng (8.8 GW), Western Cape (7.5 GW) and KwaZulu-Natal (2.4 GW).

The NTCSA’s Ronald Marais said that survey results were important in indicting where IPPs were interested in connecting to the grid and at what volumes and would be used by the NTCSA in updating the Transmission Development Plan (TDP).

The results reaffirmed the importance in investing heavily and at an accelerated pace on the main north-south and south-north backbone corridors, but also highlight the urgent need to invest in distribution and collector networks and substations.

“If we look at the capacity that wants to be connected to the grid, it's more than double the indicated capacity from last year's survey of 66 GW, which is a significant increase and gives us great insight to where capacity unlocking needs to be on the grid,” Marais said.

He stressed, however, that it did not represent a grid allocation, with the capacity under development far larger than the demand being forecast in all modelling undertaken to date.

Interestingly, the survey also includes responses on what ancillary services could be provided, with 447 respondents indicating that their renewables or battery plants could provide such services, mainly in the form of reactive voltage supply and control and reserves.

An interactive dashboard of the 2024 survey is available on the NTCSA website at: https://www.ntcsa.co.za/south-africa-renewable-energy-grid-and-survey/

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation