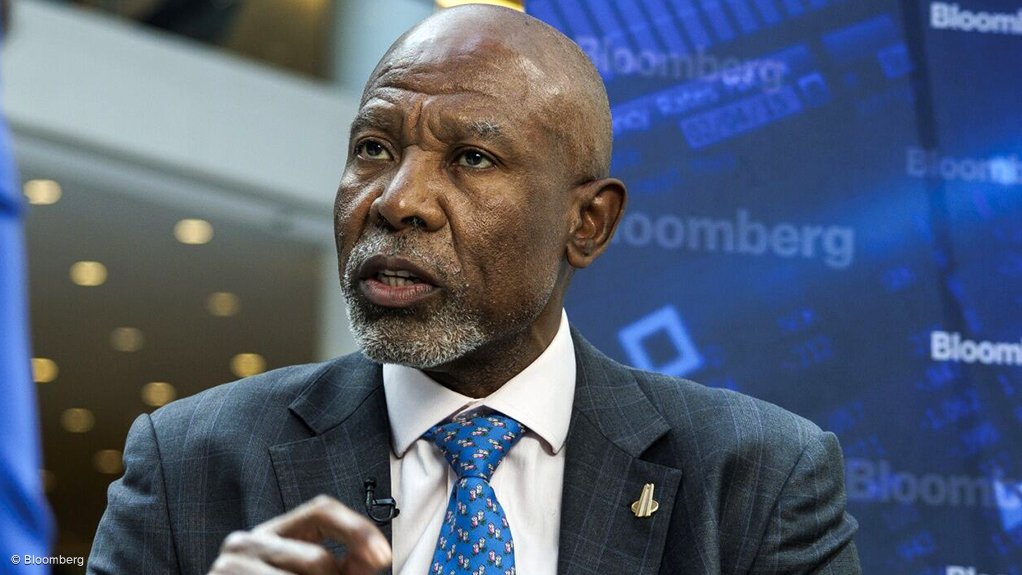

Kganyago roots for central bank independence

South African Reserve Bank Governor Lesetja Kganyago defended the independence of the monetary authority, which has faced repeated calls for its mandate to be expanded ahead of elections this year.

“Central bank independence came about because we tried central bank dependence and it did not work,” Kganyago said in a speech posted on the bank’s website. “In countries where central banks are captives of the political process, they tend to be willing to fund whatever government wants, or to adjust monetary policy to suit election timetables,” he said.

Such changes “come at a huge cost to the economy, paid with an inflation tax, which is levied disproportionately on the poor and vulnerable people in society,” the governor said.

South Africa’s ruling African National Congress has said it wants the central bank’s mandate broadened to shore up the economy and promote employment, in addition to its existing task of targeting inflation. The party is expected to face its toughest election this year since coming into power in 1994. The voting date has not yet been announced but must take place before the end of August.

Kganyago has regularly defended the reserve bank’s mandate to deliver price stability, stressing that it is enshrined in South Africa’s constitution. Last week he said expanding the mandate to include employment and economic growth won’t solve the structural issues in the country.

“If we do not have electricity, you are not going to have that growth,” he said. “If the logistics system is not working and mines are digging stuff out of the ground, but they can’t get their iron ore, or the coal or their manganese to the markets, because our national logistics system is not working, no expansion of the mandate of the central bank will solve those problems. We have got to be acting in sync.”

South Africans endure almost daily power cuts — known locally as load shedding — because years of neglect and mis-management have left state-run electricity utility Eskom Holdings unable to keep up with demand. Myriad problems also plague port and freight-rail operator Transnet and their combined woes have crimped economic activity, stoked inflation and dented consumption.

The central bank’s monetary policy committee voted unanimously at its last meeting to leave the benchmark interest rate at a 2009 high of 8.25% for a fourth consecutive time.

Before pausing in July, the bank had hiked rates at 10 meetings to rein in inflation that remains above the 4.5% midpoint of its target range, where it prefers to anchor expectations. Kganyago has said the MPC won’t cut rates for as long as there isn’t any sustained decline of inflation towards the midpoint of its target band.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation